We will look at the potential benefits of including hedge funds as part of a portfolio solution. However, when it comes to the practical steps – selecting specific hedge funds and determining how to invest – it may be prudent to speak to an accredited advisor or access hedge fund exposure through a curated basket of funds offered by a Discretionary Fund Manager (DFM).

Hedge funds are less risky than you think

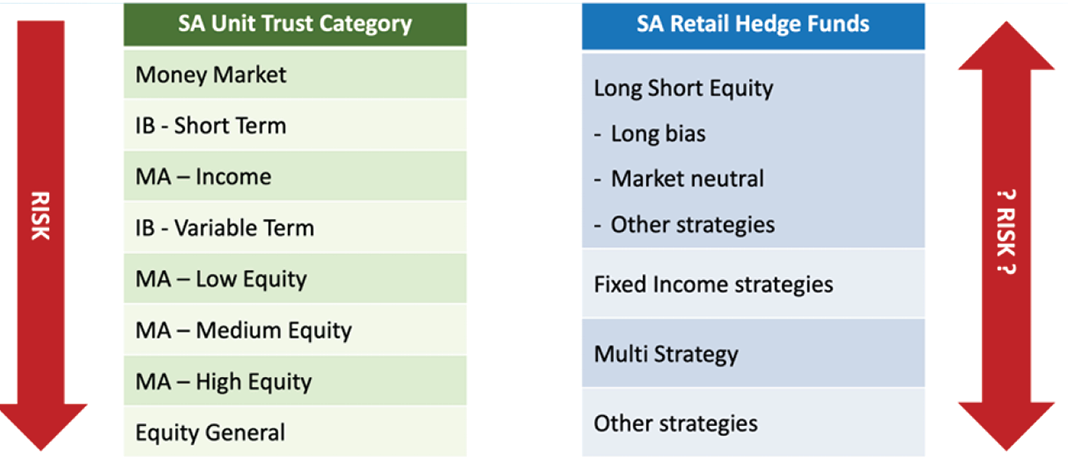

The hedge fund universe is broad and not homogeneous in terms of risk or return. Funds vary based on the underlying assets in which they invest and the strategies they deploy. Even within the same category, hedge funds can demonstrate significantly different risk and return characteristics.

This contrasts with the more linear risk spectrum typically seen in the unit trust industry, ranging from low-risk money market funds to higher-risk equity funds. In that space, risk tends to increase predictably as one moves along the spectrum (Figure 1).

Given the variety of hedge fund strategies and idiosyncrasies and risk dynamics, the CISCA regulator has stipulated a range of strict risk limits that approved Retail Investor Hedge Funds need to adhere to.

Investing’s Holy Grail

We can identify several advantages to including hedge funds in diversified portfolios, which may essentially result in better risk-adjusted returns:

- Robust regulation: The industry is very well regulated in South Africa, with hedge fund managers being regulated under the Financial Advisory and Intermediary Services Act (FAIS) and hedge funds being regulated under the Collective Investment Schemes Control Act (CISCA).

- Prudent risk limits: Within CISCA, there are conservative, world-class risk limits published in Board Notice 52. This means that the risks which are deployed in hedge funds, especially retail hedge funds (RIFs), are not as high as you may think. The regulations protect investors by limiting potential losses, controlling leverage and ensuring portfolio diversification. These limits – such as Value-at-Risk (VaR), exposure caps and liquidity requirements – help prevent excessive risk-taking and reduce the likelihood of large drawdowns. They promote transparency, risk oversight and alignment with expectations.

- Mandate advantages: Hedge funds have the flexibility to pursue diverse sources of return beyond traditional long-only strategies. One approach involves capitalising on relative price movements between two stocks, like long/short equity funds. Other funds may provide investors with access to specialist markets, such as interest rate derivatives, that may not typically form part of traditional portfolios.

- Uncorrelated returns provide diversification benefits: Hedge funds offer the unique advantage of generating positive returns, regardless of general market conditions. Due to their diverse nature, hedge funds also tend to perform differently from each other too. They therefore combine very well with traditional portfolios and other hedge funds to potentially improve an investor’s total risk-return profile.

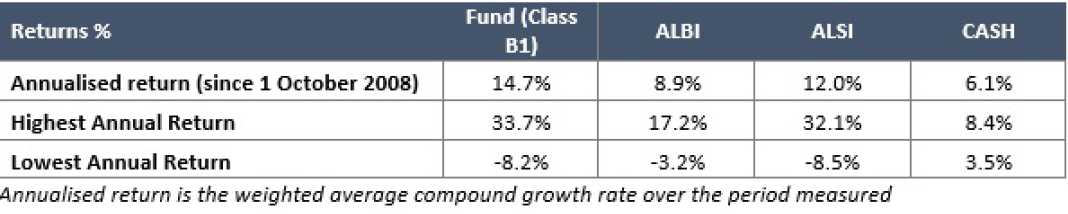

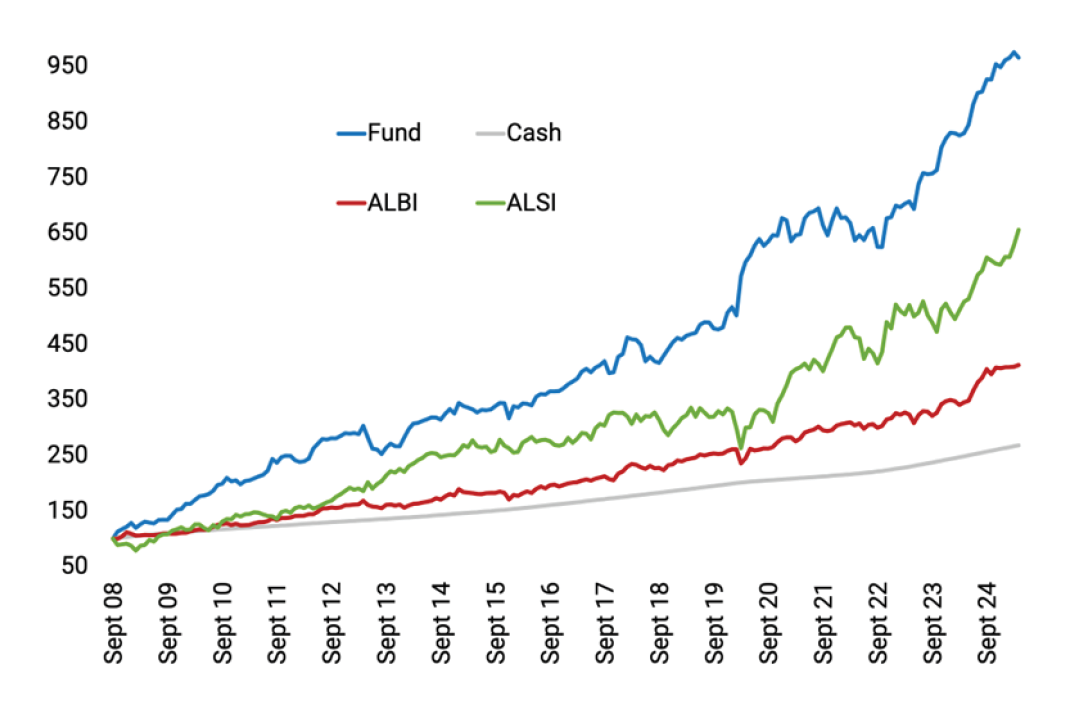

Source: Matrix SCI Fixed Income Retail Hedge Fund MDD, 30 April 2025. Note that past performance is not necessarily a guide to future performance and subject to disclaimers in link opposite.

Proof of the pudding

By way of example, the Matrix SCI Fixed Income Retail Hedge Fund (Class B1) has returned cash plus 9% after fees, which is greater than inflation plus 10%, while maintaining a low correlation of 0.45 to bonds and a mere 0.07 to equities, thereby making it an excellent diversifier.

In summary, hedge funds can play a valuable role in a diversified portfolio by offering low correlation to traditional assets, reduced overall volatility and the potential for above-average, risk-adjusted returns over time.