Blue Quadrant Capital Management

Blue Quadrant Capital Management is a specialist South African hedge fund and unit trust investment manager.

Diversification is the only free lunch

Corion Capital is a pioneer of the South African hedge fund industry whose funds have been able to comfortably outperform their benchmarks since inception and with lower volatility. Blue Chip speaks to Garreth Montano, CEO, Corion Capital.

Corion Capital

Corion, previously a division of Brait Ltd, was founded in 2001 and continues to deliver market-leading risk-adjusted returns, nearly 25 years later.

Choosing the right hedge fund

Investment strategy, track record, risk management, investment team, fees and a thorough due diligence are key considerations when choosing a hedge fund.

Considerations for retail and institutional investors when incorporating hedge funds into...

A careful consideration of how hedge funds fit into an overall investment strategy is crucial for both institutional and retail investors, as is close attention to regulatory requirements.

Bateleur Capital

Bateleur Capital has delivered 20 years of outperformance while protecting capital, with one of the longest-running hedge funds in South Africa.

Investment partnerships breed hedge fund excellence

Amplify Investment Partners’ managing director Wade Witbooi explains the value that Amplify brings to the table and predicts a bright future for both his business and the industry as a whole.

Amplify Investment Partners

Based in Tygervalley, Cape Town, Amplify Investment Partners is a registered discretionary Financial Services Provider, which holds a FAIS Category I, II and IIA licence (FSP No. 712).

The pros and cons of using a hedge fund

Hedge fund strategies are not guaranteed to outperform more traditional investments, but they can turn market downturns into value-generating opportunities.

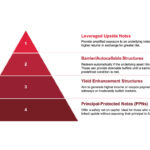

Types of hedge funds offered in South Africa

All hedge funds in South Africa are classified according to four tiers. Each tier addresses one of four key questions that any hedge fund investor should consider when deciding to invest.

Most Popular

The Intelligent Adviser’s Playbook: PROpulsion hosts 2026 Practice Management Conference

A practical virtual conference for financial planning businesses that want to run smarter operations, without adding unnecessary risk or complexity.

PROpulsion Practice Management Conference 2026

The 2026 PROpulsion Practice Management Conference focuses on how advisers and their teams can use intelligent tools, including AI, in practical, defensible ways that improve efficiency, consistency, and client experience.

When clients ask if they have done enough

Kobus Kleyn (CFP®, Tax and Fiduciary Practitioner, Kainos Wealth) writes about understanding vulnerability in financial advice.

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.