In September 2018, the South African government announced the Infrastructure Fund Initiative that is focused on transforming South Africa’s infrastructure. The goal of the Infrastructure Fund is to attract over R1-trillion in private capital to fund the country’s infrastructure shortfall.

South Africa’s spending on infrastructure through time has been comparatively lower than many other countries, and considerably lower than countries that have experienced substantial economic growth over the past 30 years like China, the US and Singapore. Furthermore, all these countries have expanded their economic infrastructure to stimulate and grow their economies.

Right off the bat, it is important for us to clarify what exactly infrastructure is. Infrastructure is defined as the basic physical and organisational structures and facilities needed for the operation of a society or enterprise. So, roads, railways, ports, bridges and all other physical assets that help a society to function would be considered infrastructure.

Infrastructure development in South Africa has a long and complex past, which is intricately linked to the development of the mining industry. Many of the country’s core infrastructure assets including its rails, electricity generation and roads were primarily built to service the mining industry. Through time, South Africa has developed a core network of infrastructure assets. However, this core infrastructure network has not been maintained and expanded sufficiently to service the country’s citizens.

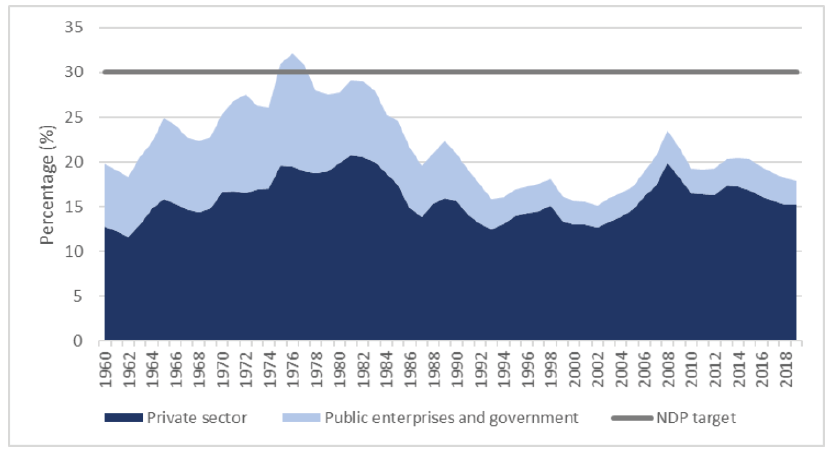

Perhaps the best way to show how much capital is required to address this shortfall is to compare current infrastructure spending levels to those envisaged by the country’s National Development Plan¹. The NDP’s goal in 2010 was to increase infrastructure spending to 30% of Gross Domestic Product (GDP) by 2030. Below we show actual investment levels in South Africa compared to this target.

Figure 1. Infrastructure investment in South Africa vs the NDP target as a % of GDP (1960-2019)

Figure 1 shows that only for a short period of time in the 1970s, the country was able to meet the NDP’s target for infrastructure investment. Subsequently, the spending shortfall has been quite considerable.

As a more reasonable shorter-term goal, the Department of Public Works and Infrastructure has set a target of increasing investment to 23% of GDP by 2024. However, this is still a massive task. To put it in perspective, spending at 18% of GDP in 2019 amounts to around R910-billion. Increasing this to 23% would require around R260-billion a year in additional expenditure, which is the equivalent of nine new Gautrain projects a year.

According to Futuregrowth Asset Management, there are currently around 276 planned infrastructure projects in South Africa valued at R2.3-trillion that currently require R1.7-trillion in additional funding. The funding gap faced by energy infrastructure projects is by far the largest, followed by water and digital infrastructure projects. The funding gap will need to be filled by government and the private sector. However, how much each party will contribute is unknown.

There are currently around 276 planned infrastructure projects in South Africa valued at R2.3-trillion that currently require R1.7-trillion in additional funding.

As shown in Figure 1, over the past 60 years the private sector has always been the largest contributor to infrastructure investment. Moreover, when the private sector has gotten involved in funding infrastructure projects, they have been relatively successful. One example of this success is the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) – a government-led infrastructure initiative to increase investment in the country’s renewable energy production.

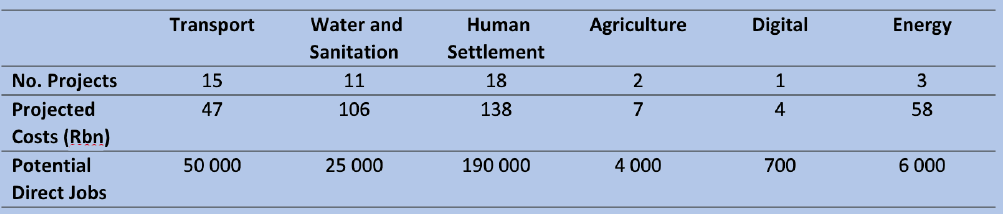

The expected benefits from infrastructure projects in South Africa are far-reaching. Not only are they expected to supplement trade, increase accessibility to goods and services and improve the standard of living, but in the process of being built, these projects are likely to create a significant number of jobs. Below, we show some key statistics across 51 of the country’s largest planned infrastructure projects. Collectively, they have the potential to create over 275 000 jobs.

Figure 2. Sustainable Infrastructure Development Symposium SA – project pipeline (July 2020)

With a significant need for the private sector to get involved in building South Africa’s stock of infrastructure assets, it is necessary to spend some time detailing how investors could gain exposure to infrastructure. Typically, infrastructure investments may provide some level of diversification to a portfolio, and they also may act as a hedge against inflation.

The kinds of investors that invest in infrastructure include pension funds, banks, life insurers, collective investment schemes, private equity funds and development finance institutions.

Typically, larger institutional investors (like pension funds) can access infrastructure investments directly while retail investors are only able to access infrastructure investments through listed equity, either through listed companies that invest in infrastructure or through listed companies that service the infrastructure sector (like construction companies). In addition, many infrastructure projects are likely to use some form of debt financing and specific funds may be set up to invest in infrastructure-related debt.

We are currently seeing fund managers ready themselves for the launch of funds which are targeting infrastructure investment. Fund managers are wanting to ensure they are positioned to channel investor demand into viable projects, and it does appear there may be a land grab of sorts taking place.

While project roll-out is still needing to commence, it is likely that investors will have more fund options to access this sector directly in future, including both debt and equity alternatives. In instances like this, it does pay to ensure that adequate due diligence is performed when considering new fund options given the potential for newcomers to this sector to fall short in having established competencies in place.

We are currently seeing fund managers ready themselves for the launch of funds which are targeting infrastructure investment.

While the expected benefits that can accrue from successfully developing South Africa’s economic infrastructure are considerable there are a few things we need to get right before we start to see those benefits filter through to the economy.

Part of the reason for the degradation in the country’s current economic infrastructure base has been because of maladministration involving the SOEs that manage these assets (Eskom, Transnet, etc), and this will need to be addressed to ensure that existing assets are properly maintained and new projects are implemented effectively. This is arguably the largest key dependency that the sector faces.

Secondly, given the current funding shortfall of around R1.7-trillion, the private sector will have to make considerable investments in South Africa’s infrastructure before a large majority of these projects can be developed.

Lastly, government and the private sector will have to partner with one another to ensure a successful role-out of infrastructure across the country.

A breakdown in trust between these two players may result in funding and construction of key infrastructure drying up. By and large, South Africa will really need to work together on this for the benefit of all.

¹ The NDP is a South African government economic plan to eliminate poverty and reduce inequality by 2030.