Investment Solutions by Alexforbes

Based in Sandton, Johannesburg, Investment Solutions by Alexforbes is a newly established division of Alexforbes, South Africa’s leading investments multi-manager, entering the Discretionary Fund Management (DFM) market.

INN8 Invest

INN8 Invest leverages global expertise and a disciplined, research-driven approach to deliver consistent, long-term investment performance while empowering financial advisors and investors through best-in-class discretionary fund management solutions.

Equilibrium Investment Management

Equilibrium empowers financial advisors with expert investment management solutions by streamlining your workflow, fostering collaboration, and delivering exceptional service.

Improved balance in your practice

Florbela Yates, Managing Director of Equilibrium, speaks about the current DFM landscape and the status of her organisation.

Who should pay the DFM its fees?

Investors pay for the expertise of a Discretionary Fund Manager (DFM), but the fees are often offset by access to cost-saving strategies and discounted fee classes—ensuring that professional portfolio management remains a valuable investment. Learn more here.

Portfolios built for prosperity

Capital Internationals Group's collaborative approach enables them to better understand your business, adapt to its unique requirements and ensure that your client needs come first.

How important is investment performance for a DFM?

As Discretionary Fund Managers differentiate their offerings, how should the advisor measure a DFM’s success?

Should a financial planner use more than one DFM?

Most financial advisors in South Africa currently only use one discretionary fund manager (DFM), but some bigger practices have diversified their clients’ investments to...

Choosing the right DFM

There is a long list of factors to consider when choosing a Discretionary Fund Manager (DFM), but the most important factors are the experience...

Analytics

Partnering with Analytics is a strategic decision that extends far beyond simply outsourcing investment management, writes James Towell, Managing Director at Analytics.

Most Popular

Protecting independent financial advice

The Financial Intermediaries Association of South Africa’s primary purpose is to guard, develop, promote and represent professional advisory and intermediary businesses in the financial services industry. Blue Chip speaks to Lizelle van der Merwe, CEO of the FIA.

The Intelligent Adviser’s Playbook: PROpulsion hosts 2026 Practice Management Conference

A practical virtual conference for financial planning businesses that want to run smarter operations, without adding unnecessary risk or complexity.

PROpulsion Practice Management Conference 2026

The 2026 PROpulsion Practice Management Conference focuses on how advisers and their teams can use intelligent tools, including AI, in practical, defensible ways that improve efficiency, consistency, and client experience.

When clients ask if they have done enough

Kobus Kleyn (CFP®, Tax and Fiduciary Practitioner, Kainos Wealth) writes about understanding vulnerability in financial advice.

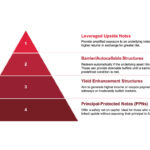

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.