Momentum Investments’ new CEO: Ferdi van Heerden

Ferdi van Heerden took over the reins at Momentum Investments on 1 September 2023.

Offshore investing: where, how and how much?

In an exclusive Blue Chip discussion, South Africa’s leading investment professionals focus on offshore investing and why it is important to engage with a financial advisor. Part Two deals with the practicalities of taking money offshore, the exchange rate and the importance of timing.

Consider paying off debt prior to retirement

Coming to the end of your working career requires a step up in terms of financial planning, says Florbela Yates, Head of Equilibrium.

Give clients more control through certainty

In this environment of high interest rates, clients can lock in very attractive guaranteed annuity rates, says Fareeya Adam, head of guaranteed annuities at Momentum Wealth.

Deepening trade ties with member states

South Africa, represented by SACCI, is chairing the

Trade and Investment Working Group of the BRICS Business Council.

The increasing popularity of share buybacks

Schroders’ research shows that buybacks became more widespread in 2022, with some markets narrowing the gap with the US, where they’re most common.

Emerging Markets: a coming bull market?

After thirteen years of underperformance versus high-flying US markets, investors have forgotten what an EM bull market looks like. A closer look at history and where markets are today suggests we may be closer than many think or are positioned for, argues James Corkin, Portfolio Manager at Steyn Capital Management

Soaring “margin of safety” in bonds boosts their appeal

Higher yields boost returns prospects and offer a historically large cushion against potential losses, says Duncan Lamont, CFA Head of Strategic Research, Schroders.

Alternative energy fund launched

A R400-million Energy Fund designed to cater to small to medium-sized enterprises (SMEs) who need to find ways of keeping their businesses supplied with power has been created by Business Partners Limited, says Executive Director, Jeremy Lang.

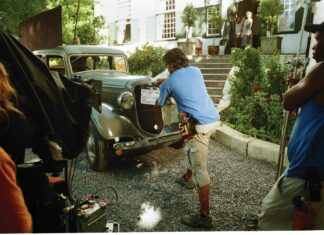

Creative industries are growing the economy

South Africa’s cultural creative industries have seen a rise in activity and economic contribution in recent years. The direct impact (also called Value Added) of the CCIs in 2018 was $5.51-billion, accounting for 1.7% of GDP (compared to 1.5% in 2016). Taking the Direct Effect, Indirect Effect, and Induced Effect into account, the CCIs’ total effect on the economy was $18.01-billion, or 5.6% of the country’s GDP.

Most Popular

Blue Chip DFM Guide 2026

Welcome to the 2026 edition of the Blue Chip DFM Guide, a guide to Discretionary Fund Managers in South Africa.

Why blending unit trusts remains essential

In an environment where opportunity and uncertainty coexist, blending unit trusts is not about being cautious. It is about being prepared. By Natalie Harrison, Head of Distribution at Curate Investments.

How do SPs fit into the South African investment landscape?

Structured products are gaining traction in South Africa, complementing traditional asset classes through more customised risk management amid technological and regulatory change.

What key factors should institutional investors consider?

The role of structured products in institutional investments is growing, but these investors need to consider all the usual risks and benefits including liquidity and compliance with regulations such as Regulation 28 of the Pension Funds Act.

What risks and potential rewards need to be evaluated in structured products?

In evaluating structured products, all the risk factors need to be balanced against the benefits to ensure that the risks don’t undermine the benefits.