Corion was founded in 2001, previously a division of Brait Ltd. As one of the pioneers of the South African hedge fund industry, Corion’s flagship fund, Corion Absolute FR, was launched in 2001 and continues to deliver market-leading risk-adjusted returns, nearly 25 years later. In 2012, David Bacher led a management buyout, rebranding the business to Corion Capital.

Everything we do at Corion is driven by simplicity, agility and engagement. We continually challenge the status quo with innovative asset management strategies as well as pro-gressive reporting and client engagement.

The people of Corion

The management team are deeply experienced and highly qualified with senior members of the investment team having cut their teeth through the genesis of the South African hedge fund landscape. Our core focus on quantitative analysis helps us stay at the forefront of developing systems and analysis in a world where technology is driving efficiencies and cost reduction. The team has been built with an extensive range of skill sets that contribute to diverse ways of thinking when creating investment solutions.

All in the philosophy

We design investment strategies based on the following core investment beliefs:

- Investors are rewarded for taking risk over the long term. While alpha can be earned in the short term by tactical positioning, the core of any portfolio must be an asset allocation that seeks to take advantage of long-term market tendencies.Agility is a cornerstone of risk management and the achievement of alpha is the ability to reposition portfolios quickly, cost-effectively and within agreed-upon risk parameters.

- For us, valuation remains the most reliable indicator of market cycles and we seek opportunities to buy into cycles when it makes sense to do so, even if it may take time for the position to pay off.

- Diversification is paramount when constructing robust investment strategies. In order to take advantage of the risk premium associated with the different asset classes, having as many sources of return, and thus as high a degree of diversification across asset classes, territories and jurisdictions, different strategies (including investment factors) and styles, will stand a portfolio in good stead over time.

- Costs must be managed against the return profile or risk mitigation benefit any investment represents.

The process

In our approach to multi-managed investment portfolios, we are deeply aware of the inefficiencies it produces. This is why we have developed mechanisms to enable us to restore balance to a portfolio quickly and cost-efficiently, without having to make ponderous and slow manager changes. Ballast is our risk management function. We provide it at no additional cost and ensure that we avoid conflicts of interest in that there is no incentive to hold a larger or smaller portion of the portfolio as Ballast. We have numerous practical examples of having effectively employed the Ballast methodology in our track record since we first implemented Ballast into our portfolios.

Products on offer

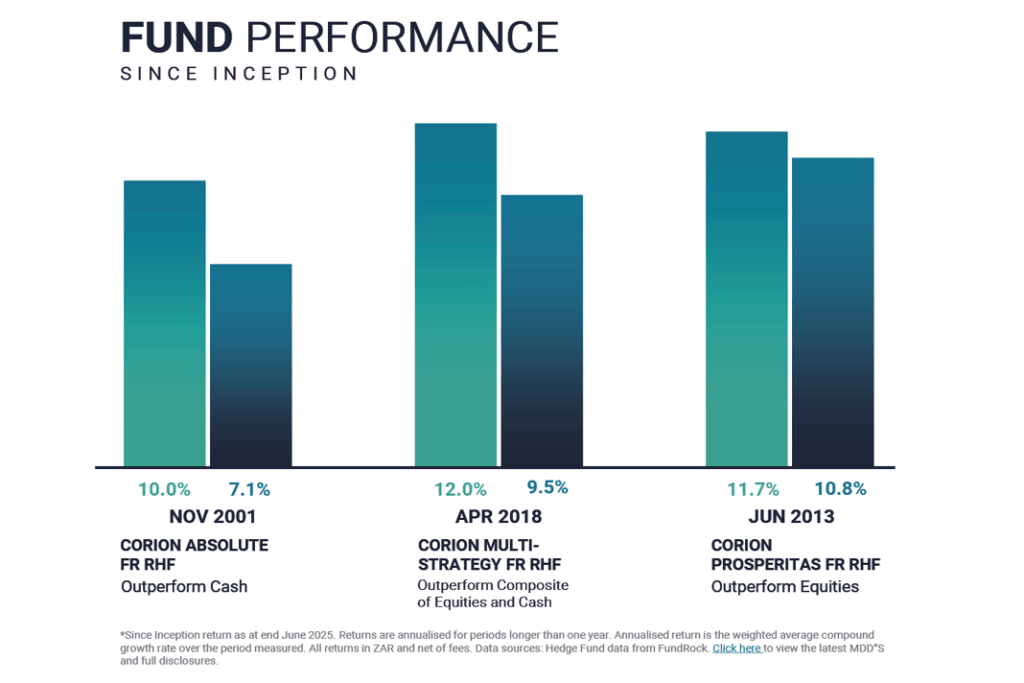

We have three retail investor hedge funds available to clients: Corion Absolute FR RIHF, Corion Multi-Strategy FR RIHF and Corion Prosperitas FR RIHF.

Depending on the investment objectives and risk tolerances of a client, there are often compelling reasons why a diversified hedge fund should be included. Hedge funds have proven outperformance with reduced volatility. Our hedge funds have successfully navigated varying market cycles, corrections and crashes. They provide clients with access to a myriad of return drivers through multiple strategies that are complementary to traditional strategies and provide compelling risk-adjusted returns. Corion is the single-entry point to diverse strategies, asset classes and uncorrelated return profiles and strategically reduces portfolio risk while unlocking profitable opportunities typically out of reach to most investors.

Perspective on performance

With a long-standing track record, all three hedge funds have delivered exceptional returns. They have consistently provided solid risk-adjusted returns, being able to not only participate in the upside but prioritising the protection of capital during market downturns.

Contact information:

- Nicole Keenan

- Telephone: 021 831 5400 / 063 255 8977

- Email: clientservices@corion.co.za

- Website: www.corion.co.za