Mapping your advice process: the most important thing you can do...

Wealth Associates recently undertook the task of mapping their advice process, and if there’s one thing they learned, it has unlocked significant opportunities to improve client experiences, writes Theoniel McDonald

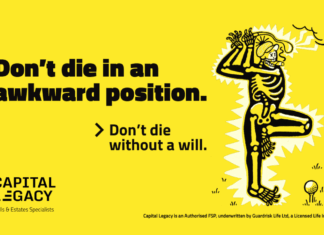

Don’t die in an awkward position

Capital Legacy stresses the importance of South Africans having a will regardless of age through their latest awareness campaign: "Don't die in an awkward position. Don't die without a will.".

A major milestone in the evolution of professional certification in financial...

The Financial Planning Institute of Southern Africa (FPI) is proud to announce the successful completion of its first CFP® Capstone and Financial Plan assessment, marking a significant milestone in the evolution of professional certification in financial planning.

Financial Planning Institute of Southern Africa announces new board chair

At its Annual General Meeting (AGM), the Financial Planning Institute of Southern Africa (FPI) announced the appointment of Olwethu Masanabo, CFP®, as the new Chairperson of the Board — signifying a seamless and strategic shift in leadership within the organisation.

ETF evolution: global and South African trends driving the future of index...

According to Fikile Mbhokota, CEO at Satrix, the ETF market is evolving at an unprecedented pace, reshaping global investment landscapes.

Succession planning for independent financial advisors in South Africa

Succession planning is a critical yet often overlooked aspect of managing an Independent Financial Advisory (IFA) practice in South Africa, writes Péru du Toit Founder, IPSE Tech Law Services

The hidden complexities of trust beneficial ownership compliance

According to Sandile Khumalo,LLM (Unisa),

FPSA®, GTP(SA), Fiduciary

Practitioner, Lex24, financial advisors frequently recommend the use of trusts as an estate planning tool and in some instances, they serve as the professional trustee on client trusts.

Shaun Thompson | Financial Planner Profile

Blue Chip speaks to Shaun Thompson, Financial Planner at Asset Tree Financial Advisors, about his journey as a Financial Planner®.

A home for independent financial planners

According to Warren Ingram, Co Founder of Galileo Capital, there is a real concern that independent financial planning is dying.

Darren Robertson, CFP® | Financial Planner Profile

Blue Chip speaks to Darren Robertson, CFP® at Opes Wealth, about his journey as a Certified Financial Planner®.

Most Popular

Causeway Securities

Founded in 2016, Causeway Securities is a global independent securities brokerage headquartered in Belfast, with offices in London and New York.

IRFA 2026 Conference

The IRFA 2026 Conference will address the dual transformation facing African retirement funds: navigating a fundamentally changed global order while meeting dramatically evolved member expectations.

How flexible and customisable should a DFM offering be?

As DFMs grow in scale and influence, the debate around flexibility and customisation in their investment offerings intensifies.

Meet the Managers 2026

Meet the Managers is considered the “Ted-Talk” in investment management, where financial advisors can access a vast array of investment managers, covering all types...

Offshore investment gains momentum in SA

Blue Chip speaks to Hymne Landman, CEO at Momentum Wealth, about offshore investing for South Africans.