In the post-Covid-19 transformed world of business, remaining flexible, supportive and resilient is vital. Florbela Yates, Head of Momentum Investment Consulting, shares her advice on how to keep a long-term view through short-term volatility.

Florbela, you joined Momentum Investment Consulting in January 2017 as the head of Momentum Investment Consulting. Please describe the path that led you to this point.

I started my career as a consultant in the healthcare space at Alexander Forbes. I transferred to Investment Solutions after six years. That’s where I became involved in investments, even though I was mainly involved with the institutional side of investments.

When I worked for the group previously (for the division that is now Momentum Global Investment Management, but was then RMB International Multi-Managers), I got my first insight into retail invest-ments. So I guess that’s the start of the path that led me to this point.

What are the defining highlights of your career?

One would have to be the year that the institutional team at Investment Solutions brought in

R10-billion in assets. There is no better feeling than knowing that a client has seen the value that your team can add. Securing a client and then jointly growing assets with them would be a career highlight for me regardless of where I have worked over the years. Also, heading up various new business teams and being involved in partnership JVs with advisors would be other highlights.

What do you deem to be the most critical component to financial success?

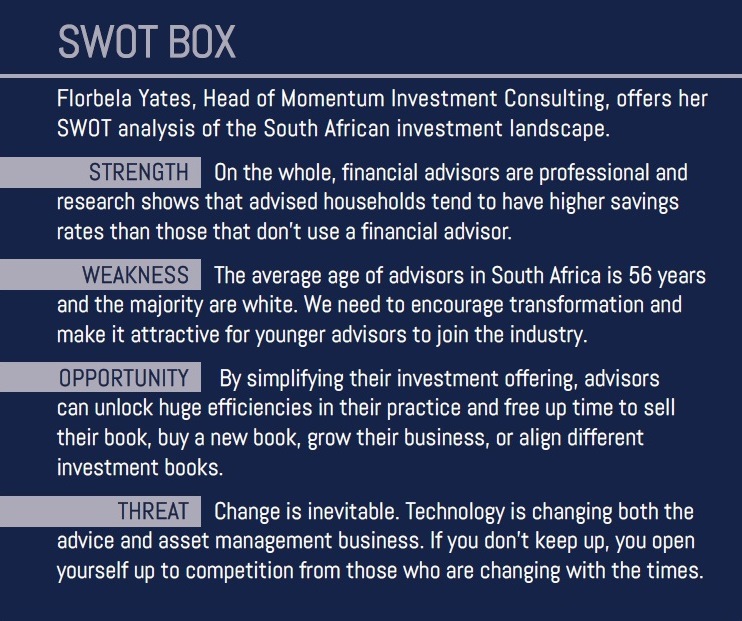

I believe that the best place to start in securing your personal financial success is to appoint a financial advisor and together go through a budget exercise to determine your short-, medium- and long-term financial goals. Once this is clear, it’s easy to evaluate the different investment options likely to get you to those goals. Without a plan or goal, it’s difficult to measure how successful or unsuccessful you have been.

Momentum Investment Consulting

Momentum Investment Consulting (MIC) was launched in 2008 to minimise the pressures of determining asset allocation and fund choices for client portfolios – and today MIC manages assets in excess of R7-billion. What do you attribute this success to?

Our understanding of the financial advice process is one of our key strengths. Our team is made up of CFA charter holders, actuaries and certified financial planners, allowing us to consider the various effects of decisions taken in managing client portfolios.

We are a client-centric business. Our clients often cite our regular communication, transparent and detailed reporting, and flexibility in the execution of our investment skill, as the things that they value most.

What is the baseline factor the makes MIC’s financial services and products so popular?

I think our outcome-based investing (OBI) philosophy works well in an advice-led investment world. It makes it easy for us to construct portfolios that are closely aligned to clients’ own investment goals over their investment terms.

Please outline areas of growth in the past two years.

We have segmented the retail clients into different markets, allowing us to price appropriately and competitively regardless of client size. The evolution in the advice market and the expected effect that legislation such as the Retail Distribution Review (RDR) will have on advisors has resulted in us developing a more flexible offering so that both Category I and Category II advisors have more choice in the services that they can get from us.

In what areas do you see the company expanding in the short term?

Although the majority of our advisors have historically wanted to be involved in all aspects of building solutions for their clients, this year we have seen a trend towards outsourcing the full asset management service to us.

Without a plan or goal, it is difficult to measure how successful or unsuccessful you have been.

We are also seeing an increase in appetite from other Category II licensed advisors and advisor networks wanting to partner with us to enhance their existing offering. I suspect this is where the majority of the growth will come from once RDR comes into effect.

As a result of these trends, we have accordingly restructured our team to ensure specialisation. We need to remain scalable and flexible. The biggest focus has been on the automation of our processes and the development of more tools to enhance the value for our clients.

Please tell us about the industry benchmarks that MIC has fashioned.

Momentum Investments is the South African market leader in building outcome-based or goal-based investing solutions. MIC has adopted this philosophy and most of our clients use an OBI benchmark over a suitable measurement period.

Consistency is the measure that we place the biggest emphasis on. Although we aren’t peer-cognisant, we do always report back to clients showing both our benchmark as well as the relevant peer group benchmark. We encourage our clients to measure us against both benchmarks in terms of consistency and our hit rate (or realised probability of reaching the benchmark).

What are the latest developments, trends and innovations in this market that pertain to your business directly?

Consolidation and digitisation are two big trends that I believe will continue for the foreseeable future. Compression on fees is another trend that I’m seeing especially in a low-return environment. I also believe that RDR will have a significant effect on advisors and asset managers.

Outcome-based Investment Philosophy

What makes the outcome-based investing philosophy revolutionary in the investment management space?

This philosophy allows us to build portfolios that we can adapt to client-specific needs rather than trying to fit all clients into a balanced fund regardless of their varying needs.

How can you ensure that a financial advisor’s advice process is aligned with the outcome-based solutions you offer?

When we first engage with an advisor, we spend a lot of time understanding their advice process and what their particular clients require. We then build portfolios that specifically align with the advisor’s advice process, which give advisors flexibility in using the range of portfolios to cater to their clients’ varying needs.

How equipped is the advisor to deliver a goal-based service to their clients?

All the research we have seen both globally and locally shows that clients benefit from advice. One study showed that advised households accumulate 2.73 times the amount of assets than those that don’t have an advisor. At MIC, we believe hugely in the value of advice. I’d say that many of the advisors that we deal with already advise in such a way as to assist their clients in achieving their particular individual goals.

What skills do financial advisors need to be able to help clients stay the course to achieve their goals?

Consistency is the measure that we place the biggest emphasis on.

I believe that our advisors have all the necessary skills and training to give advice, but if they can then overlay this with an understanding of client psychology (especially during times of crisis), they can then have even more powerful conversations with their clients.

Over the past two years, we have spent a great deal of time researching the effect of client behaviour on investment returns. We all know that timing the market is impossible. When you overlay this with the insights that show how clients make decisions based on fear and greed, you get a great perspective into why clients who don’t stick to their longer-term strategies lose value. As shown in the table below, missing out on the best return day in every year over the past five years can harm a client’s returns. Missing the top 20 performing days has a significant effect.

How does outcome-based investing align with active or passive investment management?

Outcome-based investing is the overarching investing philosophy. When we execute, we do this through the use of active, passive or smart-beta strategies depending on the appropriateness and availability of each of these in various asset classes.

Discretionary Fund Managers

Why use a Discretionary Fund Manager?

A Discretionary Fund Manager (DFM) should become an extension of the advisor’s practice. They become the advisor’s investment team, giving him access to specialist investment skills, which should improve their clients’ investment outcomes.

In a market that is preparing itself for the Retail Distribution Review (RDR) regulatory framework, MIC’s tailored DFM capability applies to both Category I and II financial service providers. Please expand on this.

Category I advisors often partner with a DFM to help them with portfolio construction, manager or fund selection and the efficiencies that a Category II licence brings. For example, a DFM can apply asset allocation or fund changes simultaneously across all advisors through their ability to bulk switch, whereas a Category I advisor would need to meet with each client and get their signed consent to make these changes.

Advisors should remain objective and not allow their subjectivity or own personal views on markets, the economy or the virus to drive the formulating and planning process.

Although advisors with a Category II licence can legally provide these services, many are smaller firms without the necessary skills to provide the full range of services. In these instances, they often appoint a DFM in a sub-advisory role.

MIC offers a range of services ranging from manager research, portfolio construction, attribution, performance monitoring, portfolio optimisation, asset allocation, reporting and execution, allowing other Category II licence holders to enhance their value to clients.

What changes would you like to see happen in the industry over the next five years?

I would like to see the industry becoming more professional and transparent in terms of both fees and skills. I am encouraged by the suggested licensing requirements for different categories of licences that we saw under the latest RDR proposals.

What are the latest developments, trends and innovations in this market that pertain to your business directly?

Consolidation and digitisation are two big trends that I believe will continue for the foreseeable future. Compression on fees is another trend that I’m seeing especially in a low-return environment. I also believe that RDR will have a significant effect on advisors and asset managers.

Effect of Covid-19

MIC combines traditional and alternative asset classes to meet the specific risk and return objectives of clients. This approach is based on asset classes that are defined by their different responses to changes in economic conditions. The effect and unexpected response in the economy that Covid-19 caused has been unfathomable.

Were the predictions in terms of responses to economic fluctuations adequate?

We build diversified and resilient portfolios that will consistently deliver on their objectives or outcomes over the relevant time frames, regardless of short-term volatilities or crises. Risk management forms part of the portfolio construction process. We don’t believe that all managers have skills in all asset classes, and so we prefer to select best of breed managers per asset class. We use a combination of active, passive and smart-beta solutions in asset classes where this makes sense.

Our risk process places a greater emphasis on downside risk in the more conservative portfolios, and a greater emphasis on getting to the goal in the more aggressive portfolios where we have the luxury of time. We have optimised our portfolios to have a greater focus on quality factors, and so we went into the crisis with exposure to more resilient companies and higher-quality credit, which we believe gives us better protection in the current market environment.

I’d love to say that our portfolios weren’t affected by the crisis. But the reality is that the extreme moves in yields, spreads, listed property, inflation-linked bonds and equities experienced towards the end of February and March, did result in portfolio values falling.

The good news is that diversification gave us some protection and we saw some recovery in April and into May.

We remain committed to outcome-based (or goal-based) investing as an overriding philosophy. The biggest step in our process is the strategic asset allocation, and that looks through the cycle and ignores current crises or events. However, we do consider making tactical calls at the margin where we feel that certain assets are mispriced or showing obvious over- or undervalued steps.

The coronavirus has led us to re-evaluate the current positioning, and given the expected volatility over the next few months, we have made some tactical changes relative to our longer-term strategic positions.

We believe that our portfolios are still positioned to make their targets over the longer term.

What significant changes, if any, have been made to the portfolios?

We have slightly underweighted the positions to the more aggressive asset classes given the current and expected market volatility and uncertainty over the shorter term. We have also evaluated our exposure to credit and positioned the portfolio towards higher-quality equity and credit counters.

What is MIC’s perspective on how long we can expect the volatility that we have seen in markets to continue?

It’s difficult to say exactly how long this volatility will continue. Given that we haven’t yet seen a peak in the infection rates locally, the fact that the lockdown has been extended beyond the original period added to the knock-on effects to various industries, I would say it’s safe to expect this to continue for at least the next six months.

Depending on the fall-out that we see and how significant the effect is on the economy and unemployment, as well as the effect of greater liquidity being injected by governments across the world, it could potentially continue for longer.

The current slowdown in global economic growth coupled with South Africa’s sluggish economy and increasing government debt is extraordinary. What strategies should clients adopt?

Yes, our economy faces many challenges. I expect growth to remain weak over the short term, but some asset classes will continue to deliver real returns despite this. Make sure you partner with someone who understands markets and can build resilient and diversified portfolios.

How do you manage client behaviour in an era where fear steers every decision made by every individual?

Over the last two years, Momentum as a group has spent a lot more time researching and trying to understand the effect of client behaviour on their investments. The best that we can do is to continuously share these results with the market to get clients to stick to their investment goals and not make decisions based on emotions. Our clients have started to see the value of this research and we are starting to see them questioning their decisions.

We build diversified and resilient portfolios that consistently deliver on their objectives or outcomes over the relevant time frames, regardless of short-term volatilities or crises.

Please outline the dynamic behaviour of asset markets during high-stress events. What advice can you share with the industry on how to manage through this trying time?

The coronavirus has had a dramatic effect on financial advisors in two key ways: 1) a fall in their revenue due to the fall in investment markets and the difficulty of generating new business in the lockdown; 2) clients who have been affected financially – either through job loss or a temporary fall in income or the value of their investments.

From an investment perspective, I would suggest that those clients who can, stay invested and consider other alternative sources of income. For example, many insurers have allowed clients to consider reducing cover or even take some payment holidays for the next few months. If there are any assets that they don’t need, selling these could also release some capital. I would suggest reducing debt and saving more.

For clients who have lost their jobs or experienced a reduction in income, and need to disinvest to meet their costs of living, I would suggest that disinvesting from the more liquid money market or income portfolios while leaving their long-term portfolios the time to recover.

Partner with a financial advisor that can help you identify your investment and income goals over the short, medium and long term. Revisit them at least yearly and make sure that your investments keep pace with your changing life. It has been tough, and we expect the volatility to continue for some time to come. In South Africa, the government has projected that we will only see a peak in infections in August or September, so I don’t think the bad news is over yet.

What advice would you give to advisors about how to manage their clients who are currently going through a difficult time?

I recommend that advisors stay true to their clients’ financial needs and plan accordingly. Many of their clients’ financial needs may be changing due to changes in their circumstances and advisors need to update their investment plan accordingly. Implementing the changes in planning should be done in such a way as to limit the effect on the client’s returns, such as locking in losses.

Improved communication is key during these times of increased volatility.

Advisors should remain objective and not allow their subjectivity or own personal views on markets, the economy or the virus to drive the formulating and planning process.

Should strategic asset class preferences change during and after Covid-19?

Strategic asset allocation forms the cornerstone of our investment process. It looks through current markets and focuses on the expected returns of each asset class through the cycle. Although it should be reviewed at least yearly, to ensure that our expectations still hold, we wouldn’t recommend making changes based on shorter-term movements, as a result of a crisis. Where asset prices are depressed, this may present an opportunity to rather make some tactical changes.

It is very important to have a disciplined approach to tactical asset allocation as you don’t want to make such big changes that you erode the value of your strategic asset allocation.

What are the fundamental factors that Momentum Investment Consulting considers when planning to build investment portfolios that are resilient to financial market shocks?

We apply a disciplined process and build diversified portfolios that are better able to consistently deliver on their objectives. Risk forms part of our portfolio construction process. We tend to place a greater emphasis on asset managers with specialist skills and a greater focus on quality factors in both the equity and fixed income space. We constantly monitor and evaluate decisions taken and ensure that every manager is delivering on their appointed strategy and mandate.

How does the global economic effect of Covid-19 affect offshore investments? The effect of the pandemic also affects retirement savings that are invested offshore. How so? What do you advise people in this predicament?

Although we follow the same process locally and internationally, we do rely heavily on our international team based in London to guide us on the international market as they are a lot closer to it than we are. For the offshore portion of local portfolios, we believe that the biggest detractor of performance has been fees. In model portfolios, the costs of feeder funds and performance fees often result in underperformance. We prefer to execute using mainly passive or smart-beta strategies.

For hard currency solutions, we would once again prefer to use specialist managers in each asset class and can execute through active, passive and alternative strategies depending on their appropriateness in each portfolio.

To what extent have advisors who have had a DFM during the pandemic benefitted?

I think the biggest benefit is probably the ability for us to implement any decisions simultaneously across all the portfolios. Our Category II licence allows our discretion to make changes to both the underlying asset classes and funds. All our clients benefit from this advantage at the same time.

What is the silver lining, if any, in what has happened to investment markets?

What is the silver lining, if any, in what has happened to investment markets?

Markets that were overvalued have come off. The sell-off in March presented this opportunity for our clients who were waiting for the correct time to get into the market.

We saw large flows of assets transitioning into model portfolios as the capital gains tax (CGT) effect of switching out of other assets reduced.

Please give a message of motivation with regards to financial investments during this Covid-19 term.

Markets go through cycles and if your investment is worth less now than a few months ago, remember that you have not lost money until you disinvest and lock in those losses. Patience and discipline in your investment goals result in success.

If the lockdown has prompted you to save money on items that you usually spend on (eg fuel, beauty treatments, etc) invest this now, so you can build a bigger reserve. If you are forced to supplement your income, start by selling assets that you don’t need or use. Then only start using savings. Use this opportunity to revise your budget and to find ways to be disciplined in saving again, once your circumstances change.

Momentum’s brand proposition is: “Keep your clients focused on their goals, even as the world around us changes”. How has MIC helped advisors in keeping their clients focused on their goals?

The MIC team has increased our interactions with advisors. We have been writing a lot more articles (literally every week) explaining the effect of movements in local and offshore assets on their portfolios.

As an investment team, we have also increased the frequency of our interaction with asset managers and clients alike. Improved communication is key during times of increased volatility. We have implemented changes this quarter by increasing our exposure to the quality strategy and reduced our vulnerability to funds with high exposure to credit and listed property – an area that we believe the risks of defaults has increased.

As August is Women’s Month, what advice do you give to women in the finance industry?

Our deputy CEO, Jeanette Marais, always says that “A man is not a plan”. I’d like to expand on this by saying that you shouldn’t rely on anyone else to have your best interests at heart. Make sure that you start saving early, continue to save and have sufficient money for life’s surprises.

For women entering the financial industry, you have the opportunity to contribute and shape it in the same way that your male counterparts have done. Join an employer who offers equal opportunities, the flexibility to continue working when you decide to have children and the ability to add value throughout your working career. And then give back by being an inspiration and mentor to younger women.

For more information contact Momentum Investment Consulting at mic@momentum.co.za