While value investors may not typically be buying for growth, there is no escaping the fact that growth is the ultimate source of equity returns. Yet in our experience, investors regularly undervalue growth, which can mean holding off on expensive purchases that over time reveal themselves to be good value.

With growing concerns about seemingly overinflated tech stocks, companies such as Accenture and tech giant Alphabet may currently look pricey. However, data¹ shows that shares from both firms have been materially undervalued for the last decade. Ten years ago, an investor would have paid a 17.4 multiple to buy into Accenture, and data confirms that even with a significantly higher multiple of 44.1, the company would have still been able to deliver at least the index return. Similarly, Alphabet reflects a 10-year historic price to earnings ratio of 17.6, whereas investors paying a multiple of 48.9 would still have received the index return as a minimum.

Both firms have also delivered double-digit earnings growth throughout this period, and we expect them to continue doing so. In the case of Alphabet, we anticipate compounding earnings growth accelerating to over 20% over the next three years, despite its size as a 22-year-old business already.²

When considering the various ways to value growth, data suggests that portfolios of high-value, sustainable-growth businesses can provide a good, solid performance over time. Investors would thus be wise not to underestimate a combination of quality and growth when making strategic investment decisions.

Stable growth

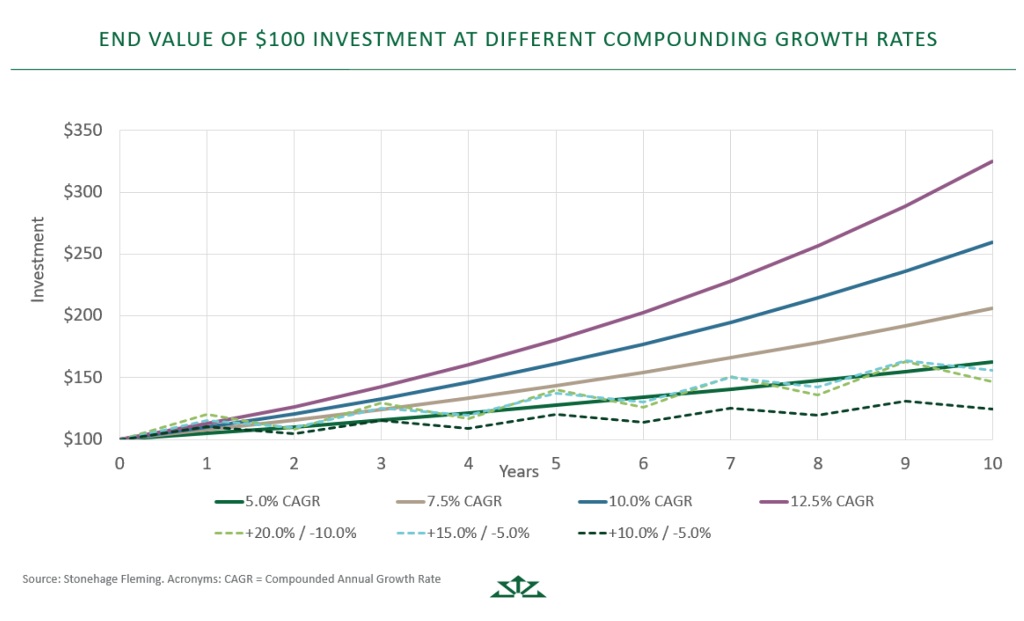

The graph (above) supports the principle of focusing on sustainable growth. By illustrating the end value of a $100 investment at different compounding rates, it reveals how much more valuable lower, stable growth is compared to volatile, cyclical higher growth. While a stable 5% rate results in an end value of 1.6 times the original investment, a rate of 12.5% produces a doubling end-value of 3.25 times. Critically, in contrast, when comparing the varying results of much higher, but fluctuating growth rates (eg, +2 %/-10%), it is striking that all their end values return less than those of the stable compounding 5% growth.

Add stable, incremental growth to the above 5% growth example, and the results over time illustrate the value in holding a good investment for longer to benefit from the ever-compounding growth. An additional 5% pa over five years can increase the end value by more than a quarter of excess value ($33), and if that investment is held for another two and a half years, the incremental excess value almost doubles to $60. Held for another five years after the initial five years, the incremental value almost trebles to $96.

Quality usually persists

Investors are often afraid to pay up for quality out of fear that a business may not continue to deliver in the future. However, it is our view that quality typically persists over time, and that the same applies for low-quality businesses.

One should not be overly concerned by a high valuation for a high-quality company and by contrast, investors should refrain from buying a weak franchise on a seemingly low valuation in the hope that it will get better, as typically low quality usually also persists.

Valuations

It may come as a surprise to some that, despite the strong market performance under dire economic circumstances, the current 14% upside to consensus bottom-up company valuations is marginally higher than the 10-year historic average of a 12% upside for the MSCI World Index. This is due to the high expectations for a strong economic recovery on the basis of the successful vaccine rollouts and sharply increasing company valuations. From a consensus target valuation perspective, it therefore seems that the market is still fairly valued.

¹ Source: Bloomberg, Stonehage Fleming Investment Management Ltd, February 2021

² Forecasts are based on assumptions and are not reliable indicators of actual results.

The opinions or views expressed are for information purposes only and are subject to change without notice. The information does not constitute legal, tax or investment advice, it is neither an offer to sell, nor a solicitation to buy, any product or services. All investments risk the loss of capital. Past performance should not be used as a guide to future performance. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes. Issued by Stonehage Fleming Investment Management Limited, authorised and regulated by the Financial Conduct Authority, and registered with the Financial Sector Conduct Authority, FSP No: 46194. © Stonehage Fleming 2021.