A DFM can’t help you with your hair but can help...

When choosing a LISP platform, investors will be faced with the decision around an open-architecture platform (ie an independent platform that offers a wide range of underlying funds) or a more closed-architecture platform (that restricts the number of underlying funds you can invest in), says Florbela Yates, Head of Equilibrium Investment Management.

The fundamental need for health and behaviour modelling in retirement planning

Through this merging of technology and investment expertise, Cogence is not only the first truly global discretionary fund manager (DFM) in South Africa, but the first DFM globally to add a layer of personalised health and longevity insight to essentially map out every aspect of an individual’s financial plan, says Adrian Gore, CEO, Discovery

Global model portfolios for your advice practice

The new Equilibrium global model portfolios, sub-managed by our London based investment business, Momentum Global Investment Management (MGIM), gives South African investors access to a diversified range of global opportunities across a broad range of asset classes, countries, companies, currencies, and market sectors.

Should financial advisors use a DFM?

There is no one-size-fits-all definition that applies to all DFMs. It depends on the value proposition that a DFM has.

How advisors are benefitting from partnering with a DFM

A growing number of financial advisors in South Africa are starting to use discretionary fund

managers to help them manage their clients’ funds in the complex world of fund management, says Methula Sikakana, Business Development Manager, Equilibrium

Blue Chip Round Table Series

Blue Chip will be launching a series of Round Tables in 2023, covering key topics of interest to Financial Planners. The first round table, brought to you by Equilibrium (a division of Momentum Investments), focuses on Discretionary Fund Management. Register here...

Most Popular

Protecting independent financial advice

The Financial Intermediaries Association of South Africa’s primary purpose is to guard, develop, promote and represent professional advisory and intermediary businesses in the financial services industry. Blue Chip speaks to Lizelle van der Merwe, CEO of the FIA.

The Intelligent Adviser’s Playbook: PROpulsion hosts 2026 Practice Management Conference

A practical virtual conference for financial planning businesses that want to run smarter operations, without adding unnecessary risk or complexity.

PROpulsion Practice Management Conference 2026

The 2026 PROpulsion Practice Management Conference focuses on how advisers and their teams can use intelligent tools, including AI, in practical, defensible ways that improve efficiency, consistency, and client experience.

When clients ask if they have done enough

Kobus Kleyn (CFP®, Tax and Fiduciary Practitioner, Kainos Wealth) writes about understanding vulnerability in financial advice.

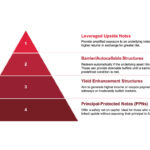

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.