Mapping your advice process: the most important thing you can do...

Wealth Associates recently undertook the task of mapping their advice process, and if there’s one thing they learned, it has unlocked significant opportunities to improve client experiences, writes Theoniel McDonald

Preparing the Next Gen heirs for the complexities of managing the...

Stonehage Fleming addresses an often-asked quesion by families grappling with how to go about succession planning: When should we start preparing the Next Gen heirs for the complexities of managing the family fortune, and how should we go about it?

If you really want to influence a client’s behaviour, appeal to...

Giving technical information and advice to clients is one thing. Getting them to take appropriate action is another, writes Rob Macdonald, Independent Consultant

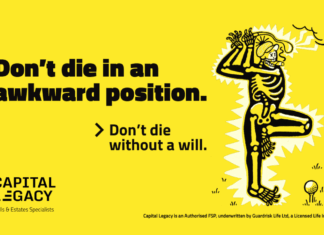

Don’t die in an awkward position

Capital Legacy stresses the importance of South Africans having a will regardless of age through their latest awareness campaign: "Don't die in an awkward position. Don't die without a will.".

MitonOptimal South Africa

For over 25 years, Cape Town-based MitonOptimal has established enduring partnerships with advisors by emphasising innovation, adaptability and a steadfast client-centric approach.

A major milestone in the evolution of professional certification in financial...

The Financial Planning Institute of Southern Africa (FPI) is proud to announce the successful completion of its first CFP® Capstone and Financial Plan assessment, marking a significant milestone in the evolution of professional certification in financial planning.

What 25 years as a market pioneer taught us about South...

Satrix is making investing accessible, affordable and effective for everyone. Kinsely Williams, Chief Investment Officer at Satrix explains how.

Succession planning for independent financial advisors in South Africa

Succession planning is a critical yet often overlooked aspect of managing an Independent Financial Advisory (IFA) practice in South Africa, writes Péru du Toit Founder, IPSE Tech Law Services

The hidden complexities of trust beneficial ownership compliance

According to Sandile Khumalo,LLM (Unisa),

FPSA®, GTP(SA), Fiduciary

Practitioner, Lex24, financial advisors frequently recommend the use of trusts as an estate planning tool and in some instances, they serve as the professional trustee on client trusts.

Forged by fire: where futures take flight

Gareth Collier, CFP®, one of the 2024 Financial Planner of the Year Award runners-up, recently opened his own financial planning practice, Firecrest Modern Capital. Blue Chip spoke to Collier about the intricacies of this inception.

Most Popular

Alexforbes named South African Manager of the Year at the Raging Bull Awards

Alexforbes were honoured at the Raging Bull Awards with two prestigious awards that highlighted the firms investment achievements and long-term performance.

What are the different types of structured products available to retail and institutional investors...

There is a limited range of structured products offered in South Africa compared to the rest of the world.

The 2026 guide to structured products in South Africa

Exclusive: The 2026 Structured Products Guide is now available as an eBook. This guide features a range of highly informative introductory articles about structured products in South Africa and provide profiles of leading companies offering structured products in South Africa.

Is everything becoming AI – and how can you respond without selling equities?

How can investors guard against the concentration risk of the technology/AI narrative without giving up equity exposure?

What is a structured product?

Structured products can offer investors a unique way to access market returns while managing risk with capital protection and tailored pay-offs. These innovative investments have evolved and can now offer the potential for enhanced or geared returns, with partial capital protection. Investors must weigh the trade-offs against the gains.