Frontier markets feature some of the most exciting investment opportunities globally. However, interest in these markets has waned in recent years.

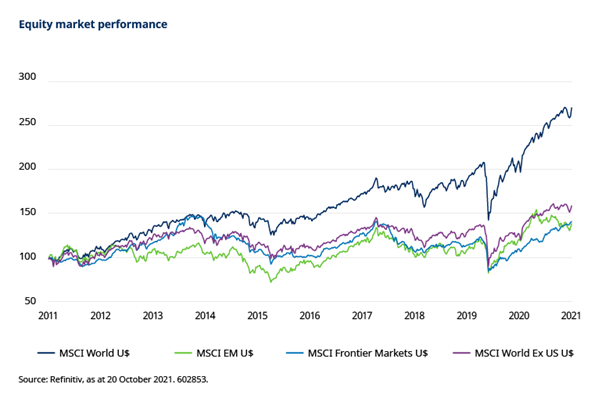

Having been promoted as a high growth, high return asset class, frontier equity market returns have on average disappointed over the last decade. Meanwhile, there has also been a major evolution in the frontier investment universe.

Ten years ago frontier equity investing was dominated by Middle Eastern, oil price-sensitive markets. Today, many of these have graduated to emerging markets, allowing the investment opportunity set to become more balanced.

Importantly, export-led manufacturing economies now represent a greater share in major frontier market indices. Allied to this is the fact that many frontier investors also expand their investment parameters to smaller, less developed emerging markets, which offer similar investment characteristics.

After some years in the investment wilderness, we think the future is brighter for frontier markets.

What is a frontier market?

The definition of a frontier market is not straightforward. In economic terms, we might think of them as the “less developed” developing economies. However, global index providers define markets based on equity market characteristics, not economic profiles.

In general, frontier markets are countries with smaller, less liquid equity markets that often have reduced operational capabilities and foreign investor access limits. Historically, this has meant that some wealthy countries with strict limitations on foreign investment, for example in the Middle East, have until recently been classified as frontier markets.

On top of the risks associated with investing in emerging markets, frontier markets pose some additional issues. As typically smaller, less developed economies, frontier markets can be more volatile and more susceptible to economic shocks.

Greater economic volatility can go hand in hand with greater social and political uncertainty and instability. Frontier markets often impose restrictions on foreign investment such as ownership limits. This may reduce the opportunity set and liquidity available to foreign investors.

How the investment case has evolved

The performance of frontier markets has disappointed over the last ten years, with market returns for the most part tracking those of emerging markets. As the chart below shows, both regions have lagged developed market returns, which have been boosted by the strong performance of US equities.

Many of the factors behind that somewhat disappointing investment outcome have now changed for the better. A series of evolutions in the frontier universe has removed most of the high income Gulf markets from the frontiers opportunity set. This has rebalanced the universe away from a Middle East-centric, dollar-linked energy complex, towards a more coherent set of low income, less developed countries with greater exposure to export-led development.

In our view, the best way to approach frontier equities investing is to include the small, less developed emerging markets, in order to maximise the long term opportunity. Many of these share some common characteristics with frontier markets. The combined frontier emerging markets represent a structural growth story supported by strong GDP growth, favourable demographics, and an expansion in capital markets.

What are the long term factors which support growth in frontier markets?

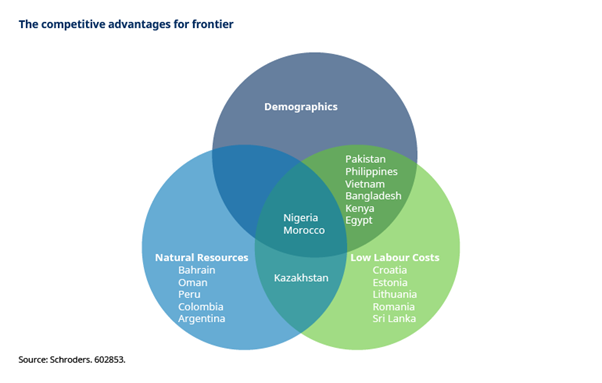

Frontier emerging markets enjoy a number of competitive advantages, with several countries benefiting from combinations of low labour costs, young populations and/or rich natural resources, as shown below:

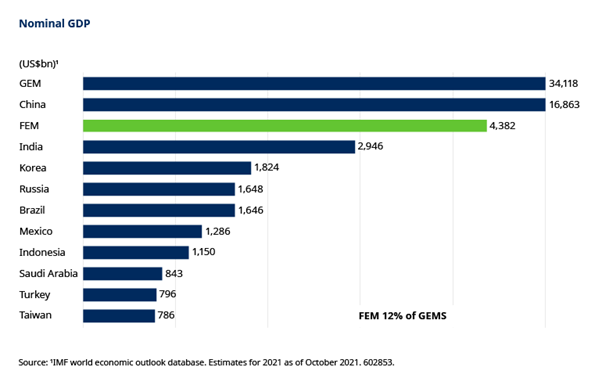

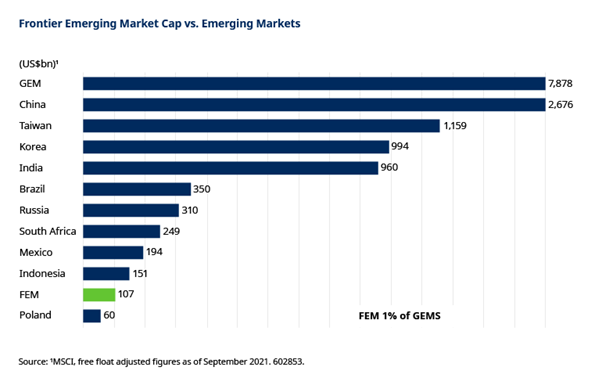

As a group, frontier emerging markets are not small. The total population of these markets is close to a billion people, equivalent to almost 15% of the global total. Their aggregate GDP is about one-eighth that of emerging markets, and one-twentieth of total global GDP, but their capital markets are under-represented. The stock market capitalisation of frontier emerging markets is just one hundredth that of emerging markets.

Over time, we expect both these ratios to increase. Most of the markets that we invest in are nascent economies that have been growing at 5%+ per annum. A relatively low base of financial inclusion points towards the sustainability of these rates for an extended period of time.

Advancements in connectivity and innovative fintech solutions are fast-tracking financial inclusion in many frontier emerging countries. Digitisation of government services and a push towards cashless societies are helping to formalise what are typically sizeable parallel economies.

Vietnam: the frontier star

Vietnam is the largest market within the frontier emerging investment universe. It is also one of the very best structural growth stories in the developing world.

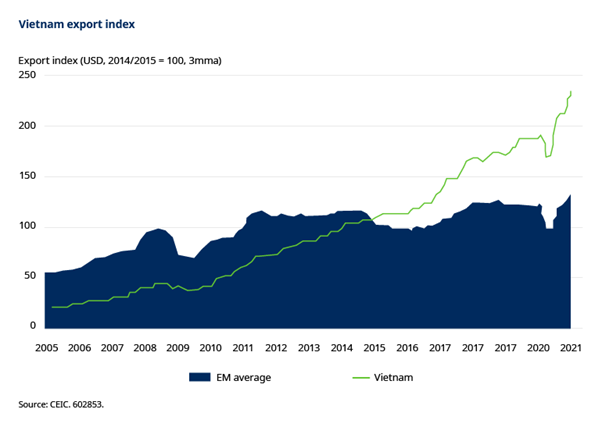

Vietnam has been a key recipient of foreign direct investment (FDI) for more than a decade, which has fuelled a sustained export boom. The country began by attracting basic industries away from China and has been gradually climbing the evolutionary ladder by moving into higher value-added industries such as mobile handset assembly and LED screen production.

Recently, Apple announced its first iPad production in Vietnam – a major breakthrough as the country moves up the supply chain and moves into more expensive industries.

The Covid-19 pandemic has reinforced the trend as companies seek to diversify their supply chains and make them more robust.

Vietnam benefits from a large, highly skilled, English-speaking labour force, a major attraction for global companies.

Wage competitiveness is supportive of manufacturing shifts and technology outsourcing to the country, as is good quality infrastructure, which continues to be upgraded given government initiatives.

Policy is generally anchored around a socialist-oriented market economy, pursuing economic development and growth through private enterprise, trade, and infrastructure development; known as the Doi Moi reforms.

In the long term, we expect to see an expansion in the capital markets as a result of the economic liberalisation. That said, the government has so far been slow to reduce meaningfully its stakes in state-owned companies and/or increase foreign ownership limits. We believe that, eventually, capital markets should play a major role as a conduit to channel international investment, in addition to the foreign direct investment that the country attracts.

As Vietnam’s role as a global manufacturing hub matures, this will inevitably feed into stronger income and spending growth in the local economy as well.

Why frontier is a fertile ground for active fund managers

In addition to a strong market growth opportunity, frontier equity markets are also an ideal environment for active fund managers to outperform.

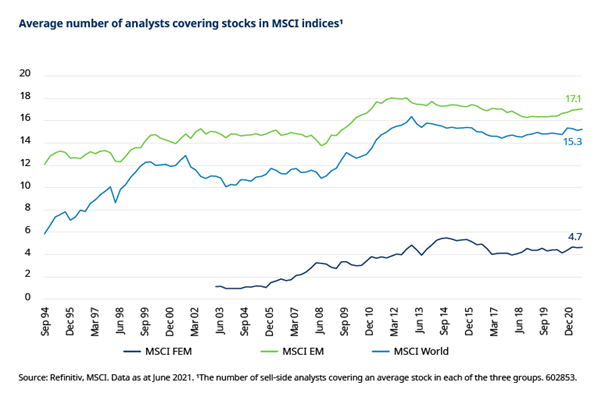

In general, company disclosure in frontier markets is more limited, and analyst coverage is much lower, than is typical in either developed or emerging markets. This tends to provide opportunities for well-resourced active managers focused on fundamental research to add value.

Also, frontier equity markets tend to have a large base of retail investors and consequently lower institutional investor participation. The high share of retail participants, who typically have shorter time horizons and can overreact to short term news flow, is another positive for fund managers with active investment processes.

What do valuations look like?

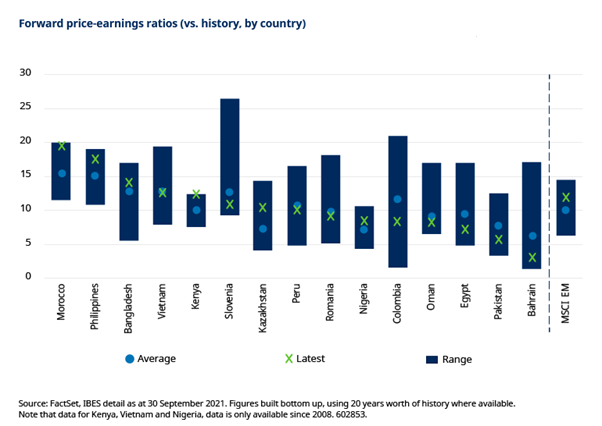

Despite a near 20% rally since the beginning of the year (as at 30 September 2021), valuations remain attractive, supported by strong earnings growth.

The chart below shows the forward price-to-earnings (PE) ratios of the 10 largest frontier markets (excluding Iceland due to its limited history) plus the five emerging markets within the frontier emerging markets index (excluding Argentina, which will move to standalone status in November, owing to capital controls).

How have frontier markets been impacted by Covid-19?

Some frontier emerging markets were severely affected by the Covid-19 pandemic. As they recover, we believe that their long-term domestic drivers will be in the front seat again and that GDP growth will return to 5-7% across the board.

Covid has further highlighted the need for many of these countries to liberalise, attract FDI and expand their export bases. Over the long run, this will make them more self-sufficient, increase their resilience against global shocks and in some cases reduce their dependency on tourism.

Expansion in capital markets will play a key role in the economic development of the frontier emerging countries, providing them with deeper and more sustainable sources of funding. As a result, we believe that the asset class offers the prospect of attractive financial returns.

Salt harvesting in Vietnam image by Quang Nguyen Vinh, Pixabay