The power of play in the workplace: how fun fuels success

According to Kruger, employees engaging in playful activities “experience a sense of freedom that allows fresh thinking, stronger connections with colleagues and increased motivation”.

Survival of the fastest

With the arrival of Artificial Intelligence into the mainstream world, we find ourselves at a point of optimism over the future in this cycle of technology innovation, writes Doug Nicol, Investment Analyst at Fundhouse.

Record of advice: various definitions often lead to misinterpretation

Anton Swanepoel, Founder of Trusted Advisors, states that some advisors refer to the client proposal as the record of advice and others refer to a quotation as the record of advice, both of which are only partially correct.

A home for independent financial planners

According to Warren Ingram, Co Founder of Galileo Capital, there is a real concern that independent financial planning is dying.

What is keeping the next generation of wealthy families awake at...

A panel discussion with next-gen family members at Stonehage Fleming’s annual Family Conference highlighted the pressures, opportunities and critical factors that could determine whether families and family businesses thrive or falter across generations.

Creating procedures with ChatGPT

Francois du Toit, PROpulsion, shares his guide to creating SOPs using ChatGPT.

Looking forward to a RAG-based future

Professor Evan Gilbert and Paul Nixon, Momentum Investments, provide answers to why AI is going to be a part of the future of financial advice.

A Coaching Way of Being

Blue Chip explores the role of coaching in unlocking financial potential. Behavioural coaching expert, Rob Macdonald, unpacks what it is and why it is important to the work of a financial planner.

Three AI tricks to make your clients love you more

Using AI cleverly can drastically reduce your workload and extend your reach, writes Zeldeen Müller, CEO, AgendaWorx.

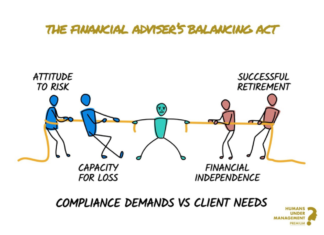

Choose your poison

According to Any Hart, Founder of Humans Under Management, financial advisors must champion their clients’ futures, confronting misguided compliance systems that obscure the real risks – capital loss, inflation, and poor returns – while working towards a framework that truly safeguards financial well-being.

Most Popular

How do SPs fit into the South African investment landscape?

Structured products are gaining traction in South Africa, complementing traditional asset classes through more customised risk management amid technological and regulatory change.

What key factors should institutional investors consider?

The role of structured products in institutional investments is growing, but these investors need to consider all the usual risks and benefits including liquidity and compliance with regulations such as Regulation 28 of the Pension Funds Act.

What risks and potential rewards need to be evaluated in structured products?

In evaluating structured products, all the risk factors need to be balanced against the benefits to ensure that the risks don’t undermine the benefits.

The transparency of structured products’ risk-return profiles and fees

When recommending structured products, advisors need to ensure risk and return profiles are suitable for investors. Full disclosure also requires transparency about the costs of investing. But risk-return profiles in structured products sometimes depend on the interplay of guarantees, conditions and pay-offs. Embedded costs are difficult to evaluate but listed products should be disclosing these.

Alexforbes named South African Manager of the Year at the Raging Bull Awards

Alexforbes were honoured at the Raging Bull Awards with two prestigious awards that highlighted the firms investment achievements and long-term performance.