Cutting out the noise

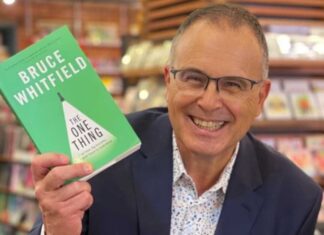

The FPI Harry Brews’ Award recognises an individual who has made a significant contribution to the financial planning profession through service to society, academia, training, government, media and any other professional activities. Blue Chip speaks to Bruce Whitfield, winner of the FPI Harry Brews’ Award, 2024.

Alexforbes strengthens investment capabilities

Alexforbes announces significant enhancements to its investment team, aimed at delivering superior outcomes for clients across various regions.

Analytics

Partnering with Analytics is a strategic decision that extends far beyond simply outsourcing investment management, writes James Towell, Managing Director at Analytics.

Why should a financial planner use a DFM?

Explore the many advantages financial advisors can gain by leveraging a Discretionary Fund Manager to oversee investment portfolios.

The Altvest Orient Opportunities Fund is opening doors

By bridging South African capital with China’s booming venture-capital market, Altvest Capital's Orient Fund empowers investors to participate in transformative global innovations and diversify beyond conventional asset classes.

Why Bitcoin?: Altvest Capital’s bold entry into the world of digital...

Altvest Capital Limited (JSE: ALV) has announced its first investment in Bitcoin (BTC) as part of a strategic treasury management initiative aimed at strengthening financial resilience, preserving shareholder value, and gaining exposure to the world's most recognized decentralized digital asset.

Alternative investments: Don’t overlook the potential of up-and-coming artists

In certain quarters, art has become an increasingly attractive alternative investment as part of a diversified portfolio. One of its biggest advantages is that,...

I am because of others

Kirsty Scully, board chairperson of the FPI, has been elected to serve as chairperson of the FPSB Council. The FPSB is the standards-setting body for the global financial planning profession. Its mission is to manage worldwide professional standards in the industry represented by the CFP® mark.

Alexforbes named best investment survey provider in Africa

Alexforbes is proud to announce that its investment survey team has been named the Best Investment Survey Provider in Africa for the sixth consecutive year.

A tale of two grocers

From the perspective of shareholders, Pick n Pay has been a significant disappointment, while Shoprite has proven to be a resounding success. What factors contributed to these vastly different outcomes? Were there any early indicators? Paul Whitburn and Wilhelm Hertzog of Rozendal Partners delve into the contrasting fortunes of these two grocery chains to explore the reasons behind their respective achievements or failures.

Most Popular

Blue Chip DFM Guide 2026

Welcome to the 2026 edition of the Blue Chip DFM Guide, a guide to Discretionary Fund Managers in South Africa.

Why blending unit trusts remains essential

In an environment where opportunity and uncertainty coexist, blending unit trusts is not about being cautious. It is about being prepared. By Natalie Harrison, Head of Distribution at Curate Investments.

How do SPs fit into the South African investment landscape?

Structured products are gaining traction in South Africa, complementing traditional asset classes through more customised risk management amid technological and regulatory change.

What key factors should institutional investors consider?

The role of structured products in institutional investments is growing, but these investors need to consider all the usual risks and benefits including liquidity and compliance with regulations such as Regulation 28 of the Pension Funds Act.

What risks and potential rewards need to be evaluated in structured products?

In evaluating structured products, all the risk factors need to be balanced against the benefits to ensure that the risks don’t undermine the benefits.