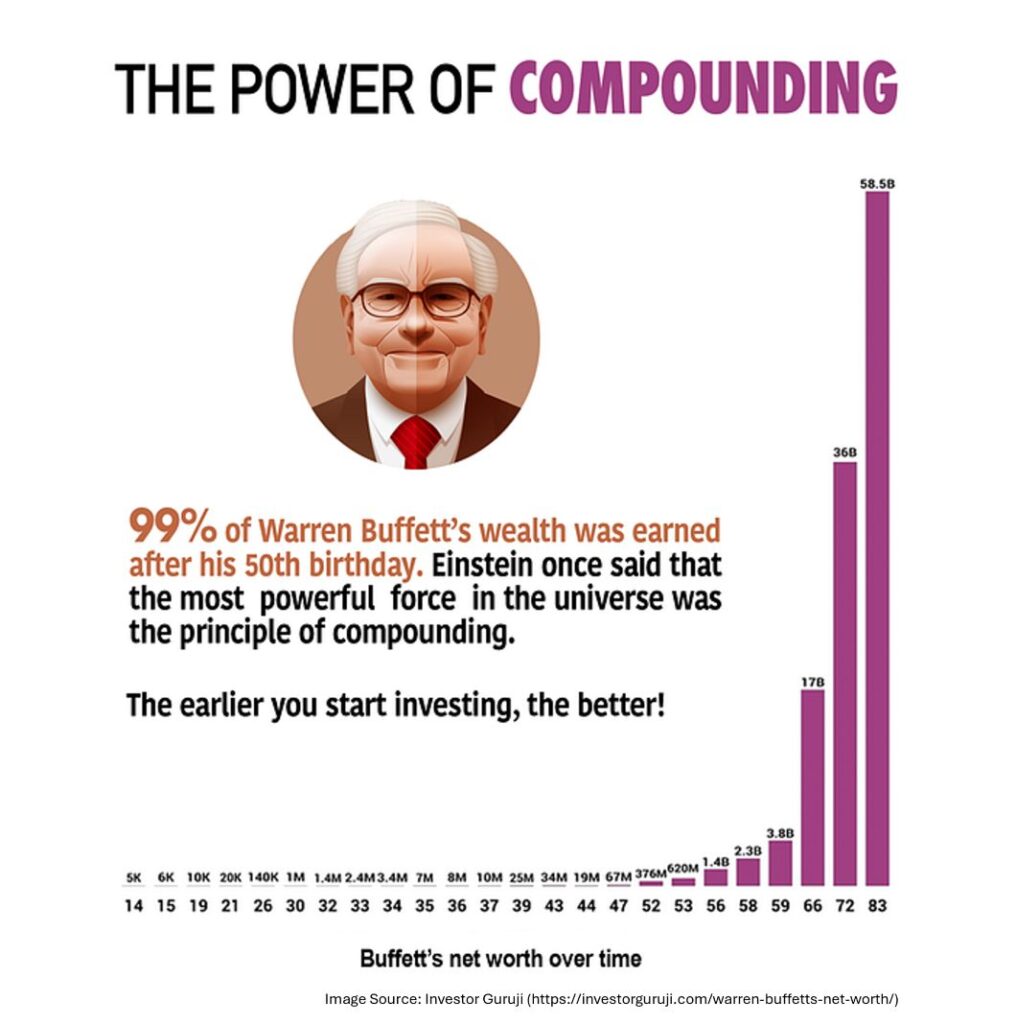

But the true architect of enduring wealth? People who patiently invest in high-quality companies that grow and compound over time.

Think Warren Buffett and Berkshire Hathaway, Bernard Arnault and Louis Vuitton Moët Hennessy, Bill Gates and Microsoft, Mark Zuckerberg and Meta and closer to home, icons Jannie Mouton and PSG, Michiel Le Roux and Capitec as well as Johann Rupert and Richemont come to mind.

Building wealth over the long term presents two investing challenges:

- Identifying high-quality companies that have the potential to compound over time.\

- Having the discipline to stay invested, even when patience runs thin – because compounding takes time, and most people struggle to wait for the payoff.

The Mazi Global Equity team, led by seasoned global fund manager, Andreas van der Horst, embraces a quality investment philosophy designed to tackle these two essential investment challenges. Mazi’s approach combines a time-tested philosophy with a meticulous, repeatable process, ensuring consistent and disciplined execution.

The philosophy is crucial as it removes subjectivity, ensuring that the portfolio manager and team objectively identify genuinely high-quality companies with compounding potential, while minimising risk and the potential loss of investor capital. Following a quality investment philosophy de facto ensures that risky companies are eliminated from investing as they don’t meet the rigorous investment criteria of high-quality companies, e.g. low debt, sustainable future cash flows, high returns on invested capital (RoIC) or high economic value add (EVA).

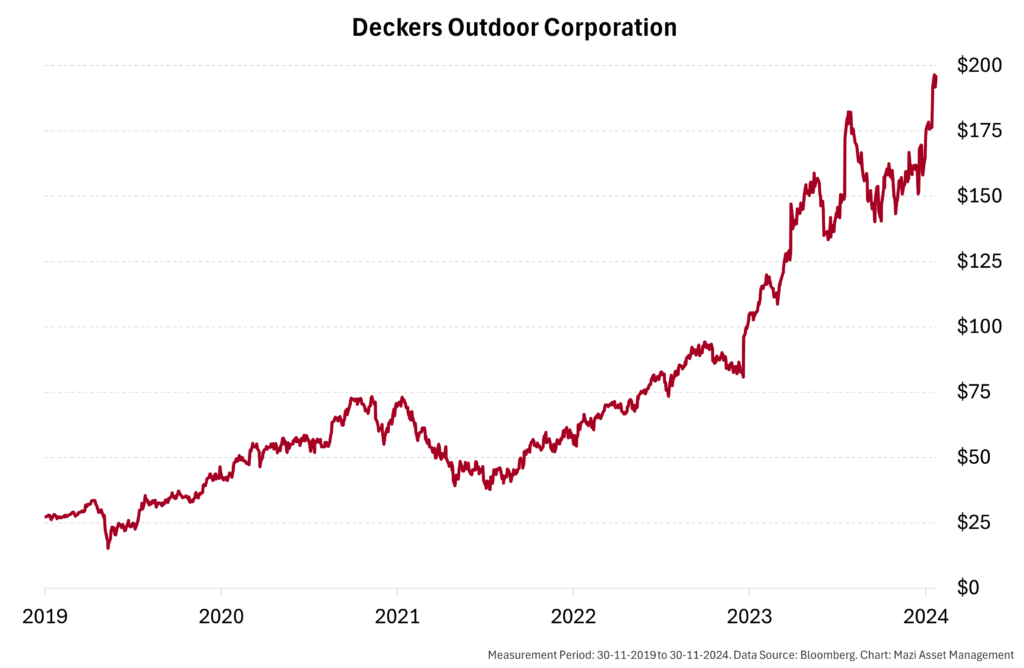

Deckers Outdoor, known for HOKA running shoes and the fashionable UGG footwear brand, is a great example of our process. Mazi’s global team recognised the company’s exceptional qualities, growing market share and unique product offering, portending sustainable profits for years to come. Deckers has delivered, to the end of November 2024, for our investors a compound annual return of 85% in US dollars.

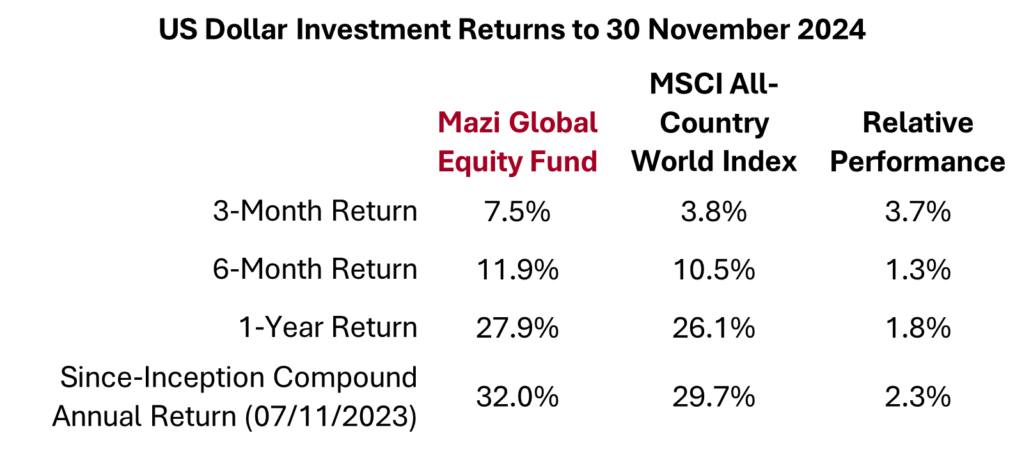

The success of Mazi’s investment approach shines through in the performance figures of Reference Feeder Fund, but present performance of UCTIS fund, launched during the tumultuous equity market peak of the Covid era. This success paved the way for creating the offshore, Ireland-domiciled, USD-denominated Mazi Global Equity Fund, offering our investors both rand and US dollar access to our high-quality global investment solution. The fund is a Bank of Ireland regulated Undertakings for Collective Investment in Transferable Securities (UCITS) fund and its management company is Prescient Ireland.

The takeaway? The Mazi Global Equity team invests in great companies and lets time do the work… compound into wealth for our investors.