The debate about whether it is better to invest in a boutique manager or a more established manager has been argued for years. It joins the list of value vs growth, onshore vs offshore, small cap vs large cap, flat fee vs performance fee and many other hotly contested comparisons.

The great boutique debate

Firstly, one can become bogged down in definitions about what constitutes a boutique. Most agree it is a function of the size of assets under management but is it the size of, say, the equity portfolio or balanced portfolio or the size of the manager’s total assets under management across all mandates? For example, many larger, more established managers allow proven professionals to manage relatively tiny specialist portfolios within a much larger house. Conversely, some boutique portfolios are sizeable.

Secondly, it is not clear what is meant by “better”. It seems to make sense that a “better” manager outperforms a not so good one. However, the argument becomes more nuanced about before and after fee performance and the power of the brand. Many investors are prepared to sacrifice some (usually, poorly defined) amount of performance for the peace of mind of being invested with a manager with a powerful brand splashed all over airports and televisions.

Boutique managers cover a much wider range of returns.

The better ones tend to be dramatically better. However,

the poorer ones have been awful.

Luckily, the South African investment market is both world-class sophisticated and quite small so this article will concentrate on the South African industry and within that equity only funds or

funds that are listed in the ASISA General Equity category.

That category has 75 funds listed in it; fortunately, many of those can be ignored for this exercise due to specialist mandates such as funds that invest in only technology shares, for example, or Islamic funds or themes such as value, emerging markets and others. The final constraint is to consider only active managers and not passive or index-tracking managers.

This analysis has highlighted twelve boutique managers and eight larger or more established managers.

Before examining the specifics of what South African boutique managers have achieved, there are some theoretical agenda items usually propounded in the boutique debate:

Pro boutique

-

- Smaller managers are nimbler and can buy in and sell out of their positions more easily.

- Boutiques managers can take meaningful stakes in smaller companies without hitting JSE limits on ownership or in-house liquidity constraints.

- Managers with smaller assets tend to have higher concentration or fewer shares in their portfolios.

- There is a tendency for early-stage managers to be owner-managed rather than part of a large institution and so have more “skin in the game”.

Pro larger managers

-

- Companies seeking capital at the earlier and, conceivably, more profitable stage of their developments look to raise that capital from more established managers.

- Larger managers carry more clout with companies if they wish to encourage a company to change the way it operates.

- Managers with a brand attract stickier money and the fund managers do not have to worry about the profitability of the organisation as it has already achieved critical mass.

- The best talent can gravitate to larger managers as their budgets allow the best systems, research, access to company management and/or career development opportunities.

The list above is by no means exhaustive and it would require a much longer article to debate the pros and cons of each and several other points without, necessarily, reaching a clear conclusion.

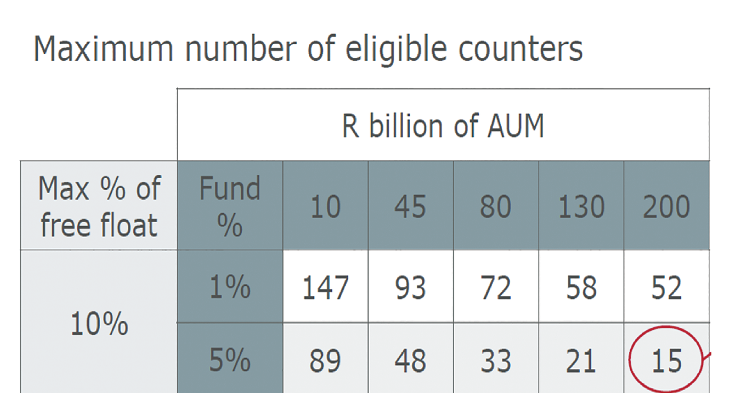

Kagiso Asset Management publishes a monthly analysis of the limitations of fund management caused by the size of assets under management. An extract from their August 2020 analysis is below:

The circled number is interpreted as follows: A manager that has R200bn invested in South African equities and wishes to take a meaningful 5% exposure in its equity portfolio but doesn’t want to breach a limit of owning more than 10% of the company’s free float of shares is limited to 15 shares on the JSE. A smaller manager managing only R10bn of South African equity has a choice of 89 shares.

This means that the larger managers simply have a smaller playing field for their high-conviction plays and anything outside of the list of the 15 largest shares cannot have a larger than 5% exposure in the portfolio. This, typically, means that the larger managers have a longer tail of smaller exposures in their portfolios.

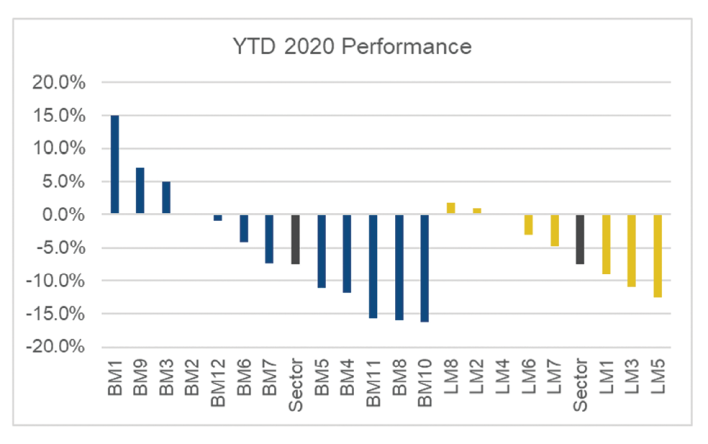

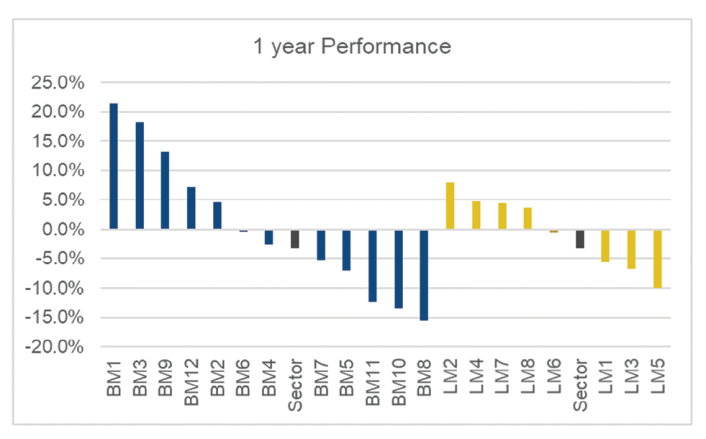

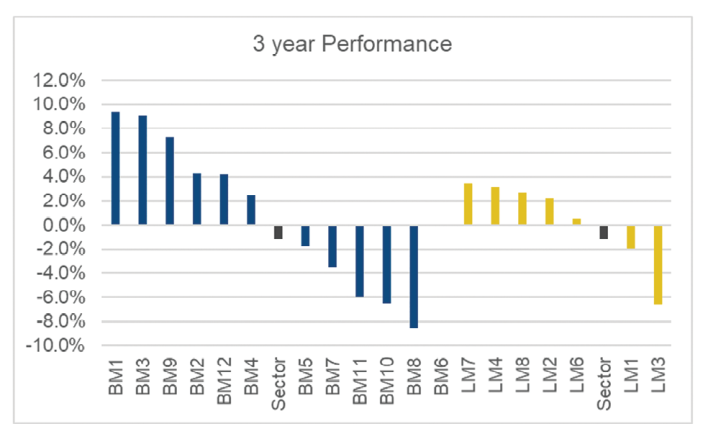

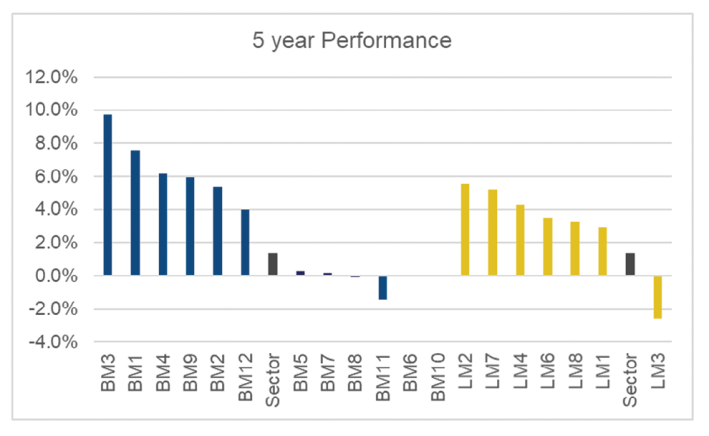

So, how have the boutiques stacked up historically against the larger managers? The charts (right and on page 29) show performances to 30 September 2020 for the year-to-date (YTD), one year, three years and five years. They have been ranked within their size band with the boutique managers (BM) on the left and the large managers (LM) on the right and the sector average in dark grey within each band.

Smaller managers are nimbler and can

buy in and sell out of their positions more easily.

The following charts require some scrutiny. Over all periods, the boutique managers cover a much wider range of returns. The better ones tend to be dramatically better. However, the poorer ones have been awful.

There is, indeed, some consistency across periods with BM1, BM3 and BM9 being the consistent good performers in the boutique space and BM8, BM10 and BM11 being the laggards.

The consistently good large managers are not as obvious but LM1, LM3 and LM5 have not done well.

It has not been clear that boutiques have, as a group, out-performed large managers over any period.

As with any investment decision, investors should embark on considerable due diligence research before choosing a portfolio or, better still, use the services of a professional advisor with the correct credentials and experience to pick the more successful managers.