How would you describe your investment philosophy as it pertains to managing hedge funds?

Our investment philosophy is consistent throughout all of our funds and does not differ when it comes to hedge funds. We design investment strategies based on the core investment beliefs of risk premia (being rewarded for taking risk over the long term), being agile, valuation-driven to seek opportunities in market cycles, diversification and ensuring that costs must be managed effectively.

What do you see as your competitive advantage?

Corion serves as a single-entry point to diverse strategies and asset classes which combine uncorrelated return profiles. We strategically reduce portfolio risk while unlocking profitable opportunities typically out of reach to most investors. Our long history in the industry has afforded us entry into strategies and funds that are now closed to the general retail investor base, as well as our critical mass securing access to opportunities in new startup funds with favourable fee terms. Our experienced investment professionals have been in the markets for 20+ years and therefore involved in the markets over various cycles and not just in one long bull market. Corion is in the “Goldilocks stage” – not too big and not too small, resulting in dynamic systems, analysis and execution.

How do you manage risk in your hedge fund(s)?

Here is a breakdown of how we manage risk in our hedge fund(s).

- Top-down basis which starts with the portfolio construction – diversification is the only free lunch.

- Detailed due diligence and analysis of underlying fund managers by manager research team – decreases operational and manager risk

- Detailed quantitative work utilising optimisation to blend different risk and return payoffs to obtain the greatest probability of achieving the stated return vs risk profile – Corion has three very specific hedge funds targeting three different risk and return profiles – Low, Moderate and High

- Detailed look through analysis and monitoring utilising the services of third-party risk specialists

- We have developed an internal risk management function called Ballast which allows us to rebalance portfolios swiftly and cost-effectively, avoiding the delays and expenses at no additional cost.

How do you see the future of the hedge fund industry?

These are exciting times for the hedge space. Managers have access to a complete set of investment tools, many of which aren’t available to the traditional long-only investment manager – such as shorting and leverage. The SA hedge fund industry is fortunate to have a base of high-quality, exceptionally driven investment professionals, while the investment industry has started to embrace the industry and has recognised that hedge funds, when included correctly in one’s investment portfolio, can add substantial benefits.

How do you generate investment ideas?

As in life, there’s no getting around the fact that it all comes down to hard work. Hard work includes an extraordinary amount of reading, debating, listening and detailed analysis of markets. Corion has put in place dynamic, diversified investment teams that focus on different areas of the market and then meet regularly to discuss investment ideas. Once our top-down approach has been framed, we then employ managers with specific skill sets to deliver on our macro view.

What are your strategies for hedging against market downturns?

Diversification of uncorrelated strategies and assets is key, while utilisation of derivatives for hedging purposes and being agile in the implementation and management of such strategies is also important. Investing in assets with asymmetric payoffs is another strategy we follow.

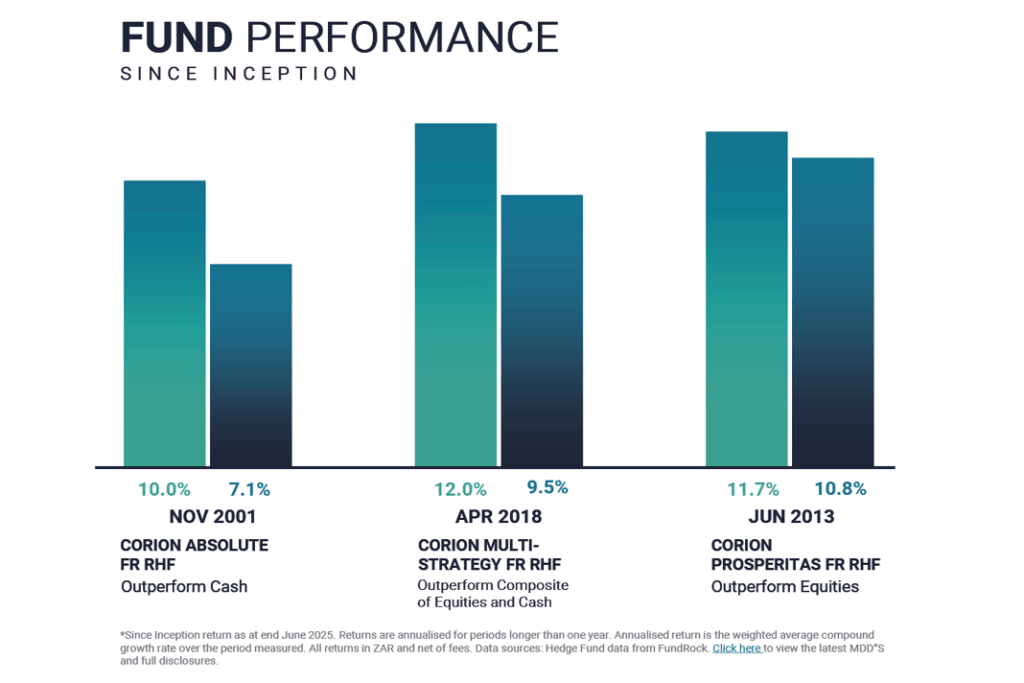

What is your track record, and how have your hedge funds performed in different market cycles?

Our longest-running hedge fund is coming up to a 24-year track record which means there have been various market cycles, corrections and crashes that have been experienced. Our funds have been able to comfortably outperform their benchmarks since inception and with lower volatility.

| About Garreth Montano Garreth began his career as a private client portfolio manager before embarking on his investment banking career with Investec. He attained vast local and international experience in equity derivatives. Garreth has experience in managing hedge funds and financial services businesses and has worked with Corion since 2012. Leandro holds a BCom (Honours) from the University of Cape Town and is a CFA charterholder. |

Corion Capital (Pty) Ltd. is An Authorised FSP (44523). https://www.corion.co.za/hedge-funds/