Retirement planning often feels like a balancing act between what your client wants and what their savings can realistically deliver. For decades, the 4% withdrawal rule has been the go-to guideline for living annuities, generating an income that could last for 25 to 30 years.

But in today’s world of fluctuating markets and rising costs, sticking to that rule can feel impossible. The good news? Innovative solutions like Momentum Wealth’s Guaranteed Annuity Portfolio (GAP) are rewriting the rules, helping retirees secure retirement income for longer without taking on excessive risk.

A rule of thumb is a general principle or guideline based on practical experience rather than a strict law or scientific proof. It’s used to make quick, approximate decisions when exact information isn’t available or necessary.

There is a rule of thumb for people with a living annuity, but it is sometimes difficult to achieve.

The rule is simple: if your client wants their living annuity income to last 25 to 30 years while keeping up with inflation, their withdrawal rate should be no more than 4% to 5% of the investment value at retirement.

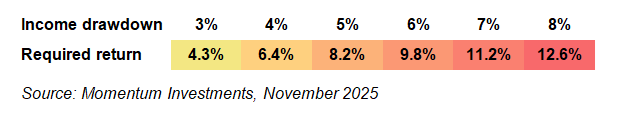

What’s not immediately obvious is that this rule essentially includes an underlying assumption about returns. When using a simplistic inflation assumption of 5% on the income amount, you can calculate that for an initial 5% withdrawal rate, you would need an 8.2% net of fee return to maintain your income for 25 years.* This does seem like a realistic long-term rate of return. The same calculation can be done for each level of drawdown (see the table).

This tells us why the rule is at 4% or 5%. Moving to an income drawdown of slightly over 6%, you would, for more than two decades, need double-digit returns after fees to make this equation work. These levels may not always be achievable, but in reality, it may not always be avoidable.

Drawing an income of only 5% (and that will still be taxable) from your living annuity means you would need R2 million in a living annuity to get a starting income of R100 000 per year, or R8 333 per month.

| Living annuity market value | Yearly starting income at 5% | Monthly starting income at 5% |

| R2 000 000 | R100 000 | R8 333 |

| R4 000 000 | R200 000 | R16 667 |

| R6 000 000 | R300 000 | R25 000 |

| R8 000 000 | R400 000 | R33 333 |

| R10 000 000 | R500 000 | R41 667 |

| R12 000 000 | R600 000 | R50 000 |

| R14 000 000 | R700 000 | R58 333 |

| R16 000 000 | R800 000 | R66 667 |

| R18 000 000 | R900 000 | R75 000 |

| R20 000 000 | R1 000 000 | R83 333 |

| R22 000 000 | R1 100 000 | R91 667 |

| R24 000 000 | R1 200 000 | R100 000 |

Source: Momentum Investments, November 2025

It is clear that the amount of money needed can become astronomical very quickly, and many people will have to break the rule of thumb. They will have to draw more than the guideline of 4% or 5%, implying that they may need a 10% or much higher return from their market-linked funds to maintain the intended income stream.

At Momentum Wealth, we believe we have a way to make it easier to achieve the rule of thumb. The Guaranteed Annuity Portfolio pays a guaranteed income for as long as your client lives, thereby protecting a portion of their retirement income. Unlike the traditional market-linked components used in living annuities, the Guaranteed Annuity Portfolio’s return’ is not linked to the market, as its income payments are guaranteed for life.

The levels of income that you can lock into in the Guaranteed Annuity Portfolio are generally high, so clients can draw a higher level of income from their living annuity without increasing the underlying required return needed on their market-linked assets to maintain the income as above.

As an example, a 65-year-old male, drawing a 5% starting income from a traditional living annuity, would be able to maintain his income (increasing by 5% per year) to the age of 90, should his market-linked assets generate a return, net of fees, of 8.2% per year.

When allocating 50% of his portfolio to the Guaranteed Annuity Portfolio, that same man would be able to maintain a 6.5% starting income (increasing by 5% per year) from his ‘hybrid’ living annuity, even if the market-linked assets are performing at less than 8.2% per year.** In this instance, it is a 30% higher level of income when markets are performing at 8.1% instead of 8.2%.

This happens because with R1-million allocated to the Guaranteed Annuity Portfolio, the starting income of R6 686*** per month (escalating at 5% every year) is about R80 232 per year. If we think of this as a starting income of just more than 8% (R80 232 of R1 000 000), and we only needed 6.5%, it’s easy to understand that we would only need to draw just less than 5% from the market-linked assets. This is in line with the rule of thumb and shows why the 8.1% net return on these market-linked assets would be sufficient.

Clients no longer have to choose between the certainty of a life annuity and the flexibility of a living annuity. The Guaranteed Annuity Portfolio enables a blended solution that addresses longevity risk, income sustainability, and client peace of mind, all while giving advisers a powerful tool to differentiate their retirement planning approach.

Reimagine retirement income planning and empower your clients to retire with confidence. Speak to your Momentum consultant today to explore the retirement income solutions from Momentum Wealth and how the Income Illustrator can elevate your retirement income planning conversations. For more information, full details on limitations, exclusions risks and fees, visit our website here.

*Potential changes to inflation and inheritance needs have been ignored for simplicity.

**These are calculations done on a specific example and will not hold for clients drawing excessive income from their living annuities.

***The guaranteed rates of income that were available at the time of the research on a R1-million GAP.

Momentum Wealth is part of Momentum Investments and Momentum Group Limited. Momentum Wealth (Pty) Ltd is an authorised financial services provider (registration number 1995/008800/07, FSP number 657). Momentum Metropolitan Life Limited is an authorised financial services and credit provider (registration number 1904/002186/06, FSP number 6406). The Retirement Income Option and the Guaranteed Annuity Portfolio are life insurance products, underwritten by Momentum Metropolitan Life Limited, a licensed life insurer under the Insurance Act and administered by Momentum Wealth (Pty) Ltd. The information in this article is for general information purposes and not intended to be an invitation to invest, professional advice or financial services under the Financial Advisory and Intermediary Services Act, 2002. Momentum Investments does not make any express or implied warranty about the accuracy of the information herein.