Critical to achieving these objectives is identifying gaps, bottlenecks and stress points in business processes that dilute the customer experience and potentially harm the business. While a sound business is reliant on robust processes, financial advice is ultimately about people. An infrastructure that supports business scalability and solutions that improve client outcomes, without sacrificing the human element, is essential. All this needs to be achieved within the framework of ongoing industry education and training, regulatory change and compliance pressure.

Michael Kitces conducted research into How Do Financial Advisors Actually Spend Their Time And The Limitations Of Productivity? He concluded that the typical advisor spends no more than about 50% of their time on direct client activity-related tasks and scarcely 20% of their time meeting with clients. He goes on to suggest that there is room for a significant increase in advisor efficiency.

Pinpointing business inefficiencies and stress points is often the easy part. The real challenge lies in attempting to address them when one considers the amount of time spent on the administrative tasks required to simply keep a business going. Unfortunately, this problem is amplified when inefficiencies exist, and more time is spent on compensating for them.

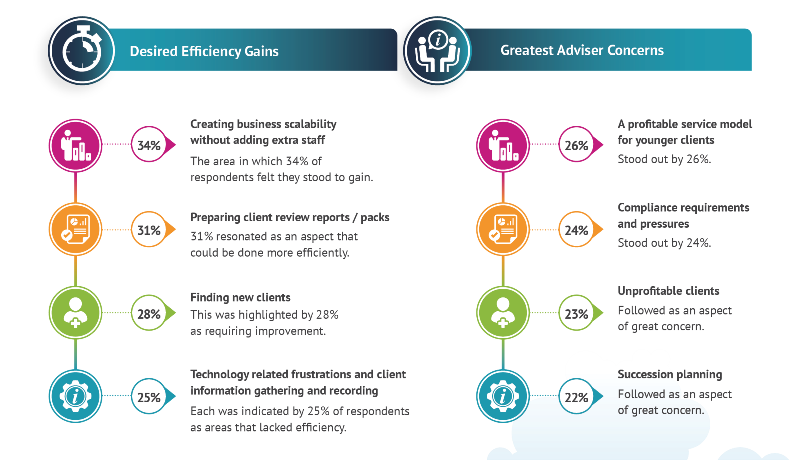

A survey conducted by PortfolioMetrix generated responses from more than 150 advisors from South Africa, the UK and the Republic of Ireland. Further insights were obtained via a roundtable discussion with 20 advisors. The objectives of the survey and roundtable were to identify:

- key areas in which advisors would like to drive business improvements and efficiency gains

- the aspects of being an advisor that cause the greatest concern

The infographic below highlights the main results of the survey.

A few of the standout areas highlighted by the survey are particularly interesting. Client profitability, including a profitable way to service younger clients who are mostly accumulating wealth, but also operate differently in the way they engage with their finances and with advisors, is an aspect many advisors are grappling with. Newer entrants to the job market or people who are in the early stages of their careers may work differently from what many advisors are used to: from home or in another part of the world compared to where their employer may be. And 9 to 5 for a single employer (with a retirement fund) for a lengthy period may no longer be the norm. The approach to saving and demands on accumulated funds may be different, with needs often focused more on the immediate or shorter time horizons.

A sound technology framework coupled with robust business processes supported by the right people is arguably the most effective way of creating business scalability.

A primary concern around a profitable “young client” proposition centres around ensuring that clients are adequately serviced and that relationships are built. The use of technology may support a more cost-effective way of addressing the profitability aspect, but the risk remains the potential loss of the vitally important personal touch. The answer may lie in a differentiated service model for separate client segments. However, advisors should be cautious of the pitfalls of creating what may amount to two or three different businesses or vastly separate service offerings as this would potentially result in increased inefficiency.

The solution would be to determine what it costs to deliver a service to clients that is centred around a core value proposition and to then build service levels and processes that allow for varied service and profitability tiers. Importantly, it begins with having a firm understanding of what it costs to onboard a client and what it costs to retain a client.

Technology-related frustrations is an area that appears to be hampering business efficiency. Several advisors have expressed the view that technology providers should focus on being brilliant at the “one thing” they do rather than attempting to be all things to all advisors. True efficiency lies in ensuring that best-of-breed tools or applications “talk” to other systems.

A further potential obstacle to ensuring the efficient use of technology is selecting the most appropriate option for a specific need and for a particular business. No one option will be the solution for every business: quite often there isn’t a universal “best” option. By their own admission, some advisors admit that they don’t know where to start when searching for and assessing the available technology solutions. It may mean testing multiple systems or possibly having to switch systems several times to arrive at the most optimal option. The significant time and financial costs of a system change are often difficult to quantify.

That said, where innovation and the advancement of technology point to potential efficiency gains for a firm, the benefit of the change may outweigh the cost. It’s unlikely that the choice of every tool or application will be permanent.

No one option will be the solution for every business: quite often there isn’t a universal “best” option.

A sound technology framework coupled with robust business processes supported by the right people is arguably the most effective way of creating business scalability. It will contribute significantly to a practice being able to manage an increasing number of clients in a cost-effective manner without damaging the client experience. Thankfully there are many advisors who are happy to share their technology successes (and mistakes) to the benefit of those who find themselves earlier in the technology journey.

To offer practical insights, it’s worth hearing from advisors who have successfully driven efficiency gains in their businesses:

There is absolutely no doubt that choosing to work with the correct partners has had the most significant impact on the efficiency of my business. That was a decision borne from the understanding that my function as a financial planner is to strategise and conceptualise the financial plan for the client and that the actual fund analysis, selection and blending, as well as the related monitoring and maintenance, was not part of that role.

Another significant impact has been the streamlining of processes and workflows. Every interaction with the client should look and feel the same – consistency is king. It was not always a smooth transition but the refinement over time has given us a great result.

It is in the sphere of technology that I feel the next biggest impact could be felt. Tech needs to be simple, and outputs need to be simpler. That is not to say things should be overly simplistic – just short, clear and easy to understand. I accept that there is no one solution that covers all needs. — Angela Saltas (Corporate Retirement Services)

Since the inception of WealthUp, we have had a deliberate focus on using technology to enable us to work more efficiently, which has helped us to grow our client base without the need to continually add people to the team. We are open to testing new tools and where we identify potential benefits, attempt to incorporate them to enhance the client experience. We’ve realised that clients find comfort in the guidance and safety of dealing with a human and have therefore limited the use of technology to internal processes and systems.

We’ve created a virtual team library where we store useful information that is easily accessible to better share knowledge internally. A centralised processing approach ensures that requests, queries and tasks are efficiently handled. Regular team feedback sessions ensure that all team members are kept informed of important information. These measures have helped to streamline often time-consuming administrative tasks.

We’ve simplified our financial plans and view them as scenario planning tools to illustrate to our clients the impact of a financial decision and whether a particular decision moves them closer to or further away from their objectives. This has been a tremendous time saver as we can now create plans with our clients in a live environment. — Louis van der Merwe (WealthUp)

In looking to identify where efficiency gains may lie, a good starting point would be to focus on recurring mistakes, increasingly unhappy clients, inadequate service levels and frustrated colleagues. Difficulty in establishing priorities and excessive last-minute scurrying when servicing clients are also warning signs. The solution is not to simply throw more people at the problem: this perpetuates the inefficiencies and increases running costs.

By implementing efficiency gains clients receive better service, staff experience greater job satisfaction and feel more valued, and the business is more profitable.