What are the alternatives to using a DFM?

There are alternatives for advisors who don’t want to partner with a DFM, but each has its drawbacks. Find out more in the 2025 DFM Guide...

Why should a financial planner use a DFM?

Explore the many advantages financial advisors can gain by leveraging a Discretionary Fund Manager to oversee investment portfolios.

Research and transparency reigns supreme

Marius van der Merwe, a founding member and CEO of Amity Investment Solutions, explains the company's unique approach as a DFM.

What is a DFM actually?

The introductory article 'What is a DFM Actually' in Blue Chip's 2025 DFM Guide provides a comprehensive overview of how DFMs navigate complex investment strategies to deliver optimal portfolio solutions for financial advisors and their clients.

How and why a financial planner should use a DFM

An exclusive Blue Chip discussion with three of the country’s top investment and financial planning professionals focusing on Discretionary Fund Managers and how financial planners can best utilise their services.

The power of balance in your advice practice

Equilibrium has successfully grown its market share over recent years, built on good investment outcomes and by adding value to advice practices, writes Riaan Bosch, portfolio manager at Equilibrium.

Will financial planners ever be professionals?

The two most important professions of the 21st century are, undoubtedly, the medical profession and the financial planning profession, says Rob Macdonald, Head of Strategic Advisory Services, Fundhouse

The rising relevance of DFMs

In August 2022, Discovery launched Cogence, South Africa’s first truly global discretionary fund manager as well as the first discretionary fund manager to fully model retirement solutions by taking

health experience into account.

Global model portfolios for your advice practice

Interest in investing offshore has surged in South Africa, however, the investment opportunity set available offshore is vast. Florbela Yates outlines the benefits of partnering with a discretionary fund manager like Equilibrium.

Consider paying off debt prior to retirement

Coming to the end of your working career requires a step up in terms of financial planning, says Florbela Yates, Head of Equilibrium.

Most Popular

Protecting independent financial advice

The Financial Intermediaries Association of South Africa’s primary purpose is to guard, develop, promote and represent professional advisory and intermediary businesses in the financial services industry. Blue Chip speaks to Lizelle van der Merwe, CEO of the FIA.

The Intelligent Adviser’s Playbook: PROpulsion hosts 2026 Practice Management Conference

A practical virtual conference for financial planning businesses that want to run smarter operations, without adding unnecessary risk or complexity.

PROpulsion Practice Management Conference 2026

The 2026 PROpulsion Practice Management Conference focuses on how advisers and their teams can use intelligent tools, including AI, in practical, defensible ways that improve efficiency, consistency, and client experience.

When clients ask if they have done enough

Kobus Kleyn (CFP®, Tax and Fiduciary Practitioner, Kainos Wealth) writes about understanding vulnerability in financial advice.

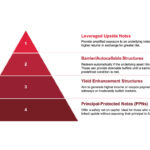

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.