Last year, we predicted that 2025 would see continued US economic exceptionalism while the rest of the world stumbled out of their doldrums. We also warned that Donald Trump’s policies would increase volatility, as investors wrestled with the question: Will Growth Trump Inflation? This largely played out, with the US experiencing exceptional above-trend growth, while Europe, emerging markets and Australia saw growth recover from its 2024 lows. However, as Trump’s focus oscillated between his pro-growth policies and protectionist agenda, we witnessed significant swings in both equity market performance and economic outlook following Liberation Day. Investors keep asking us: Is the wild ride over? Unfortunately, we believe it is not.

A new market protagonist

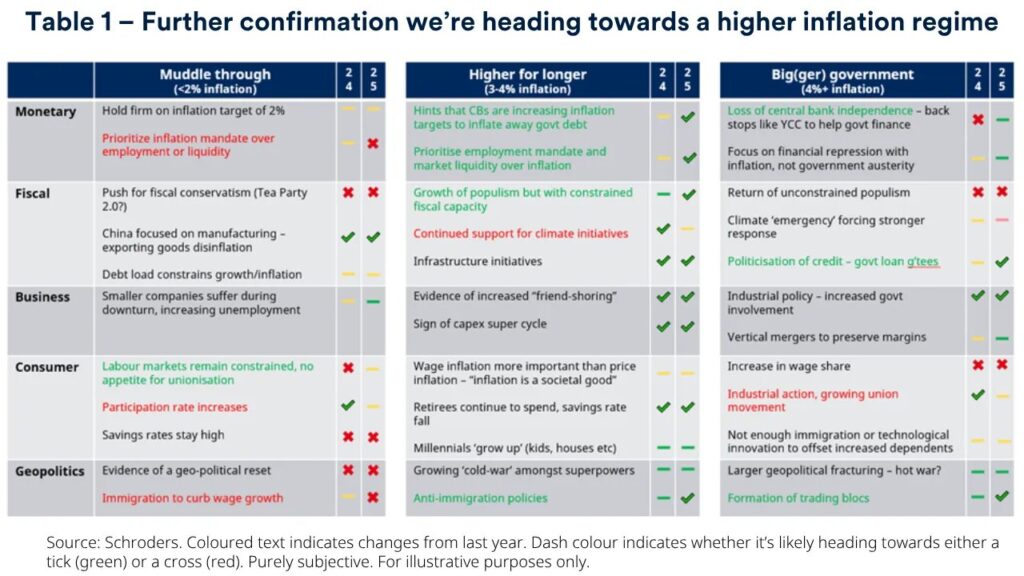

As governments around the world shift from a decade of fiscal constraint, we’re truly in a regime where fiscal policy plays a leading role in economic outcomes. This is a 180-degree change from a period of fiscal austerity – where loose monetary policy was doing everything it could to boost inflation up towards central bank targets – to a period of fiscal largesse, where central banks will be forced to keep rates higher for longer to bring inflation back down towards their target.

Governments will be forced to spend on defence, upgrade infrastructure, realign supply chains, and secure access to critical resources, on top of dealing with increasing inequality and delivering on the populist policies they promised in order to get into government. This fiscal spending will lead to higher debt levels, requiring higher growth and inflation to inflate the debt away. Higher inflation will likely lead to higher economic volatility, but also positive equity-bond correlations, leading to more asset price volatility.

These regimes are inherently more unstable, so we do not believe the volatility of 2025 will disappear in 2026. Policy driven economies are far more susceptible to economic or market jolts, as the economy realigns with the will of the government. However, the good news is that we believe global growth will remain resilient in 2026, with policy makers doing everything they can to keep the economy humming along.

Where does this leave our view of asset classes for 2026?

Starting with equities, valuations continue to be stretched in the US. Other markets look more reasonable, but very few would be called cheap. Earnings remain strong and beating expectations, with earnings revision ratios improving globally, but led by the US. While we do not think we are at the end game of a potential artificial intelligence (AI) bubble, valuations and positioning are a short-term concern.

Given our view on the rest of the world, we believe that regions like Europe and emerging markets will continue to shine into 2026. Within Europe, we continue to like the periphery over the core. The economic strength of Italy and Spain has been remarkable, with France and Germany falling behind. Despite the economic strength and recent stellar rally, Italy and Spain remain cheap relative to the rest of the EU while also seeing strong positive earnings revisions, especially compared to the rest of the bloc. We said throughout 2025 that the PIIGS¹ are flying – we expect them to continue in 2026.

We continue to like emerging market (EM) equities. Despite our concerns in China, the recent rally of Chinese tech companies makes sense. They were too cheap for too long while China was deemed ‘uninvestable’, but ever since President Xi shook hands with Alibaba chairman Jack Ma and announced an equal playing field for private and public companies, valuations re-priced higher. We think this trend can continue, but for now it’s a re-rating trade as opposed to belief the Chinese economy is reaccelerating. We would need to see more fiscal stimulus out of China to get bullish on a broader Chinese equity rerating.

We do, however, like Latin America. LatAm remains cheap relative to other EM regions, but also cheap compared to its own history. At the same time, we’re seeing improved earnings in the region. While far from certain, election polls seem to be moving to more market friendly candidates in both Brazil and Chile. Mexico has been under attack by Trump, but still stands to benefit the most from the US plan to bring more manufacturing back onshore.

Japanese stocks have also re-rated with the election Sanae Takaichi. Her pro-reform agenda will help continue the corporate reform gains from Abenomics, which combined with her push towards more fiscal stimulus, should help see the economy continue to recover. We like Japanese stocks; although they are no longer cheap, they can still benefit from further re-ratings.

Therefore, despite being short-term neutral on positioning and valuations, we continue to be positive on equities into 2026. While we do not believe the US AI bubble will pop in 2026, we do believe that the rest of the world’s stock markets can start to play catch up.

When it comes to bonds, there is still attractive high quality income on offer to investors. However, given our higher growth and higher inflation view in the US, we believe too many rate cuts are priced in the US. We think the stronger economy will see rate cuts be taken out of market pricing, along with fiscal and central bank independence worries potentially keeping long-end US Treasury yields on an upward trajectory. Credit spreads are also looking extremely tight, especially in the US. We find better value in Europe, Australia and securitised credit. We are not expecting a new default cycle, so we believe investors can take carry in credit, but there is not much margin of error in US credit.

With governments spending around the world and inflation likely staying elevated in the developed world, investors often ask us how to hedge when the equity-bond correlation has turned positive. Our solution is to be dynamic in our asset allocation, adjusting the portfolios when valuations, the cycle, or liquidity change. For those who are unable to dynamically adjust their asset allocation, they may want to reassess how they invest their defensive assets. As an active house, there is always plenty of money to be made in fixed income, even if we’re more cautious structurally. Country and curve selection can continue to add value and protect equity allocations even when the overall duration benchmark is weak.

But there are also other hedges investors can use. We use cash as part of our dynamism, but also put options when valuations are attractive. We also like using currencies and commodities. Historically we have used the US dollar as a risk off currency, but with the recent weakness, we have shifted towards the Japanese yen, Swiss franc and euro. In commodities, we have favoured gold given our worry over currency debasement. The shiny metal did very well in 2025, so it would make sense for there to be some consolidation before another bull run. But structurally we remain positive. Central bank buying continues, with emerging market countries striving to increase their gold holdings as a percent of reserves. They still have a long way to go. We’ve also seen a pick-up in Western investor demand. Gold allocations in portfolios are at best 0-2% and we believe this could rise over the coming years.

Conclusion

We believe we are in a fiscally-driven world, which comes with higher pressure economies, higher GDP growth, but also higher inflation and higher volatility. This volatility will create opportunities for those who are more dynamic in their asset allocation. With equity-bond correlation remaining positive, investors have to be active when it comes to adjusting their portfolio positioning, but also look harder for other diversifiers.

¹ Portugal, Ireland, Italy, Greece and Spain

About the Author

Sebastian is the Head of Multi-Asset and Fixed Income for Australia. He leads investment decision making for Schroders’ Australian Multi-Asset and Fixed Income portfolios and is the portfolio mana ger of the Schroder Real Return Fund strategies and the Global Total Return Fund. His responsibilities include the development of the investment process and strategy across the team’s product set, and co-ordinating the research and implementation functions of the team. He’s a member of several local strategy research groups including equities, credit and cycle.

In addition, he contributes to the global Schroders Multi-Asset Investment Group (SIGMA) research platform as a member of the equity risk premium group. Sebastian has over 17 years’ experience in portfolio management and has been managing multi-asset portfolios for over 14 years. Prior to joining Schroders in February 2019, he worked for Nikko Asset Management in both Singapore and Sydney, as well as Challenger Limited in Sydney. Sebastian holds a Master of Applied Finance from Macquarie University in Australia as well as a Bachelor of Science (Honors) in Mathematics and Computer Science from the University of Bath in the UK.

Company website: https://www.schroders.com/en-za/za/intermediary/

Disclaimers:

Important Information

For professional investors and advisers only. The material is not suitable for retail clients. We define “Professional Investors” as those who have the appropriate expertise and knowledge e.g. asset managers, distributors and financial intermediaries.

Investment involves risk.

This information is a marketing communication. The information contained herein is believed to be reliable. Where third-party data is referenced, it remains subject to the rights of the respective provider and must not be reproduced or used without prior consent.

Any data has been sourced by us and is provided without any warranties of any kind. It should be independently verified before further publication or use. Third party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither we, nor the data provider, will have any liability in connection with the third party data.

The material is not intended to provide, and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Any references to securities, sectors, regions and/or countries are for illustrative purposes only.

Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any investments to rise or fall. Schroders has expressed its own views and opinions in this document, and these may change.

This document may contain “forward-looking” information, such as forecasts or projections. Any forecasts stated in this document are not guaranteed and are provided for information purposes only.

Schroders will be a data controller in respect of your personal data. For information on how Schroders might process your personal data, please view our Privacy Policy available at https://www.schroders.com/en-za/za/intermediary/footer/privacy-policy/ or on request should you not have access to this webpage.

For your security, communications may be recorded or monitored.

Issued in January 2026 by Schroders Investment Management Ltd registration number: 01893220 (Incorporated in England and Wales) which is authorised and regulated in the UK by the Financial Conduct Authority and an authorised financial services provider in South Africa FSP No: 48998.