US human rights activist, Malcolm X, said that “We cannot think of being acceptable to others until we have first proven acceptable to ourselves”. It’s a comment on the importance of your Golden Triangle, which I discussed in last month’s article.*

As a reminder, the Golden Triangle is being clear on three key elements of your financial planning business: first, knowing what value you offer; second, clients recognising your value and third, clients being willing to pay for your value. For most businesses these three elements are fairly obvious. But financial planning clients often don’t know what they are paying their adviser for, and inevitably they think that payment has more to do with the cost of a product, investment or policy.

It is no surprise then, that clients do not always see the real value that financial advisers offer. This is a legacy of the sales-focused origins of the profession. The many scandals that have rocked the industry over the years. The key role of trust in relationships where money is involved. The fact that financial advice does not have the roots or gravitas of other professions. It is an evolving profession. The sales-focused legacy lives on. Large financial institutions still regard financial advisers (whether in-house or independent) as a means to distribute their products.

Clients do not always see the real value that financial advisers offer.

Only a complete separation of the roles of advice and product distribution will enable clients and advisers to be clear that financial advice is about professional planning and advice, and not about product sales.

Despite the salesperson legacy, regulators around the world recognize that financial advice is a critical social and professional service. As financial planning evolves into a profession we see the growing importance of globally recognized qualifications, professional membership bodies and codes of ethics. There are increasingly stringent ongoing educational, professional and licensing requirements for financial advisers. All contributing to stabilizing the currency of financial advice, which most client surveys suggest is trust.

In this shift to professionalism, an important first step, as Malcolm X says, is to be “acceptable to yourself.” To be honest about what type of financial adviser you are, and whether that is acceptable to you first, and your clients second.

The problem, as US business man Max du Pree says is, “We cannot become what we need to be by remaining what we are.” But we also need to be honest about what we are before we can make any shift that may be needed.

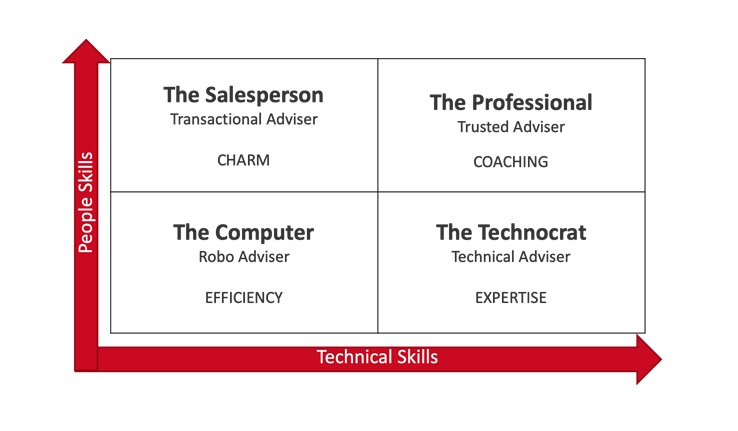

To be clear on what type of financial adviser you are, I propose a four quadrant framework in which you can locate yourself. As you can see, the framework is premised on the view that financial planning involves a mix of people and technical skills, and depending on what type of adviser you are, you will have either have a bias to one, or a balance of both.

The Salesperson – Transactional Adviser

It’s appropriate to begin with the adviser who is The Salesperson, as many financial advisers start their career in this role. Whether independent or tied, they are often seen as the distributor of financial products, and in many instances associate themselves with the brands of product providers, rather than promoting their own brand.

Whilst a salesperson needs to have sound product knowledge, there is no doubt that charm is a key weapon in their arsenal, which makes people skills important. But unfortunately the sales model means there is a focus on transactions, that is how salespeople get remunerated. Salespeople don’t get paid for the advice they give, no matter how sound it is.

Regulators globally are trying to change this. And they are getting help from an unlikely source.

The Computer – Robo Adviser

Technology is tripping up jobs everywhere. Robots are now threatening to replace people as financial advisers. You can go onto the internet and find a Robo-adviser who will help you make financial decisions in a matter of minutes. Decisions that could have lifetime consequences. Or at least be felt for years. This begs the question, is the 21st Century when human financial planners go extinct?

The World Economic Forum thinks not. In a 2018 study it suggests that many roles that are charades of financial planning like being a broker or acting as an intermediary of any sort will become redundant. This suggests that the salesperson as financial planner is a dying breed.

They are not alone. Even financial analysts are under threat, as are accountants and lawyers. But the good news is, that the report suggests the role of a financial or investment adviser is a stable one. In other words it won’t disappear in the technology tsunami that is engulfing most industries. But it depends what type of a financial adviser you are.

Many financial advisers do still see themselves as brokers, intermediaries or distribution channels for large financial institutions, earning a commission on a product sales.

What is the value of a human financial planner to a client?

This form of remuneration means that the client can never be sure if you are acting in their interest or your own. But many financial planners have earned a good living through earning commission and have done a great job for their clients. The problem is, the Robo-adviser can take over this role of intermediary at a fraction of the cost of the human adviser. And is doing so. This begs the question, if financial advisers have been identified by the World Economic Forum as a stable role going forward, what role will that be?

To answer that question, I think we need to consider what is the value of a human financial planner to a client?

We now know that it won’t be as a salesperson. Financial planning will be as important in the 21st century as the medical profession. Medical advances are enabling people to live longer. Financial health will have to match physical health. Both are inextricably linked. Income level is already known to be a key indicator of health. The higher the income level, the better the health. Perhaps it is a more technically skilled adviser who will survive the 21st Century?

The Technocrat – Technical Adviser

Given the move to professionalism, it is no surprise that the Technocrat, the technical expert who can solve any client’s financial problem has emerged as a relatively new type of adviser. Often the technical experts have skills traversing fields like economics, finance, accounting, maths and law. As a result there are growing numbers of financial planners entering the profession who are lawyers, accountants or actuaries by training and original profession.

Despite the undoubted expertise of Technical Advisers, the way financial advisers are paid remains problematic. Many technically capable advisers still offer services “on risk” in the hope of securing a client’s business. This devalues the work they do initially with a client.

This is not the case with other professionals. Doctors, lawyers, accountants, charge clients for the professional service they offer. In some cases lawyers will go “on risk” but the principle of a professional fee for a professional service is well accepted. A fee that is paid directly by the client. Organisations like medical aids do act as an intermediary in certain instances. But the money is still effectively coming out of the client’s pocket. It is not being deducted from a product provider account as a result of a client having been sold a product.

The challenge that many financial planners face is that they don’t want to charge fees because they are not sure of their real value to the client. In taking a fee as commission from a product, at least the financial planner can give something concrete to the client that has demonstrable value, the product.

The challenge that many financial planners face is that they don’t want to charge fees because they are not sure of their real value to the client.

In thinking about the value of financial planning, we often focus on the great advice that an adviser has given us – the Technocrat, or a product that they have given us access to – the Salesperson. “I wouldn’t have saved nearly enough for my children’s education if my adviser hadn’t sold me an education product,” a senior executive in a financial institution shared with me. Another client tells the story: “It was a miracle. My adviser got me out of the technology bubble at just the right time. He sold the technology fund that I was invested in at the time. The fund no longer exists”. It is little wonder that clients and financial advisers see the benefit of the financial planner through the eyes of financial products and their expertise related to those products.

Doctors are often feted by pharmaceutical companies and other medical supply companies. As a result they may have preferences for the types of drugs they prescribe or equipment they use. But they are never seen as distributors of the products, even doctors who have their own prescription counters. They are simply seen as providing a valuable service. Financial advisers who supply their own products are regarded as having conflicts of interest.

Doctors take the Hippocratic oath. They commit to acting in the best interest of their clients. In contrast, financial advisers need regulators to find ways to encourage them to “treat their customers fairly”.

It’s little wonder that a late friend and colleague of mine, Nigel Scott, who was a leading financial adviser in South Africa, frequently was exasperated by the profession. He was a lawyer by training and profession before moving into financial advice. He knew what it meant to be part of a more established profession. Nigel often would say to me, “I wish we could come up with a different name for a financial adviser, that way we could get rid of the baggage that the industry carries”.

The Professional – Trusted Adviser

It may not be what Nigel was asking for, but I do believe there is a category of financial adviser who we can label The Professional, with a balance of people and technical skills and who clients regard as their “Trusted Adviser”.

There is no question that the Professional’s motivation is nothing other than acting in the best interests of their clients. But to do this effectively in the digital world of the 21st century, I believe requires greater emphasis on people skills as technical skills simply become a ticket to the game. There is no doubt that in the future the Robo Adviser will usurp the Salesperson and the Technocrat. But real financial advice is not just about money. It’s about a person’s life as well.

Which means the future of human financial advice is The Professional, a trusted adviser who engages their clients based on a coaching way of being. We’ll look at what this means in next month’s article and why it’s so important.

For now, I encourage you to consider where you locate yourself in the four quadrants. Are you a Salesperson who wants to become more Technical? Or vice versa? Are you collaborating with The Computer or planning to compete with it? Can you honestly identify as The Professional?

Wherever you locate yourself, are you already the type of financial adviser you need to be? And if not, are you committed to becoming what you need to be?

*Read the previous article by Rob Macdonald here