The data which shows the perils of chasing past stock market...

Duncan Lamont, Head of Strategic Research, Schroders, examines the data which shows the perils of chasing past stock market winners.

Why you can trust your financial advisor

Trusting your financial advisor is important, but it should be a trust rooted in verification and ongoing diligence, writes Lelané Bezuidenhout, CFP®, FPI CEO.

Real estate market rebasing: What does it mean for investors?

Kieran Farrelly, Global Head of Real Estate Solutions at Schroders, reveals how to harness long-term real estate opportunities in today's market conditions.

Success by her design: 5 ways financial advisers can help bridge...

While progress has been made toward gender equality, women still face financial challenges, such as the gender pay gap and the "pink tax," that hinder their financial wellness. Momentum Senior Legal Adviser Sharon Hamman emphasizes the vital role financial advisers can play in closing this gap.

Big data: the digital disruptor reshaping the South African insurance sector

Vuledzani Dangale, CFP® at Liberty Group, highlights that leveraging big data has become fundamental to driving transformative strategies in the insurance sector.

What role can global commercial real estate play in a portfolio?

Kieran Farrelly and Sophie van Oosterom from Schroders examine how advanced private wealth investors are increasingly recognising the advantages of integrating diverse commercial real estate strategies into their portfolios.

Capital Legacy Announces New CEO: Craig Harding

Under Harding, the Capital Legacy's core values, principles, and business objectives will remain steadfast.

The learner leader

Kim Potgieter, author, speaker and expert financial planner, won the FPI It Starts with Me 2023 Award. The Award recognises a CFP® professional for their unyielding dedication to promoting the CFP® certification.

Are women really better investors?

Paul Nixon, head of behavioural finance at Momentum Investments Group, delves into whether women are better investors through a behavioural finance lens.

Post-retirement income options amid potentially higher inflation

Inflation is the risk that investors will face in retirement. This requires careful navigation when selecting your retirement income options, argues Coronation.

Most Popular

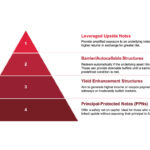

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Enter adviser practice buy-and-sell conversations with confidence

Blue Chip speaks to Brokerspace and Commspace to find out why understanding the full picture before choosing a path forward might change your succession and sale conversations for the better.

Why blending unit trusts remains essential

In an environment where opportunity and uncertainty coexist, blending unit trusts is not about being cautious. It is about being prepared. By Natalie Harrison, Head of Distribution at Curate Investments.