Experience you can count on

At Matrix, investment management is in the hands of seasoned professionals. Our streamlined structure enables agile, decisive execution within a clearly defined risk-management framework. Our leadership brings stability and vision.- Lourens Pretorius heads the Fixed Income team

- Bruce Mommsen leads the Equity and Property team

Absolute return, absolute focus

Matrix was a hedge fund manager first and that DNA still drives everything we do. Being active and pragmatic investors, we focus on liquid markets across our product offering, ensuring that we can adjust our holdings when circumstances dictate. Our absolute return philosophy prioritises capital preservation and returns that are consistent with our mandated objectives. The Matrix fixed income hedge funds focus on relative value trading strategies concentrated on the shorter end of the yield curve. We hold the view that many central banks – the South African Reserve Bank (SARB) included – implement credible monetary policy frameworks that are trend-like in nature. Moreover, we believe that market pricing tends to be an unreliable indicator of future monetary policy decisions, creating investment opportunities.

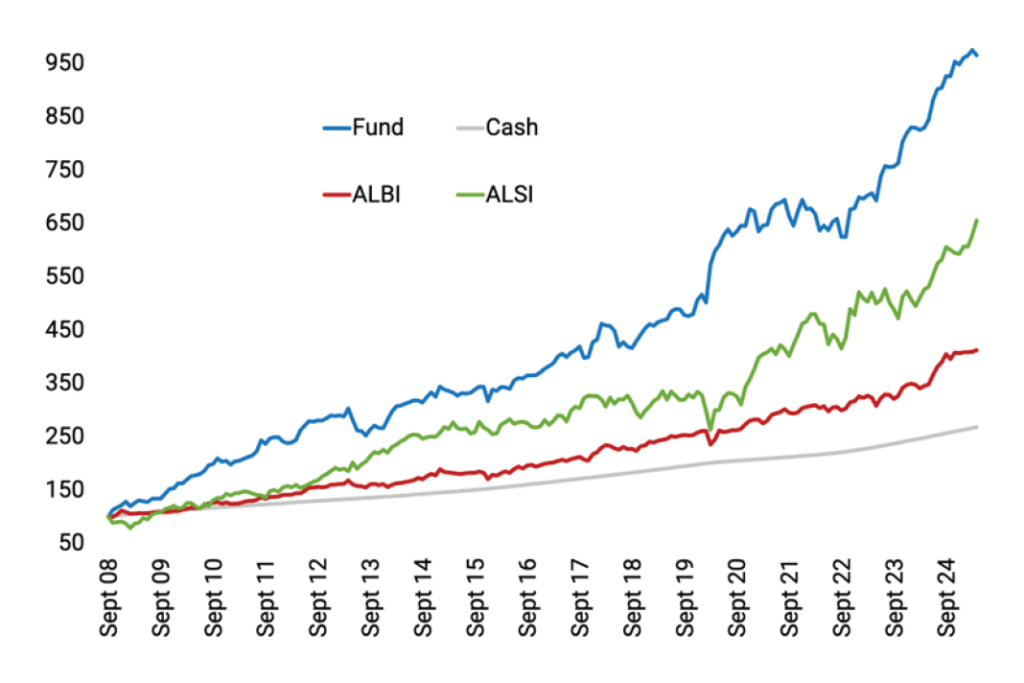

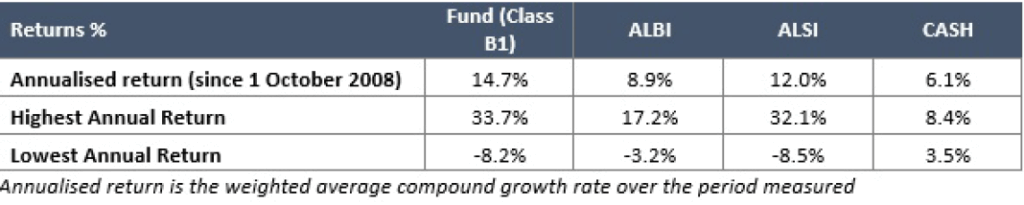

Source: Matrix SCI Fixed Income Retail Hedge Fund MDD, 30 April 2025. Note that past performance is not necessarily a guide to future performance and subject to disclaimers in link opposite.

Discipline drives alpha

Our hedge fund process is grounded in rigorous macroeconomic analysis, supported by proprietary econometric and fair value modelling. The use of interest rate derivatives significantly broadens our opportunity set, with global market access facilitated through our prime brokerage relationships. Over time, we have established ourselves as a meaningful and respected participant in this specialised market. All investment opportunities are evaluated within a clearly defined risk budget and mandate framework, ensuring capital is allocated where it delivers the greatest value. We place strong emphasis on maintaining high levels of liquidity and minimising credit risk at all times. In terms of client engagement, we work closely with our professional investors to understand their objectives and ensure efficient, transparent execution. Our clients can expect responsiveness, clear communication, and a collaborative approach at every stage.

Hedge fund solutions

Matrix offers two CISCA-regulated retail hedge funds (RHFs), complemented by a range of traditional unit trusts:- Matrix SCI Fixed Income RHF: Focused on institutional investors.

- Amplify SCI Income Plus RHF in partnership with Amplify Investment Partners: Retail ready and available on most LISPs.

Proven performance

Over time, the Matrix hedge funds have consistently delivered strong absolute returns with low correlation to traditional asset classes. Our Matrix SCI Fixed Income RHF, for example, has outperformed cash, bonds (ALBI) and equities (ALSI) over the 16.5 years since inception in October 2008, while exhibiting significantly lower volatility than equities (note that the fund converted to a regulated CIS hedge fund on 1 September 2016). When blended into a portfolio alongside traditional fixed income and equity assets, a Matrix hedge fund could have provided significant diversification benefits to portfolio risk and return profiles, a compelling case for financial advisors seeking optimal client outcomes.Contact information:

- Jean-Pierre Matthews

- Telephone: 021 673 7800

- Email: MatrixBDTeam@matrixfm.co.za

- Website: www.matrixfundmanagers.co.za

Matrix Fund Managers is spearheaded by a hedge fund legend

Blue Chip speaks to Jean-Pierre Matthews, Head of Product, Matrix Fund Managers.

What did you study, and how did you enter the investment industry?

I hold a BSc in Actuarial Science and began my career in employee benefit consulting. There was a large component of asset-liability modelling involved in the work and it was here, on the asset side, that I became fascinated by financial markets. At the time, my youth made the fast-paced and mysterious nature of that environment especially compelling.

How does your actuarial background influence the way you approach financial markets?

Actuarial science revolves much around valuing future cash flows that are often contingent on uncertain events such as life span, withdrawals or claims experience. Actuaries are trained to view the future as inherently uncertain and to make decisions that optimise for a range of potential future outcomes. That kind of probabilistic thinking about future scenarios is a practical and valuable approach to financial markets and investing.How has the hedge fund industry evolved in South Africa?

Many of my friends at Matrix and I have been involved in the SA hedge fund industry since its infancy. While it may appear to be gaining quick popularity now, this industry has been more than two decades in the making. We often joke that it has taken 25 years to become an overnight success. The regulatory framework introduced by the Financial Sector Conduct Authority (FSCA) has played a pivotal role in strengthening investor confidence, particularly among private clients. Previously, hedge funds were largely the domain of institutional investors, but we’re now seeing growing interest from the retail market.What still excites you about going to work every day?

Alpha generation remains the cornerstone of hedge fund investing, but it’s important to recognise that true alpha is rare and very few people possess the skill, insight and temperament to perform consistently. These individuals are often unconventional and highly talented, and I’m energised by them and the diverse perspectives they bring to markets and life in general. At Matrix, our hedge funds have nearly two decades of proven results, built on discipline, a differentiated approach and a growing talent pool of old campaigners and enthusiastic youngsters. It is awesome to be part of a team like that.| About Jean-Pierre Matthews Jean-Pierre joined Matrix in 2019 as Head of Product, responsible for the development and distribution of the Matrix product range. He is also a key individual, representative and member of Matrix’s Investment Committee. JP started his financial career in 1996 as a fixed income analyst and trader. A long-standing proponent of the SA hedge fund industry, JP has been involved in the establishment of various alternative asset management and securities trading businesses and was a portfolio manager and head of business at a large institutional alternative asset manager before joining Matrix. He has a degree in actuarial science and is a CFP and CFA Charterholder. |

Also available at https://bit.ly/matrixDisclaimer Sanlam Collective Investments (RF) (Pty) Ltd), a registered and approved Manager in Collective Investment Schemes in Securities. Collective investment schemes are generally medium- to long-term investments. Past performance is not necessarily a guide to future performance, and that the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available from the Manager on request. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Performance is based on NAV-to-NAV calculations with income reinvestments done on the ex-div date. Performance is calculated for the portfolio and the individual investor performance may differ as a result of initial fees, actual investment date, date of reinvestment and dividend withholding tax. While CIS in hedge funds differ from CIS in securities (long-only portfolios) the two may appear similar, as both are structured in the same way and are subject to the same regulatory requirements. The ability of a portfolio to repurchase is dependent upon the liquidity of the securities and cash of the portfolio. A manager may, in exceptional circumstances, suspend repurchases for a period, subject to regulatory approval, to await liquidity and the manager must keep the investors informed about these circumstances. Further risks associated with hedge funds include: investment strategies may be inherently risky; leverage usually means higher volatility; short-selling can lead to significant losses; unlisted instruments might be valued incorrectly; fixed income instruments may be low-grade; exchange rates could turn against the fund; other complex investments might be misunderstood; the client may be caught in a liquidity squeeze; the prime broker or custodian may default; regulations could change; past performance might be theoretical; or the manager may be conflicted.