The power of understanding financial behaviour

How Discretionary Fund Managers free advisers to focus on their clients. By Pat Magadla, Head of Distribution at Equilibrium.

Making succession planning a success

Succession planning remains a top priority for advisors everywhere. Florbela Yates, head of Equilibrium, discusses their approach, which begins with ensuring the advisor's investment offering is clean and scalable.

Partner with Glacier Invest to unlock infinite investment opportunities for your...

Glacier Invest’s leadership in South Africa’s discretionary fund management space enables them to deliver unparalleled investment and operational support to financial intermediaries.

MitonOptimal South Africa

For over 25 years, Cape Town-based MitonOptimal has established enduring partnerships with advisors by emphasising innovation, adaptability and a steadfast client-centric approach.

The Robert Group

According to John Robinson, DFM Specialist at The Robert Group, TRG Private Wealth is dedicated to the empowerment of financial advisors through innovative solutions that drive success.

STRATEGIQ Capital

By prioritising independence, expertise, transparency and partnership, STRATEGIQ empowers financial advisors with cutting-edge tools and strategic insights, writes Luis Levy, CFA®, Chief Executive Officer, STRATEGIQ Capital.

Pioneer in the DFM space

PortfolioMetrix was one of the first DFM firms in South Africa. Brandon Zietsman tells us more about their current offering.

Well positioned to thrive

Fay Khan, Senior Discretionary Fund Management Specialist at Investment Solutions by Alexforbes, offers her thoughts on the current DFM landscape.

Do DFMs just add to costs?

Nadir Thokan, Senior Discretionary Fund Specialist at Alexforbes, on the downward trend of DFM fees.

Award-winning pedigree

Leigh Kohler, head of DFM at INN8 Invest, explains why the company has an award-winning performance track record.

Most Popular

The Intelligent Adviser’s Playbook: PROpulsion hosts 2026 Practice Management Conference

A practical virtual conference for financial planning businesses that want to run smarter operations, without adding unnecessary risk or complexity.

PROpulsion Practice Management Conference 2026

The 2026 PROpulsion Practice Management Conference focuses on how advisers and their teams can use intelligent tools, including AI, in practical, defensible ways that improve efficiency, consistency, and client experience.

When clients ask if they have done enough

Kobus Kleyn (CFP®, Tax and Fiduciary Practitioner, Kainos Wealth) writes about understanding vulnerability in financial advice.

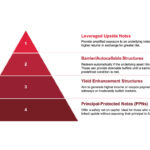

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.