Understand the price you pay for investing in America

Anyone who has travelled to the United States recently has at some point experienced “sticker shock”. For those looking to invest in American companies, the experience may be no different, writes Jonathan Wernick Global Equity Analyst, Sasfin Wealth.

Who should pay the DFM its fees?

Investors pay for the expertise of a Discretionary Fund Manager (DFM), but the fees are often offset by access to cost-saving strategies and discounted fee classes—ensuring that professional portfolio management remains a valuable investment. Learn more here.

US election provides both red flag and pat on the back for...

Helen Macdonald states that the 2024 election results in South Africa were met with widespread optimism and showcased South Africa’s robust and innovative electoral and legal system. However, we should also view the 2024 Trump victory in the US as a red flag.

How people become wealthy

The Mazi Global Equity team embraces a quality investment philosophy designed to tackle these challenges. Their approach ensures that only genuinely high-quality companies make the cut—those with low debt, sustainable cash flows, and high returns on invested capital.

Last mile planning advice

Financial advisors can tackle the complexities of last-mile service delivery by leveraging wealth technology solutions that simplify workflows, strengthen client interactions, and enable consistent, contextual engagement. These advancements not only boost business growth but also ensure higher client satisfaction, shares Andries de Jongh, Head of Sales at Seed Analytics.

The succession plan dilemma for financial advisors

Marc Wiese, Managing Director at Warwick Wealth's explores key challenges and solutions for a seamless transition.

Portfolios built for prosperity

Capital Internationals Group's collaborative approach enables them to better understand your business, adapt to its unique requirements and ensure that your client needs come first.

How a Secure AI Assistant transforms your client relationships and frees...

Zeldeen Müller, Founder and

CEO of AgendaWorx looks at how personal Secure AI Assistants can revolutionise financial advising by simplifying client interactions, streamlining operations, and offering instant, secure support, allowing advisors to focus on strategic growth while providing clients with peace of mind

How important is investment performance for a DFM?

As Discretionary Fund Managers differentiate their offerings, how should the advisor measure a DFM’s success?

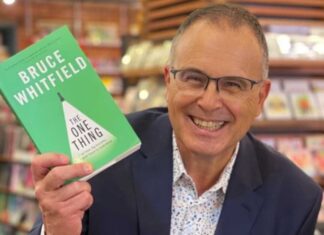

Cutting out the noise

The FPI Harry Brews’ Award recognises an individual who has made a significant contribution to the financial planning profession through service to society, academia, training, government, media and any other professional activities. Blue Chip speaks to Bruce Whitfield, winner of the FPI Harry Brews’ Award, 2024.

Most Popular

What are all the costs that go into using a DFM?

As DFMs become embedded in financial planning practices, understanding the full cost structure behind their use is increasingly important.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Satrix celebrates 25 years of industry leadership

The Satrix story began in January 2000 with a first institutional mandate of R800-million, at a time when passive investing was still largely uncharted territory.

Meet the FPI Financial Planner of the Year

Established in 2000, the FPI Financial Planner of the Year Award is highly coveted and recognises outstanding achievement in the field and practice of financial planning. In 2025, the award went to Nicola Langridge, CFP®, wealth manager at Private Client Holdings. Blue Chip caught up with her.

Investment platforms: powering advice, enabling better client outcomes

Hymne Landman, CEO at Momentum Wealth, discusses the importance of the human element in providing clients with the best financial advice and planning.