Visio Fund Management is one of the longest-running investment firms managing hedge funds and was founded in June 2003 by their current CIO, Patrice Moyal. Visio is a Level 1 B-BBEE contributor and a signatory to the UN Principles for Responsible Investing. The firm manages assets on behalf of both domestic and offshore institutional and retail clients including pension funds, family offices, multi-managers, sovereign wealth funds and retail investors. Royal Investment Managers, a JV between Royal Bafokeng Holdings and Investment Managers Group, holds a minority equity stake in the business.

People

Ofri Kahlon heads up the firm’s hedge fund strategy, under CIO Patrice Moyal, and has been part of the Visio team since 2006. The team consists of 14 investment professionals who have over 260 years of combined experience and have a range of backgrounds including accounting, engineering, mathematics, commerce and economics. Several of the investment professionals also hold CFAs and MBAs. There are five operational support staff focused on client service and business development.

Investment approach

Visio’s investment philosophy has been firmly rooted in fundamental analysis. We are focused on capital preservation and follow a disciplined, fundamentally focused bottom-up research approach while being cognisant of the world around us. This philosophy and process has been applied to hedge funds since 2003. Our approach is predominantly (90%) bottom up and sector or theme specific, with a top-down macro-overlay (10%).

Our investment philosophy always has the capital preservation mindset foremost in our approach which is focused on downside protection. To achieve this end, we focus on quality businesses with strong management teams, good governance, solid balance sheets and attractive free cash flow yields. The team engages with the boards of companies to unlock value through constructive engagement or activism.

Products

From a hedge fund perspective, Visio offers both qualified investor and retail investor hedge funds as follows:

Qualified investor hedge funds

- Visio FR Golden Hind Qualified Investor Hedge Fund

- Visio FR Occasio Qualified Investor Hedge Fund

- Pricing and dealing monthly

Retail investor hedge funds

- Visio FR Retail Hedge Fund

- Pricing and dealing daily

Since 2004, Visio has diversified its product offering across long-only SA equities, multi-asset balanced funds, offshore USD hedge funds, global equity, fixed-income mandates and property funds.

Performance

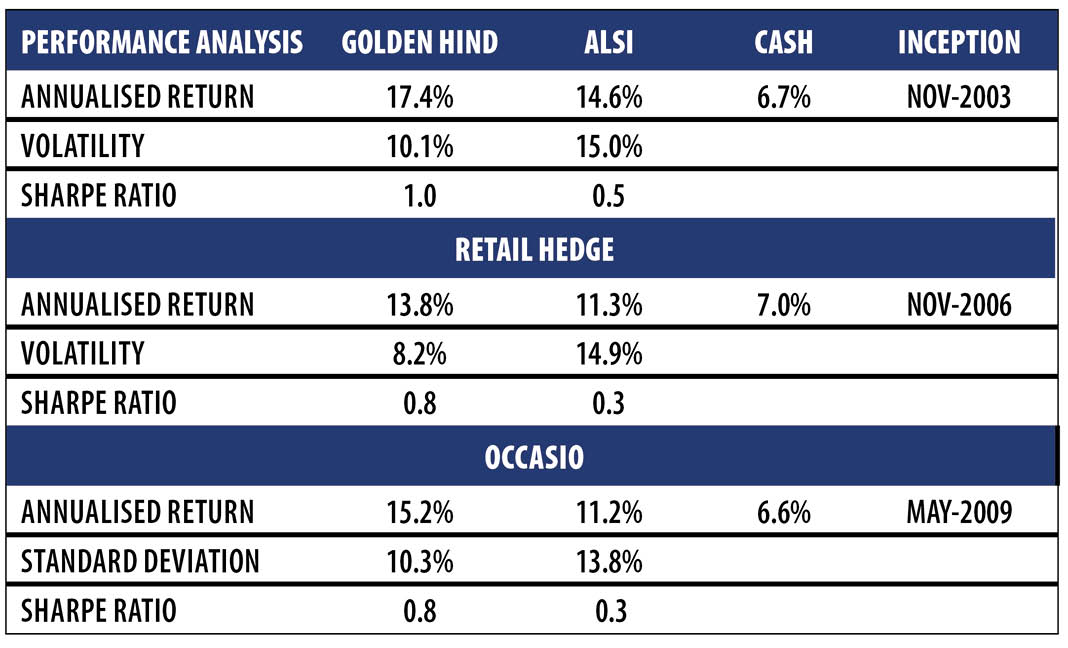

Visio has won HedgeNews Africa Hedge Fund Awards for both its rand and US dollar denominated funds over the years. The since inception returns for our rand hedge funds are summarised as follows at 30 April 2025:

Contact information:

• Craig French or Vulani Mampane

• Telephone: 010 020 6263 or 011 245 8900

• Email: info@visiofund.co.za

• Website: www.visiofund.co.za

The information above has been produced by Visio Fund Management (Pty) Ltd. Past performance is no guarantee of future returns, values can go up and down. Investments employing the strategies described in this document are by nature speculative and may be volatile and therefore should only be considered by experienced and sophisticated investors. This material is not intended to be a prospectus and does not constitute an offering of investment fund shares. For additional information please request the prospectus and supplementary documentation. Visio Fund Management (Pty) Ltd is a licensed Financial Services Provider (FSP no. 49566) with the Financial Sector Conduct Authority (FSCA).