Anton, what is your professional background relating to the Conduct of Financial Institutions (COFI) Bill?

Anton Swanepoel [AS]: I have been deeply involved with market conduct legislation since the introduction of the FAIS Act in 2004. I have served on the Financial Intermediaries Association Regulatory Committee and the Association for Savings and Investment SA (ASISA) COFI Workgroup that provided input to the Financial Sector Conduct Authority (FSCA) and National Treasury after the Bill was published for public comment in 2018.

I currently serve as a member of the COFI Bill Transition Working Group under the auspices of the FSCA’s Market Conduct Committee and I am a member of the Sub-Working Group that focuses on risk management and compliance.

What is COFI?

AS: The COFI Bill is a major piece of legislation aimed at consolidating financial market conduct regulation. It is a key part of the Twin Peaks regulatory reforms, intended to replace multiple laws, such as the Financial Advisory and Intermediary Services (FAIS) Act, the Long-term and Short-term Insurance Acts, the Pension Funds Act and the Collective Investment Schemes Control Act, with a unified, principles-based framework. This Act will be regulated by the FSCA.

What is COFI’s objective?

AS: To establish a single, comprehensive regulatory framework for the market conduct of financial institutions in South Africa, with the aim of improving how these institutions treat their customers, manage risks and contribute to the integrity and stability of the financial system.

What are the salient features of COFI?

- COFI offers a single, consistent market conduct regulatory framework for all financial institutions – not only FSPs.

- It promotes trust and confidence in the financial services sector.

- COFI emphasises governance, culture and accountability.

- It promotes innovation and sustainable competition.

- The legislation is principles-based and outcomes-focused.

- Regulatory requirements are based on the financial activities an institution performs, not only the type of licence it holds.

- It allows for tailored, risk-proportionate regulation, especially for smaller entities.

- It focuses on transformation and inclusion.

How does COFI offer a strategic opportunity?

AS: For forward-thinking financial institutions, this marks a unique strategic moment: a chance to reimagine your vision, revitalise your value proposition, embrace disruptive innovation, reset competitive advantages and optimise your technological infrastructure. Those willing to invest in proactive strategic planning and willing to adapt will be best positioned to lead in the evolving regulatory landscape.

What will change?

- Licensing

- Key definitions

- Accountability

- The focus on outcomes-based and risk-based regulation

What will not change?

- The need for good leadership

- The operational framework of FSPs

- The fundamentals of professional client engagement

- The fundamentals of prudent business management

- The significance of contractual relationships between the various stakeholders in the financial services industry

How is the Financial Sector Regulation (FSR) Act different to the COFI Bill and why should they be read together?

Lelané Bezuidenhout [LB]: This is a loaded question that could easily fill a book, never mind a 100-word answer. The FSR Act, also known as the “Twin Peaks” legislation, came into effect in 2018. It established the Prudential Authority and the FSCA, creating the framework for regulating the prudential and market conduct of financial institutions. The COFI Bill builds on this framework.

While the FSR Act creates the regulatory architecture, COFI provides the detailed conduct rules, covering governance, advice, product design, advertising, transformation and post-sale processes. They should be read together because the FSR Act sets out the “who” and “how” of regulation, while COFI operationalises the “what” of fair and ethical financial sector conduct.

How, in your opinion, will COFI impact the sector?

LB: The South African financial planning profession has been operating in a Treat Customers Fairly (TCF) world for over 45 years. Where these principles have been aspirational, they will now be codified into law. This means the principle-based best practice members lived by is now a statutory obligation with clear regulatory consequences for non-compliance. COFI therefore affirms ethical and client-centric practices for FPI members rather than radically changing them.

The FPI continues in its advocacy efforts to encourage the FSCA to deem professional members of the FPI as qualified in most, if not all, competency standards. It was done before, when phase II of the Regulatory Examinations was supposed to come into effect; FPI members were exempt from writing phase II regulatory examinations.

What is the importance of placing the client’s interest first?

LB: Placing the client’s interest first is at the very core of what we do as professionals. It’s more than compliance; it’s about doing what’s right even when no-one is watching. It means stripping away anything that could cloud your judgement – such as sales targets, commission or personal gain – and focusing entirely on what best serves your client.

When we put the client first, we build trust, act with integrity and truly live up to the promise of our profession.

The suitability of advice is a key component of the desired TCF outcomes. What are these outcomes?

LB: Suitability of advice has been part of our profession for some time through the FPI Code of Ethics and the FAIS General Code of Conduct (Chapter 7, Section 8), which focus on providing advice appropriate to a client’s needs and circumstances. COFI extends this focus beyond individual advice to include institutional conduct across the full product and service lifecycle.

The TCF framework sets out six key outcomes that underpin fair client treatment and the suitability of advice:

- Clients are confident when they deal with firms where fair treatment is central to the culture.

- Products and services are designed to meet the needs of identified target markets.

- Clients receive clear, fair and not misleading information before, during and after the sale.

- Advice is suitable and takes the client’s circumstances and objectives into account.

- Products perform as firms led clients to expect, and service is of an acceptable standard.

- Clients do not face unreasonable post-sale barriers when changing products, switching providers, submitting claims

or lodging complaints.

Under the FAIS Code of Conduct, these outcomes translate into a duty to act honestly, fairly and with due skill, care and diligence when providing advice. The FSR Act reinforces these outcomes by mandating client protection and market integrity, while the COFI Bill goes further by codifying TCF principles into law, requiring financial institutions to embed them into governance, product oversight, advertising, advice processes and post-sale conduct.

When we put the client first, we build trust, act with integrity and truly live up to the promise of our profession.

In short, suitability of advice is not only about matching products to client needs; it is about ensuring fair treatment across the entire client journey, from advice and product design to implementation, review and beyond.

What are the ethical considerations of compliance?

What are the ethical considerations of compliance?

AS: COFI demands that financial institutions must demonstrate an ethical culture. Currently, the ethical considerations of compliance are captured in the provisions of Section 2 of the FAIS General Code of Conduct. The nine principles in the reviewed FPI Code of Ethics provide a comprehensive overview of what constitutes ethical behaviour of financial advisors and intermediaries.

Please expand on the competence and ethical standards that underpin the CFP® certification. How does the CFP® certification align with COFI?

LB: Financial planning standards have been established globally for over 50 years and have been applied in South Africa since 1981, with the CFP® designation formally introduced here in 2001.

COFI, introduced decades later, reflects many principles that have long underpinned financial planning. It emphasises client-centricity, ethical culture, fair treatment and the suitability of advice – all of which are embedded in the CFP® framework through:

- Fair treatment and suitability, achieved via structured and client-focused advice processes.

- Governance and accountability, maintained throughadherence to a strict Code of Ethics.

- Conduct alignment, supported by professional standards extending from advice delivery to post-sale engagement.

CFP® certification already operationalises the core principles of COFI, ensuring that CFP® professionals are well-prepared

for its focus on ethical, competent and accountable delivery of financial services.

The FPI has renewed its Code of Ethics. What is the fundamental difference in the revised Code?

LB: The fundamental change in the revised FPI Code of Ethics is the addition of a new principle: accountability. This principle requires members to take ownership of their actions, maintain transparency and be willing to explain decisions when asked. It includes addressing the consequences of actions by making necessary corrections and improvements.

In practice, FPI members demonstrate accountability by clearly defining scope, deliverables, timelines and pricing; maintaining open, honest communication; promptly informing clients of issues or changes as well as complying with legal and ethical standards. Accountability builds trust by ensuring responsibility, transparency and commitment to ethical, client-focused conduct.

What are the nine building blocks of the FPI Code of Ethics? How do these principles align with COFI?

LB: The FPI Code of Ethics guides members to conduct themselves ethically, protecting clients, the profession and society while supporting its credibility and sustainable development. It promotes ethical behaviour, sets clear conduct boundaries and fosters ethical awareness and decision-making.

The Code consists of three parts: definitions, nine ethical principles and practice standards (the six steps of financial planning). The nine principles are competence, integrity, professionalism, client first, fairness, objectivity, confidentiality, diligence and accountability.

These principles align closely with COFI’s focus on client-centricity, ethical culture, fair treatment, governance and accountability, ensuring that FPI professional members are prepared for COFI’s requirements.

Please talk to us about the psychology of risk management and compliance.

AS: The way we think about compliance has a significant impact on how we respond to it. If we have a “groan mindset” when it comes to risk management and compliance, we will always experience pain and discomfort in this area. We need to change our thinking and adopt a “growth mindset”.

Risk management and compliance have more to do with professional practice management and creating a foundation for growth than simply abiding by the rules.

What about the need for compliance officers when COFI comes in?

What about the need for compliance officers when COFI comes in?

AS: Every FSP should embrace their compliance officer as a valuable resource in their business. No practice should operate without an FSCA-approved compliance officer. It provides the business with an extra pair of eyes to look after the interests of the business. I am in favour of compliance officers and believe that sole proprietors will no longer be permitted to render financial services without appointing a compliance officer.

How are compliance and practice management two sides of the same coin?

AS: Every component of the operational framework in every FSP is regulated and the same components require a best-practice approach to business to create a competitive advantage in the market.

Please outline what effective practice management entails.

LB: As with any professional practice, such as those of doctors or legal practitioners, effective practice management in a financial planning context entails running a sound, profitable business in South Africa with the necessary skills, resources and adherence to the practice’s regulatory universe (all regulations that apply to the practice).

It involves implementing strong governance frameworks, maintaining robust compliance and risk management processes, ensuring the competence and ongoing development of staff, embedding a client-centric culture, leveraging appropriate technology and applying the financial planning practice standards.

Together, these ensure sustainable operations, ethical conduct and consistent delivery of value to clients.

What are the three types of cultures that COFI demands?

LB: We need to be clear that this should not be confused with the New Zealand COFI Act of 2022, which came into effect on 31 March 2025. In the South African COFI Bill, Chapter 4 sets out principles relating to culture and governance for financial institutions. It mandates that institutions build and maintain a culture of fairness, integrity, market trust and transformation, supported by strong board-level governance and clear institutional accountability.

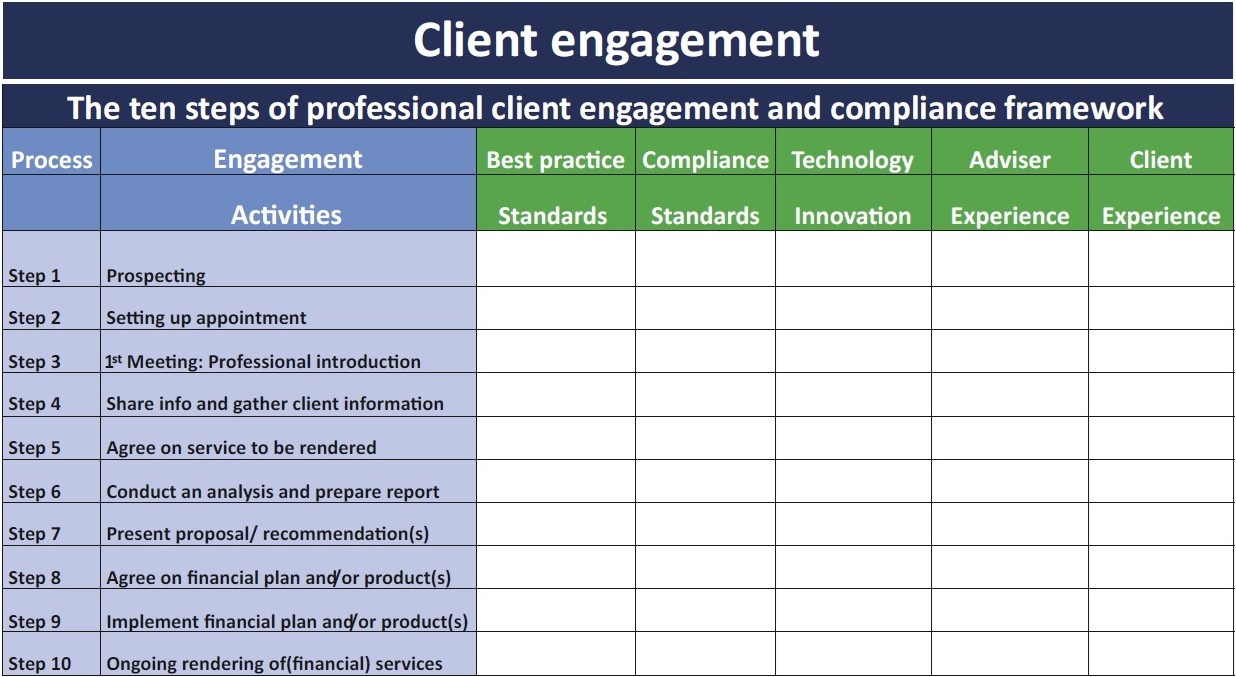

How does the 10-step process of professional client engagement align with COFI?

AS: The 10-step process of professional client engagement can best be summarised in the following table and all these steps are currently, and will remain, regulated. The client engagement framework has remained unchanged since before and during FAIS and it will continue to exist in some form during COFI. COFI will not have any effect on the client engagement process. It may affect the way we conduct ourselves from a compliance point of view during each of the steps. This process is one of the things that will not change under COFI.

It is important to note that the 10 steps of professional client engagement is not a replacement of the six-step process of financial planning. The latter is included in the former.

What are the six steps of financial planning?

LB: The six steps of financial planning have been around for decades and were updated in 2023 via the FPSB’s Global Financial Planning Standards. Now part of the “doing” domain, the Financial Planning Practice Standards outline six core practices and 20 practice standards, guiding a structured, client-centric process from relationship building to review, ensuring planners apply knowledge, skills, ethics and accountability at every stage.

What are the real-world implications of COFI?

LB: We need to consider the implications from both the financial services side and the consumers’ point of view. The COFI Bill introduces a single licensing regime with stricter governance and fit-and-proper requirements, placing greater accountability on boards to embed fair treatment, manage conflicts and foster an ethical culture.

While the financial services industry may feel increasingly over-regulated, consumers stand to benefit from improved advice quality, clearer communication, better-designed products, easier switching and complaints processes and overall stronger protections.

The FPI aims to ease the transition, reduce uncertainty and help our members remain compliant.

What advice do you have for key individuals?

AS: Take extreme ownership of your responsibilities. COFI will bring a higher level of accountability. Every key individual will have to “man up”. It offers a serious growth opportunity.

How does COFI differ from the FAIS Act in terms of its market conduct regulation approach?

AS: The FAIS Act is more rules-based than principles-based. FAIS facilitates a tick-box approach. COFI is more principles-based and outcomes-based than rules-based. The six TCF principles are firmly entrenched in COFI. It offers the opportunity for FSPs to articulate their own business policies if they meet ethical and TCF outcomes.

What role does COFI play in facilitating innovation and competition in the sector?

AS: COFI promotes innovation and sustainable competition. It is up to the leadership of every FSP to plan strategically and facilitate the effective implementation of innovative ideas and technology to establish a competitive advantage.

Why should FSPs start planning now for proportionality? And how do they prepare for it?

AS: The principle of proportionality is a core feature of COFI’s approach to regulation. It means that the regulatory obligations placed on financial institutions will be scaled according to the nature, size, complexity and risk profile of their business activities.

Smaller to medium-sized FSPs will find it increasingly more difficult to cope under COFI if they do not proactively put strategies in place to benefit from the principle of proportionality. Why start planning for it now? According to The 7 Habits of Highly Effective People, the first habit is: be proactive.

How to prepare for it? Although ChatGPT is an option, the industry will offer many presentations and workshops on this topic soon. One of the best ways to prepare is to be aware of its importance, read articles and attend related events.

The additional compliance burdens and increased costs thereof as well as shifting to a principle-based regulation may create challenges in understanding the requirements of COFI. What is the FPI doing to alleviate these concerns?

LB: We must be responsible in how we communicate the message. We can either provide certainty or create chaos by overcomplicating matters. We choose clarity.

The FPI recognises that the COFI Bill will bring additional compliance burdens, costs and a shift to principle-based regulation, which may create challenges in understanding and applying its requirements. To support members, we are engaging with the FSCA through consultations and working groups to influence proportional and practical implementation. We are also leveraging subject matter experts to deliver CPD-accredited training that simplifies COFI’s principles and translates them into actionable steps for practices.

Through advocacy and direct dialogue with regulators and other professional bodies and/or associations, the FPI aims to ease the transition, reduce uncertainty and help our members remain compliant while maintaining client-centric service delivery.

How will the FPI advocate for small FSPs during the transition to COFI?

LB: The FPI is advising that proportionality remains central to COFI’s implementation, ensuring that small FSPs are not overburdened by requirements designed for larger institutions. We are actively engaging with the FSCA to influence practical, phased approaches that consider the size, complexity and risk profile of smaller practices. The FPI also benefits from a competent advocacy committee made up of dedicated volunteers, supported by other specialist competency committees that provide additional insight and expertise.

In addition, the FPI is developing and promoting more accessible training opportunities to help members understand COFI, its conduct standards and the strategies already published by the FSCA. Through these efforts, we aim to ensure that small FSPs transition smoothly, remain compliant and continue to deliver high-quality, client-centric financial advice.

What are the three major COFI disruptors that advice professionals will need to prepare for?

LB: Activity-based licensing will require practices to map and document all their services, ensuring compliance and fit-and-proper standards for each. Embedded culture and governance demand a demonstrable client-centric and ethical culture, supported by strong oversight, conflict-of-interest management and measurable transformation plans. Outcome-based regulation shifts compliance from a prescriptive checklist to proving how advice and operations deliver fair treatment, suitability and good client outcomes.

Collectively, these disruptors require advice professionals to rethink compliance, strengthen governance and integrate client-centricity throughout their practices.

Under the COFI Bill, advisors can expect remuneration rules to appear alongside conflict-of-interest regulations. What is your view on this?

LB: It makes sense. It also speaks directly to the question asked at the start of the interview – what does it truly mean to put your client first?

Chapter 4, Part 3 of the [publicly available] draft COFI Bill makes it clear that remuneration structures cannot conflict with TCF outcomes. It requires governing bodies to take responsibility for overseeing remuneration policies, managing conflicts of interest and ensuring that incentive structures support ethical, client-centric behaviour. For advisors, this means greater scrutiny of how fees, commissions and performance incentives are structured, with a shift away from models that could undermine objectivity.

While the financial services industry may feel increasingly over-regulated, consumers stand to benefit from improved advice quality, clearer communication, better-designed products, easier switching and complaints processes and overall stronger protections.

In essence, COFI embeds the principle that remuneration must align with fair treatment, suitability and client interests, reinforcing the profession’s ethical obligations.

What are the first three steps that financial advisors should take considering COFI?

AS:

- Make sure that you approach COFI with the right mindset – a growth mindset!

- Seek first to understand the impact COFI may have on your FSP.

- Prepare for the most important strategic planning exercise for your practice in your entire career.

How can FPI members prepare for the roll-out of COFI?

LB: FPI members already have a deep understanding of the TCF framework as it has been embedded in our standards for decades. However, not all are fully prepared for COFI’s broader, client-centric and governance-driven requirements.

To prepare, practices should deepen their integration of TCF outcomes, map business activities against COFI’s proposed activity-based licensing framework and ensure supporting documentation is in place. Strengthening governance is key. Boards and key persons must review oversight structures, refine compliance policies, address conflicts of interest and develop measurable transformation plans. Risk management and monitoring frameworks should also be upgraded to meet COFI’s enhanced conduct and reporting standards.

By acting early and focusing on culture, ethical governance and client outcomes, FPI members can ease the transition to COFI.

What advice do you have for FPI members regarding COFI?

LB: Start preparing for COFI now rather than waiting for it to be fully implemented. Begin by consulting the FSR Act, the draft COFI Bill and the conduct standards already published by the FSCA. Map your business activities against COFI’s proposed licensing framework and review your governance, compliance and risk management structures. Deepen the integration of TCF outcomes in your practice to ensure a truly client-centric culture.

Most importantly, make use of the training, guidance and toolkits that the FPI is developing and hosting to simplify COFI’s requirements into actionable steps. COFI should not be seen as an administrative burden but as an opportunity to strengthen professionalism, build trust and enhance the value you deliver to clients.