As lockdown drags on many consumers are realizing that fixed monthly insurance policies don’t tally with their lifestyles. Fortunately, a new wave of Insurtech startups is offering flexible, AI-enabled alternatives which allow you to switch cover on and off with the swipe of a smartphone.

A time like this really highlights the incredible savings benefits of on-demand insurance. While we won’t be locked down forever, we are all going to spend a lot more time in our homes for the foreseeable future. And if ABSA’s prediction of a 23.5% retraction for Q2 of 2020 is anything to go by, we’re also going to have to come to terms with a belt-tightening future where every single debit order has to justify its presence on our bank statements.

How is on-demand insurance different to traditional insurance?

Home contents insurance protects an asset if it is stolen or damaged when at home… but falls away the moment it leaves the property. This kind of insurance is great for TVs and fridges, but not so wunderbar when you head out with your bike or laptop.

As the name implies, all risk insurance covers an asset for loss, theft or damage away from home. Normally this kind of cover makes sense for things like cellphones which leave the home on a daily basis, but this logic goes out the window during lockdown.

On-demand insurance gives you the flexibility to choose when you need insurance. You only pay when your cover is switched on. If you require cover for a particular asset all the time, you can leave your cover on. If you only require cover for a particular asset a few days of the month, you can switch on your cover for just the days it is at risk.

Why on-demand insurance now makes more sense than ever

Even before COVID, the world of insurance was hurtling towards a tech-enabled future where customers will craft their own tailored insurance bouquets to suit their unique and ever-changing lifestyles.

Across the globe, consumers were seeing the folly in paying year-round premiums on rooftop tents/snowboards/Swarovski binocs that, by definition, would spend most of their lives in the garage. Lockdown has simply thrown the benefits of this approach into even starker relief.

A bold new wave of Insurtech (insurance + technology) startups are doing for insurance what Fintech did to the finance industry a few years back.

A McKinsey report noted that investment in Insurtech surged from a paltry $140 million in 2011 to $2.7 billion in 2015. By 2018 that figure had risen to $9 billion, according to a research paper put out by the Milken Institute. Since lockdown began, the European market has experienced an even more startling 72% leap!

And with good reason. Millennials are used to using their smartphones to book flights, to watch movies and even to organize their love lives, so why should buying insurance be any different?

On-demand insurance – the most bespoke of all Insurtech offerings – speaks to today’s consumer because it is…

- Quick & easy. Do it all (from sign-up through to claim) on your smartphone in under 5 minutes.

- Unbundled. Choose what you want to insure, and when you want to insure it.

- On-demand. Simply swipe to switch cover on/off. Only pay for what you use.

- Secure. Products that are underwritten by household brands give peace of mind.

- Cost-saving. Only paying for the insurance you need saves money.

- Complementary. On-demand insurance doesn’t replace conventional cover, but rather augments it.

How does on-demand insurance actually work?

Truly on-demand insurance is all about giving total control to the consumer, so it goes without saying that all of the most successful products – both overseas and in South Africa – are app-based.

The process is similar to specifying an item with your broker – except you can do it at 2am on a Thursday while struggling to get a teething toddler to sleep. After filling in some basic personal info (name, ID number…) you provide the make, model, serial number and value of the item and take some pics of it for good measure.

Within minutes you’ll be presented with a quote for worldwide cover for loss, theft or accidental damage to your cherished Ray-Ban Aviators or GoPro Hero. You can repeat the process to add more items. These will then be added to the home screen. Cover will not be activated until you swipe right on an item.

Payment is generally collected in arrears on the first day of the following month, so you only pay for the cover you actually used. Claims are also resolved in-app (you’ll have to make a short video testimonial) and the money should be in your account within days.

What are the savings?

The easiest way to understand the benefits of on-demand insurance is to check out a real quote for a R60k mountain bike obtained from JaSure:

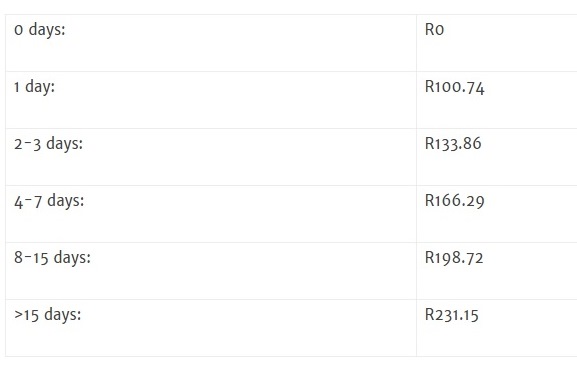

Days per month and total premium indicated below:

Put another way, if you don’t toggle your insurance in a given month you won’t pay a cent… And if you leave your cover on all month long you’ll be paying the same (or less) as you would with a regular insurer. It’s hard to argue with this kind of flexible affordability.

Low-hanging fruit

There are many ways to leverage Insurtech to save on your insurance premiums. But none is quicker or easier than switching to on-demand cover for items which spend large portions of the year (especially this year!) locked up safely at home.