Why choose semi-liquid funds for investing in renewable infrastructure?

There are more opportunities for private investors to access renewable energy investments today, write Duncan Hale and Jack Wasserman of Schroders.

The 2-pot system: An opportunity for advisors to support members’ goals

Elrina Wessels, Principal Strategic Clients at Alexforbes, emphasizes that the two-pot retirement system offers a significant chance to enhance the financial well-being of low to middle-income individuals, with the financial advisory sector being pivotal in this process.

Avoiding The Behavioral Pitfalls of Bitcoin

Bitcoin has taken over the world and there are critical measures that investors need to be aware of, writes Paul Nixon, head of behavioural finance at Momentum Investments.

What is impacting the investment landscape?

Ferdi van Heerden, chief executive officer at Momentum Investments, explores the key elements that shape investment decisions and strategies.

Who do you trust with your digital information?

Who do you trust to access your digital information, if something happens to you? A question posed by Sarah Love, CFP®, FPSA®, TEP, Fiduciary Practitioner at Private Client Trust.

Mothering & Money

Jessica Pillay, a Momentum Financial Adviser, stresses the importance of teaching children about debt, future planning, handling life milestones, avoiding scams, and learning from mistakes. By starting with basics like budgeting and saving, mothers can empower their children to make sound financial decisions for a secure future.

Reimagining retirement planning

According to Fareeya Adam, Momentum Wealth has reimagined retirement for South Africans through income solutions aimed at empowering people to confidently plan for retirement.

Two-pot reform: Resist the urge to access your retirement annuity savings...

"Understand that any withdrawal is a costly advance on your ultimate retirement benefit" writes Pieter Koekemoer, head of Personal Investments at Coronation.

Annual shareholder meetings need a shake-up, but how?

Shareholder meetings are often uninspiring but they are essential for shareholder democracy. We consider how they could be revamped to better serve the needs of all stakeholders writes Tim Goodman, Schroders.

Momentum Investments and Robeco launch partnership in Southern Africa

Momentum and Robeco's strategic partnership deepens portfolio integration in quantitative equity products and research.

Most Popular

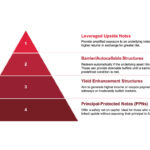

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Enter adviser practice buy-and-sell conversations with confidence

Blue Chip speaks to Brokerspace and Commspace to find out why understanding the full picture before choosing a path forward might change your succession and sale conversations for the better.

Why blending unit trusts remains essential

In an environment where opportunity and uncertainty coexist, blending unit trusts is not about being cautious. It is about being prepared. By Natalie Harrison, Head of Distribution at Curate Investments.