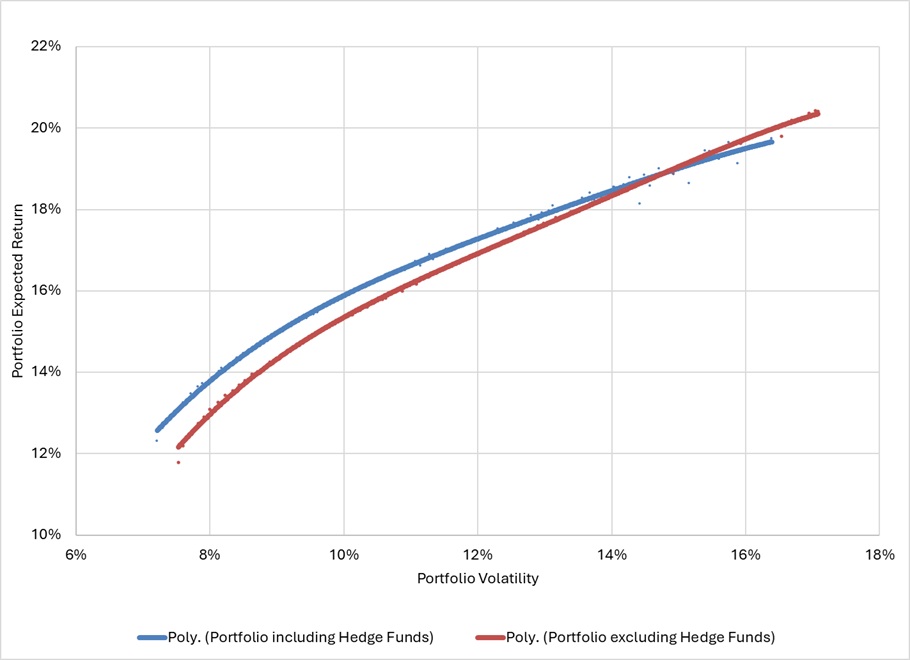

A strategic allocation to hedge funds offers a compelling solution, with the potential to shift an investment portfolio’s efficient frontier upwards and to the left, delivering higher expected returns for a given level of risk.

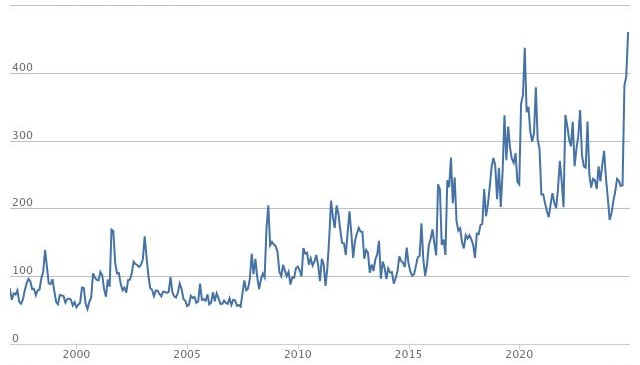

Monthly Global Economic Policy Uncertainty Index.[1]

While hedge funds offer significant potential, prudent portfolio construction emphasises diversification. Regulations, such as South Africa’s Regulation 28 of the Pension Funds Act, often limit exposure to alternative investments to less than 10%. We suggest that investors make it part of the allocation in a well-balanced portfolio.

The impact of hedge fund inclusion is illustrated in the following graph, which displays the efficient frontier for a portfolio comprising South African and global equities as well as South African bonds. The red line shows the efficient frontier without hedge funds. The blue line shows the efficient frontier with a hedge fund allocation. By incorporating hedge funds, the efficient frontier shifts upwards and to the left, demonstrating the potential for increased returns at every risk level.

Efficient Frontier: optimal portfolios including and excluding hedge funds.

Contrary to the common perception of hedge funds as purely speculative vehicles, the South African hedge fund industry has matured significantly since the launch of the first fund in 1998[1][2]. Since 2015, the industry has been regulated under the Collective Investment Schemes Control Act (CISCA), ensuring greater transparency and investor protection. With industry assets exceeding R100-billion and a substantial portion managed by experienced investment professionals, hedge funds have become an integral part of institutional asset owners’ portfolios. Pension funds and funds of funds, not people who are known for taking excessive risk, and not unquantifiable risks, are the biggest investors in hedge funds today.

A typical hedge fund aims to produce consistent, correlated returns, typically at some stated level above inflation or a broad index of interest (eg SteFi). In pursuit of this goal the manager deploys the traditional tools of buying shares, bonds and holding cash, but this is augmented with additional strategies which are not available to traditional long-only managers. These tools/strategies employed by hedge fund managers include:

- Short selling. Profit from anticipated declines or stagnation in asset prices.

- Pair trading. Profit from the relative value difference between two similar assets.

- Leverage. Amplify returns by borrowing funds, subject to regulatory limits.

- Derivatives. Financial instruments, such as options and futures, used for risk management and targeted returns.

A strategic allocation to hedge funds can be a powerful tool for enhancing portfolio efficiency. As an example, an investor who allocated 20% (rebalanced annually) to a hedge fund index[3] at the end of 2017 would have achieved a compound annual growth rate of more than 1% better than the ASISA South African Multi-Asset High Equity Group Average,[4] 9.2% versus 8.1% and this would have been achieved with less volatility.

By understanding their unique strategies and regulated nature, investors can leverage the true potential of hedge funds to achieve higher returns while effectively managing risk.

- [1] www.policyuncertainty.com

- [2] Novare SA Hedge Fund Survey 2023.

- [3] We use an equally weighted index across the South African Long/Short

Equity category as monitored by HedgeNews Africa as our Hedge Fund Index. - [4] As published by Morningstar.