Retirement is often described in numbers: savings, investments, annuities, and income projections. But for clients, the decisions at this stage are deeply human. They carry emotional weight and long-term consequences that few are prepared to navigate alone. This is where financial advisers play a pivotal role, not just as financial and investment planning experts, but as trusted partners.

When clients reach retirement, legislation requires that two-thirds of their accumulated savings from retirement funds be converted into an approved income product. For many, this is the largest financial decision they will ever make. The choice between a living annuity and a life annuity, or a blend of the two, is not simply a technical one. It involves trade-offs between flexibility, certainty, growth potential, and legacy planning.

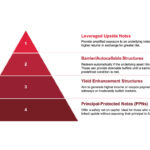

A living annuity offers more control and investment flexibility, but places longevity and market risk squarely on the retiree. A life annuity, by contrast, guarantees income for life, transferring these risks to the insurer. With hybrid solutions, such as the Retirement Income Option (living annuity) with the Guaranteed Annuity Portfolio (life annuity) as an optional underlying investment component from Momentum Wealth, clients can combine certainty with flexibility, reducing the stress of having to choose one or the other.

On the topic of behavioural biases, even rational investors struggle when faced with life-changing decisions. Loss aversion, overconfidence, and short-term thinking often derail sound planning. Clients may panic when markets dip, locking in losses and missing future gains. Others overestimate their ability to ‘beat the market’, ignoring longevity risk and inflation.

Advisers can counter these biases by reframing choices and simplifying complexity. A guaranteed annuity, for example, provides psychological comfort by removing ongoing decision-making pressure. There is no ongoing management required, and you don’t have to worry about making the wrong decision later in life.

No two retirements are alike. Health, family needs, and lifestyle aspirations all shape the suitable solution. Advisers should start with context: What matters most to the client? Sustainable income should ideally always take precedence over leaving a legacy, but beyond that, priorities differ. Some value flexibility, others crave certainty. Some want growth potential, others peace of mind.

Regulatory frameworks, such as Treating Customers Fairly (TCF) and the upcoming Conduct of Financial Institutions (COFI) legislation, reinforce this principle. They demand transparency, fairness, and suitability, all of which depend on personalised advice.

Technology can transform these conversations. With digital simulators and comparison tools, such as Momentum Wealth’s Income Illustrator, advisers can illustrate the long-term impact of choices in both real and nominal terms. Visualising how inflation erodes a level income or how different drawdown rates affect sustainability helps clients make informed decisions. These tools act as behavioural nudges, reducing fear and increasing confidence.

Ultimately, retirement planning is not a one-size-fits-all conversation. It’s a journey that requires empathy, expertise, and ongoing engagement.

While annuities purchased with compulsory money from retirement funds dominate retirement discussions, voluntary purchased annuities can address specific needs. Term-certain or life annuities purchased with money that does not come from retirement funds can, for example, fund a child’s education or bridge a temporary income gap. They also offer tax advantages as only the interest portion of income is taxable, unlike an annuity purchased with compulsory money, where the full income is taxed.

Ultimately, retirement planning is not a one-size-fits-all conversation. It’s a journey that requires empathy, expertise, and ongoing engagement. Advisers who combine behavioural insight with technical knowledge, supported by digital tools and regulatory safeguards, can help clients retire with confidence and peace of mind.

Reimagine retirement income planning and empower your clients to retire with confidence. Speak to your Momentum consultant today to explore how the Guaranteed Annuity Portfolio from Momentum Wealth and Income Illustrator can elevate your retirement income planning conversations. For more information, visit our website here.

Momentum Wealth is part of Momentum Investments and Momentum Group Limited. Momentum Wealth (Pty) Ltd is an authorised financial services provider (registration number 1995/008800/07, FSP number 657). Momentum Metropolitan Life Limited is an authorised financial services and credit provider (registration number 1904/002186/06, FSP number 6406). The Retirement Income Option and the Guaranteed Annuity Portfolio are life insurance products, underwritten by Momentum Metropolitan Life Limited, a licensed life insurer under the Insurance Act and administered by Momentum Wealth (Pty) Ltd. The information in this article is for general information purposes and not intended to be an invitation to invest, professional advice or financial services under the Financial Advisory and Intermediary Services Act, 2002. Momentum Investments does not make any express or implied warranty about the accuracy of the information herein.