Blue Quadrant Capital Management is a Cape Town-based, owner-managed asset manager. It was founded in 2010 with the intention of creating an asset management business that looked beyond the market noise and anticipated and positioned for longer-term economic and industry trends. Blue Quadrant currently has around R900-million assets under management.

Investment team

Leandro Gastaldi leads the investment team and has been responsible for portfolio management since Blue Quadrant’s inception. He has a BCom Honours degree from UCT and is a CFA charterholder. Pierre Desmidt acts as the fund’s portfolio advisor and works closely with Leandro on idea generation and research.

Matthew Robarts is responsible for fundamental research and analysis. He is a chartered accountant with substantial experience in the financial services sector, having worked as an auditor for EY. This experience gave him valuable exposure to the banking sector and regulatory compliance in the industry. The investment team is further supported by Jürgen Möller, who assists with quantitative analysis and risk management. Jürgen holds an MCom from Stellenbosch University and is a CFA charterholder.

Equity exposure may vary, depending on existing market and economic conditions and available investment opportunities

Philosophy and process

Our core investment philosophy can be described as “Macrovalue”, which combines traditional valuation with macroeconomic or industry thematic analysis. This approach allows us to identify companies that are not only undervalued, but also stand to benefit from an expected favourable shift in macroeconomic or industry fundamentals. These long trades are supplemented with CTA-like positions as well as an equity short book and select event-driven opportunities that combine to generate a return profile uncorrelated with traditional equity benchmarks or long-only equity funds.

Suitable investment opportunities are identified by screening for companies that trade below our estimate of intrinsic value, which is based on our assessment of fair median value over a complete economic or industry cycle.

Macroeconomic and industry trends are evaluated to estimate the likely timeframe within which these companies may re-rate to fair value. Qualitative factors, including the quality of the company’s management team, are also considered when determining a suitable discount rate for the given level of risk. Our macroeconomic and industry research sometimes leads to the development of a thematic thesis. We then look for undervalued equities to express this theme. Value traps are avoided by ensuring that the alignment in the macroeconomic, industry and company fundamentals favour a re-rating for selected equities, sooner rather than later.

We believe our process and philosophy to be fairly unique, offering us the ability to generate returns that are uncorrelated to offerings from other managers. This provides clients and advisors additional opportunity to diversify their investment portfolios.

Blue Quadrant Capital Growth Prescient RI Hedge Fund

The Blue Quadrant Capital Growth Prescient RI Hedge Fund aims to generate sustainable real returns over the long term. Although it has a substantial equity bias, the fund’s mandate allows for some flexibility to diversify into other asset classes, including unlisted investments.

Equity exposure may vary, depending on existing market and economic conditions and available investment opportunities. Direct and indirect equity exposure will vary between a minimum of 0% and a maximum of 150% (including unlisted equity investments) of the fund’s total nominal value.

The Blue Quadrant Capital Growth Prescient RI Hedge Fund was launched in May 2011 and received three awards for its long-term performance between 2021 and 2023.

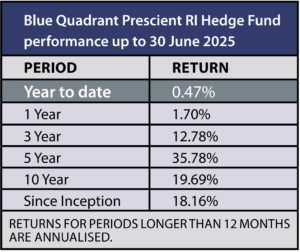

Performance