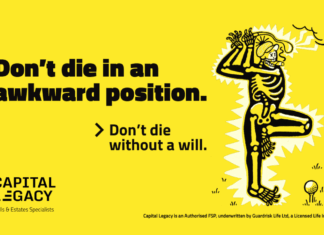

Don’t die in an awkward position

Capital Legacy stresses the importance of South Africans having a will regardless of age through their latest awareness campaign: "Don't die in an awkward position. Don't die without a will.".

MitonOptimal South Africa

For over 25 years, Cape Town-based MitonOptimal has established enduring partnerships with advisors by emphasising innovation, adaptability and a steadfast client-centric approach.

A major milestone in the evolution of professional certification in financial...

The Financial Planning Institute of Southern Africa (FPI) is proud to announce the successful completion of its first CFP® Capstone and Financial Plan assessment, marking a significant milestone in the evolution of professional certification in financial planning.

Forged by fire: where futures take flight

Gareth Collier, CFP®, one of the 2024 Financial Planner of the Year Award runners-up, recently opened his own financial planning practice, Firecrest Modern Capital. Blue Chip spoke to Collier about the intricacies of this inception.

Altvest Capital reports robust FY2025 growth: asset expansion, strategic investments, and...

Altvest Capital reports strong FY2025 results driven by asset growth and investment performance

Altvest credit opportunities fund reports transformational year of growth and impact...

The Altvest Credit Opportunities Fund (ACOF), a specialist SME-focused private credit fund managed by Altvest Capital, today announced its audited financial results for the year ended 28 February 2025, marking a breakthrough year in its mission to democratise access to capital and drive inclusive economic growth across South Africa.

A Coaching Way of Being

Blue Chip explores the role of coaching in unlocking financial potential. Behavioural coaching expert, Rob Macdonald, unpacks what it is and why it is important to the work of a financial planner.

The succession plan dilemma for financial advisors

Marc Wiese, Managing Director at Warwick Wealth's explores key challenges and solutions for a seamless transition.

Portfolios built for prosperity

Capital Internationals Group's collaborative approach enables them to better understand your business, adapt to its unique requirements and ensure that your client needs come first.

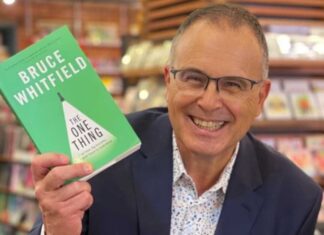

Cutting out the noise

The FPI Harry Brews’ Award recognises an individual who has made a significant contribution to the financial planning profession through service to society, academia, training, government, media and any other professional activities. Blue Chip speaks to Bruce Whitfield, winner of the FPI Harry Brews’ Award, 2024.

Most Popular

What are the different types of structured products available to retail and institutional investors...

There is a limited range of structured products offered in South Africa compared to the rest of the world.

The 2026 guide to structured products in South Africa

Exclusive: The 2026 Structured Products Guide is now available as an eBook. This guide features a range of highly informative introductory articles about structured products in South Africa and provide profiles of leading companies offering structured products in South Africa.

Is everything becoming AI – and how can you respond without selling equities?

How can investors guard against the concentration risk of the technology/AI narrative without giving up equity exposure?

What is a structured product?

Structured products can offer investors a unique way to access market returns while managing risk with capital protection and tailored pay-offs. These innovative investments have evolved and can now offer the potential for enhanced or geared returns, with partial capital protection. Investors must weigh the trade-offs against the gains.

Digital Transformation Summit – South Africa 2026

Bringing together 200+ C-level executives, CIOs, CTOs, technology leaders, policymakers, and digital decision-makers, the summit is set to take place on 11th March 2026 at the Indaba Hotel, Spa and Conference Centre.