Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.

Enter adviser practice buy-and-sell conversations with confidence

Blue Chip speaks to Brokerspace and Commspace to find out why understanding the full picture before choosing a path forward might change your succession and sale conversations for the better.

Why blending unit trusts remains essential

In an environment where opportunity and uncertainty coexist, blending unit trusts is not about being cautious. It is about being prepared. By Natalie Harrison, Head of Distribution at Curate Investments.

Blue Chip DFM Guide 2026

Welcome to the 2026 edition of the Blue Chip DFM Guide, a guide to Discretionary Fund Managers in South Africa.

The Investment Forum 2026

The Investment Forum is South Africa’s premier thought leadership event for financial advisors, asset managers, discretionary fund managers, and wealth professionals.

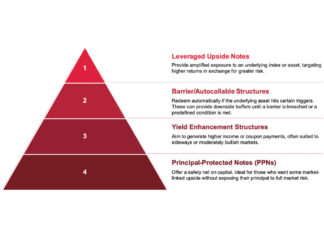

What is a structured product?

Structured products can offer investors a unique way to access market returns while managing risk with capital protection and tailored pay-offs.

2026 FPI Professional’s Convention

Join us in Cape Town on 07 – 08 October 2026 for two days of powerful learning, professional connection, and forward-thinking insights.

What are the different types of structured products available to retail...

There is a limited range of structured products offered in South Africa compared to the rest of the world.

The transparency of structured products’ risk-return profiles and fees

When recommending structured products, advisors need to ensure risk and return profiles are suitable for investors. Full disclosure also requires transparency about the costs of investing.

Most Popular

Meet the FPI Financial Planner of the Year

Established in 2000, the FPI Financial Planner of the Year Award is highly coveted and recognises outstanding achievement in the field and practice of financial planning. In 2025, the award went to Nicola Langridge, CFP®, wealth manager at Private Client Holdings. Blue Chip caught up with her.

Causeway Securities

Founded in 2016, Causeway Securities is a global independent securities brokerage headquartered in Belfast, with offices in London and New York.

IRFA 2026 Conference

The IRFA 2026 Conference will address the dual transformation facing African retirement funds: navigating a fundamentally changed global order while meeting dramatically evolved member expectations.

How flexible and customisable should a DFM offering be?

As DFMs grow in scale and influence, the debate around flexibility and customisation in their investment offerings intensifies.

Meet the Managers 2026

Meet the Managers is considered the “Ted-Talk” in investment management, where financial advisors can access a vast array of investment managers, covering all types...