Meet the FPI Financial Planner of the Year

Established in 2000, the FPI Financial Planner of the Year Award is highly coveted and recognises outstanding achievement in the field and practice of financial planning. In 2025, the award went to Nicola Langridge, CFP®, wealth manager at Private Client Holdings. Blue Chip caught up with her.

Causeway Securities

Founded in 2016, Causeway Securities is a global independent securities brokerage headquartered in Belfast, with offices in London and New York.

Offshore investment gains momentum in SA

Blue Chip speaks to Hymne Landman, CEO at Momentum Wealth, about offshore investing for South Africans.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

The Intelligent Adviser’s Playbook: PROpulsion hosts 2026 Practice Management Conference

A practical virtual conference for financial planning businesses that want to run smarter operations, without adding unnecessary risk or complexity.

PROpulsion Practice Management Conference 2026

The 2026 PROpulsion Practice Management Conference focuses on how advisers and their teams can use intelligent tools, including AI, in practical, defensible ways that improve efficiency, consistency, and client experience.

When clients ask if they have done enough

Kobus Kleyn (CFP®, Tax and Fiduciary Practitioner, Kainos Wealth) writes about understanding vulnerability in financial advice.

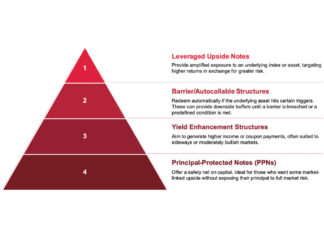

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.

Why blending unit trusts remains essential

In an environment where opportunity and uncertainty coexist, blending unit trusts is not about being cautious. It is about being prepared. By Natalie Harrison, Head of Distribution at Curate Investments.

Most Popular

Anatomy of an ‘almost’ bubble

Jo Marshall, Head of Marketing at Schroders, examines the impact of big tech and AI on the investment landscape and considers how a market bubble could affect investment portfolios.

Investment platforms: powering advice, enabling better client outcomes

Hymne Landman, CEO at Momentum Wealth, discusses the importance of the human element in providing clients with the best financial advice and planning.

Meet the FPI Financial Planner of the Year

Established in 2000, the FPI Financial Planner of the Year Award is highly coveted and recognises outstanding achievement in the field and practice of financial planning. In 2025, the award went to Nicola Langridge, CFP®, wealth manager at Private Client Holdings. Blue Chip caught up with her.

Causeway Securities

Founded in 2016, Causeway Securities is a global independent securities brokerage headquartered in Belfast, with offices in London and New York.

IRFA 2026 Conference

The IRFA 2026 Conference will address the dual transformation facing African retirement funds: navigating a fundamentally changed global order while meeting dramatically evolved member expectations.