Trump 2.0

Rob Macdonald, Independent Consultant, encourages financial planners to focus on their Circle of Control. The more you have planned your communication and implemented it consistently, the more likely you will influence client behaviour.

How having a bias affects your potential returns as an investor

According to Florbela Yates, Head of Equilibrium in the Momentum Metropolitan group, lack of diversification and irrational biases affect returns and investors’ long-term investment amounts.

Financial Planning Institute of Southern Africa announces new board chair

At its Annual General Meeting (AGM), the Financial Planning Institute of Southern Africa (FPI) announced the appointment of Olwethu Masanabo, CFP®, as the new Chairperson of the Board — signifying a seamless and strategic shift in leadership within the organisation.

ETF evolution: global and South African trends driving the future of index...

According to Fikile Mbhokota, CEO at Satrix, the ETF market is evolving at an unprecedented pace, reshaping global investment landscapes.

A home for independent financial planners

According to Warren Ingram, Co Founder of Galileo Capital, there is a real concern that independent financial planning is dying.

Knowing isn’t doing

Henda Kleingeld, UFS Program Director, discusses why smart financial advisors should have their own trusted financial advisor.

Client confidence beyond the wrapper: engaging investors on investment safety

According to Vuyo Nogantshi, Head

of Distribution: Index and Structured Solutions, Absa Group, financial planners need to demystify an increasingly complex array of products in today’s investment landscape.

Three AI tricks to make your clients love you more

Using AI cleverly can drastically reduce your workload and extend your reach, writes Zeldeen Müller, CEO, AgendaWorx.

US election provides both red flag and pat on the back for...

Helen Macdonald states that the 2024 election results in South Africa were met with widespread optimism and showcased South Africa’s robust and innovative electoral and legal system. However, we should also view the 2024 Trump victory in the US as a red flag.

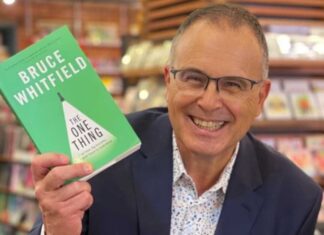

Cutting out the noise

The FPI Harry Brews’ Award recognises an individual who has made a significant contribution to the financial planning profession through service to society, academia, training, government, media and any other professional activities. Blue Chip speaks to Bruce Whitfield, winner of the FPI Harry Brews’ Award, 2024.

Most Popular

How flexible and customisable should a DFM offering be?

As DFMs grow in scale and influence, the debate around flexibility and customisation in their investment offerings intensifies.

Meet the Managers 2026

Meet the Managers is considered the “Ted-Talk” in investment management, where financial advisors can access a vast array of investment managers, covering all types...

Offshore investment gains momentum in SA

Blue Chip speaks to Hymne Landman, CEO at Momentum Wealth, about offshore investing for South Africans.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Protecting independent financial advice

The Financial Intermediaries Association of South Africa’s primary purpose is to guard, develop, promote and represent professional advisory and intermediary businesses in the financial services industry. Blue Chip speaks to Lizelle van der Merwe, CEO of the FIA.