What is keeping the next generation of wealthy families awake at...

A panel discussion with next-gen family members at Stonehage Fleming’s annual Family Conference highlighted the pressures, opportunities and critical factors that could determine whether families and family businesses thrive or falter across generations.

Knowing isn’t doing

Henda Kleingeld, UFS Program Director, discusses why smart financial advisors should have their own trusted financial advisor.

Why umbrella funds belong in your EVP strategy

Niki Giles, Head of Strategy at Prescient Fund Services, unpacks how Umbrella Funds can help South African businesses rethink their Employee Value Proposition and safeguard long-term savings — while easing administrative burdens.

Client confidence beyond the wrapper: engaging investors on investment safety

According to Vuyo Nogantshi, Head

of Distribution: Index and Structured Solutions, Absa Group, financial planners need to demystify an increasingly complex array of products in today’s investment landscape.

Three AI tricks to make your clients love you more

Using AI cleverly can drastically reduce your workload and extend your reach, writes Zeldeen Müller, CEO, AgendaWorx.

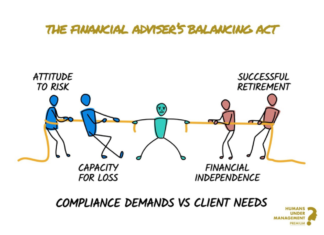

Choose your poison

According to Any Hart, Founder of Humans Under Management, financial advisors must champion their clients’ futures, confronting misguided compliance systems that obscure the real risks – capital loss, inflation, and poor returns – while working towards a framework that truly safeguards financial well-being.

Navigating the complexities of succession planning in financial planning practices

Adam Bacher, CFA®, CFP®, Director at DTB Wealth, describes succession planning as both an art and a science, requiring emotional intelligence, strategic foresight and meticulous execution. Addressing challenges proactively and following best practices enables financial planning firms to achieve seamless transitions that benefit clients, employees and the business itself.

To invest successfully, clients must overcome the Wall of Worry

Global events and investment market movements mean less than you think when it comes to successful investing, writes Rob Macdonald.

Timing [time in] is everything

It is important that investors do not derisk their portfolios too early and reduce their potential returns as they could face financial shortfalls in their later years. Grant Alexander, Founder and Director at Private Client Holdings explains why.

US election provides both red flag and pat on the back for...

Helen Macdonald states that the 2024 election results in South Africa were met with widespread optimism and showcased South Africa’s robust and innovative electoral and legal system. However, we should also view the 2024 Trump victory in the US as a red flag.

Most Popular

How flexible and customisable should a DFM offering be?

As DFMs grow in scale and influence, the debate around flexibility and customisation in their investment offerings intensifies.

Meet the Managers 2026

Meet the Managers is considered the “Ted-Talk” in investment management, where financial advisors can access a vast array of investment managers, covering all types...

Offshore investment gains momentum in SA

Blue Chip speaks to Hymne Landman, CEO at Momentum Wealth, about offshore investing for South Africans.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Protecting independent financial advice

The Financial Intermediaries Association of South Africa’s primary purpose is to guard, develop, promote and represent professional advisory and intermediary businesses in the financial services industry. Blue Chip speaks to Lizelle van der Merwe, CEO of the FIA.

![Timing [time in] is everything Grant Alexander, Founder and Director, Private Client Holdings](https://bluechipdigital.co.za/wp-content/uploads/2025/04/Grant-Alexander-324x235.jpg)