Retirement, financial education, and the curious role of AI

David Venter (Head of School: Milpark School of Financial Services) writes about the irony that retirement knowledge doesn’t change behaviour, and reveals how best to turn retirement numbers Into action.

Blending annuities

Johann Swanepoel, Head of Pricing and Proposition at Just SA, discusses a strategic approach to help retirees navigate retirement income challenges.

How to stretch retirement savings without chasing unrealistic returns

Clients no longer have to choose between the certainty of a life annuity and the flexibility of a living annuity. By Martiens Barnard, Marketing Actuary at Momentum Wealth.

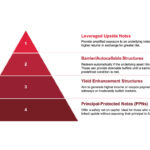

Enhancing post-retirement income with discretionary solutions

When used strategically alongside compulsory retirement funds, discretionary money can significantly improve a retiree’s financial position.

The Crème de la Crème – meet our three finalists

The Financial Planner of the Year Award was launched in 2000 and is the most prestigious award in the industry. It recognises South Africa’s top CERTIFIED FINANCIAL PLANNER® – a stellar professional who exhibits revolutionary ideas, consummate skill and unimpeachable ethics when dealing with clients. Meet our three finalists: Theoniel McDonald CFP®, Brendan Dunn CFP® and Nicola Langridge CFP®

Reimagining retirement

As financial advisers, helping clients navigate retirement planning is one of the most impactful roles they play. Fareeya Adam, CEO of structured products and annuities at Momentum Wealth, believes there is a better way for clients to plan and structure their finances when they retire by ensuring a sustainable income and blending the need for certainty and flexibility.

The spirit of growth, generosity and renewal

The CEO of the Financial Planning Institute of Southern Africa shares the FPI’s latest news.

Midlife recalibration: guiding clients through the midlife transition

Between 45 and 60, many clients feel a growing pull to recalibrate. It’s not a crisis, but a shift – a phase where priorities change, purpose is reassessed and conversations with financial planners take on a different tone. By Kim Potgieter, MD, Chartered Wealth Solutions, Author of Midlife Money Makeover.

From policy to people: How the Two-Pot System is reshaping retirement

Rob Southey, head of asset consulting at Momentum Consultants & Actuaries, reflects on how the Two-Pot System is driving the retailisation of South Africa’s institutional retirement landscape.

The evolving landscape of retirement income

As the retirement environment continues to evolve, blended annuity strategies offer a more resilient, diversified approach to income planning. By Rocco Carr, Business Development Manager, Glacier Financial Solutions

Most Popular

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Enter adviser practice buy-and-sell conversations with confidence

Blue Chip speaks to Brokerspace and Commspace to find out why understanding the full picture before choosing a path forward might change your succession and sale conversations for the better.

Why blending unit trusts remains essential

In an environment where opportunity and uncertainty coexist, blending unit trusts is not about being cautious. It is about being prepared. By Natalie Harrison, Head of Distribution at Curate Investments.