Remember Netscape Navigator? The company was the dominant web browser and search engine in the 1990s, later displaced by Google, Microsoft, Apple and Amazon as the kingpins of the Internet age. At the height of Netscape’s success, Google was a one-year-old startup, Microsoft was just releasing Windows 2000 – its latest operating system that you could buy in a box set, while Apple was making good-looking desktops and Amazon was an emerging online bookstore.

Netscape was seen by investors as the access point to the boundless opportunities that the Internet held for the future of business, causing the share price to soar after its IPO in 1995, even though it barely made a profit on meagre sales. What the company did to generate those sales did not matter to investors as they bought into the hope of future earnings.

As the San Francisco Chronicle reported at the time:

It’s more likely that investors believe the myriad alliances Netscape has struck with other technology companies will enable it to set the tone for developing business, banking and entertainment on the World Wide Web. The bottom line is that it doesn’t matter that Netscape is still a puny company on paper. The future is what counts, and optimism over the future has juiced the stocks of most Internet-related companies, not just Netscape. [1]

The public launch of ChatGPT in 2022 created a wave of excitement as the world tried to digest this new wave technology that showed the potential to answer complex questions like a human would. This also caused an increased level of anxiety as the concept of machines taking our jobs was suddenly more realistic than a Hollywood film plot. Elon Musk was at pains to point out at the time that there was a myriad of unintended consequences that followed the launch of this technology and that serious controls were needed. The AI machine, however, had been built and unleashed on the world.

The emergence of AI

AI has been in existence as a field of research since the 1950s. Much of this body of work has already been integrated into many aspects of our daily lives as well as the economy. For example, autonomous robots building cars are controlled by AI systems, while the predictive text when typing a phone message has been around for almost a decade. The step change with the most recent iteration of AI relates to the rationalisation and reasoning capabilities of the large language models (LLMs) that underpin the now common ChatGPT and Gemini applications that you can access on your phone.

These models are like a super-smart colleague that you can talk to, just like you would a person. You can ask anything – questions, help with writing, explanations or even just to chat – and it responds in a way that sounds natural. It doesn’t have feelings, but it’s been trained to understand language by reading a huge volume of Internet-sourced books, articles and conversations. It doesn’t “think” like a human; it gives you helpful or interesting answers based on what it’s learned. (This comment was in fact written by ChatGPT.)

The range of future uses for AI are impossible to predict but are likely to include services that complete mundane daily tasks like restocking your fridge to more complex tasks such as negotiating legal agreements for the sale of a property. In business, AI management teams could form the nucleus of a company directing and organising resource allocation. These tools could solve hugely complex logistical or optimisation challenges in our electrical grid or traffic management systems to boost efficiency and productivity. These ideas may sound far-fetched, but this is exactly where LLMs are being actively applied today, and we are likely to see the introduction of these services in the not-so-distant future.

The drivers of AI development

The key parties driving the development of AI technology and its progression into real world commercial applications are broadly grouped as follows:

- Infrastructure. Manufacturers of graphics processing units (GPUs) train and run the most advanced models, eg Nvidia. These chips are highly specialised and hard to replicate, with only a handful of companies providing them at this stage.

- Hyperscalers. These are large technology companies like Meta, Microsoft and Alphabet that have leveraged the scale of their platform businesses and balance sheets to develop various services and applications related to AI technology. The likes of Alphabet have chosen to internally develop this capability (eg Gemini), whereas Microsoft has formed strategic partnerships with AI leaders like OpenAI to secure its spot as the frontier of the market.

- Other downstream providers. These are businesses that have established teams of experts developing inhouse AI capabilities to avoid being behind the technology curve (banks and insurers) or venture capitalists funding early startups to set up the “new new thing”. [2]

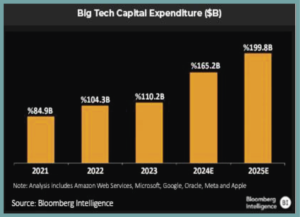

The stakes of participation are high, requiring cutting-edge computing power, significant electricity consumption, access to vast datasets and the technical expertise needed to train the models. This has narrowed the field of companies pursuing AI technology to a select group, who have deployed large amounts of capital to invest in AI-related initiatives.

Yet, AI is increasingly viewed as essential for survival across business and government, seen as a critical investment to maintain a competitive edge or to avoid obsolescence. This has fuelled an almost “sky-is-the-limit” expectation of what companies are willing to pay to stay at the forefront of AI, unlocking vast potential for future revenue streams tied to AI-related services owned by the companies that hold the key to technology.

Share prices have reflected this enthusiasm as the market increases its revenue expectations for this small cohort of stocks, in other words, rewarding AI leaders for the high level of capital expenditure on AI.

The winners today may not be the winners of tomorrow

The AI infrastructure stocks like Nvidia have been early winners, enjoying extraordinary profits as demand for their chips has risen with the need for additional computing speed and stock-piling efforts by Big Tech, while competition has been almost non-existent and supply is constrained.

However, the winning business model for service providers like Microsoft, Meta and Alphabet has yet to emerge. Despite this, their stock prices reflect a scenario in which they win the AI race and successfully translate this position into higher earnings – an outcome that is far from certain. For example, it remains unclear how Microsoft will integrate AI into its existing services, a process that could take years of trial and error. This uncertainty raises questions about Microsoft’s future business model, with a wide range of possible outcomes – ranging from immense success (Microsoft Azure cloud service) to obsolescence or something in between with slower- than-expected earnings growth.

Another threat is the emergence of innovative technologies like DeepSeek that can disrupt the status quo. DeepSeek is a one-year-old Chinese startup that recently showed the world there are faster, cheaper ways to compete. This not only reduces the amount of computing power needed to build and run AI models (less chips and data centres) but also weakens the control that Big Tech has over cutting-edge AI models.

There are questions about DeepSeek’s merit, sustainability and security, but that misses the point:

- Its emergence shows the value that AI potentially holds, with a billionaire hedge fund manager from China betting his fortune on AI. Other tech billionaires like Eric Schmidt (Google) are doing the same with startups like Anthropic.

- It reminds us that we are still in the exploratory disruptive stage of the AI lifecycle, with potentially no clear winners identified yet. Recall the earlier example of Netscape, who along with a myriad of other early innovators of the Internet disappeared, later to be replaced by Google, Amazon and Facebook, who emerged much later in the cycle as winners. They then developed platform business models that no-one, not even their founders, imagined in early infancy.

Hence, history demonstrates that the current AI winners today may not be the AI winners of tomorrow. For example, does Alphabet get replaced by a superior alternative to Google Search or does Nvidia’s dominance get eroded by emerging Chinese production of chips? There are 1 800 AI models available on the Microsoft Azure platform. Who will win? And if they do, will it use the Microsoft platform to host its services or another emerging company who disrupts the status quo? Ultimately, the range of outcomes is wide, even if we agree at a base-level that AI will change the world, and there are strong arguments to suggest it will.

Stock market expectations

Earnings for Big Tech have surprised on the upside since the AI hype began in 2023 and there has been strong momentum in its share prices, which is driven in part by speculation around the outlook for AI and in part by investors fearing missing out on the AI theme. The risks that the hyperscalers turn these AI investments into earnings growth and profits are high. Recently a few of the companies have provided more muted outlooks, citing supply constraints and challenges with electricity demand among several other emerging headwinds.

AI is increasingly, viewed as essential for survival across business and government.

We have seen the market show excitement towards new technology innovations over the past years as investors looked to identify the next “new new thing”, including thematic ideas like the metaverse3 and NFTs,4 and even Bitcoin and the blockchain. These ideas have largely perked interest and then subsided as the embedded risks or commercial viability remain a challenge. There have been other emerging themes like autonomous driving or energy transitions, where AI is destined to be the technology that binds this all together. There is also the potential that today’s AI winners are derailed by advances in computing power – led by the quantum computing industry which has yet to make its presence felt.

AI as a concept has immediate, tangible real-world applications with the potential for future evolutions. This provides a level of comfort that the benefits could deliver productivity and innovation gains for a while to come. This also means it is important not to focus solely on AI leaders as the primary beneficiaries.

As with past technological advancements, the benefits extend across the broader economy, driving productivity gains and reducing inflation. It is also likely that there will be a long list of potential losers that are either startups that fail to develop a sustainable service proposition or an incumbent that fails to adapt to the AI transition. Companies like Samsung, who have committed to developing cutting-edge chip-manufacturing technology to rival the incumbent TSMC, have failed to meet the required quality and efficiency standards and the company risks another large derating of its stock.

How to access the AI investment opportunity

AI technology has the potential to deliver meaningful investment opportunities, but the major warning for investors is that an AI leader purchased at the wrong price could prove to be a poor investment if the resulting growth in earnings doesn’t justify the investment made to achieve its dominance. Likewise, missing out on emerging opportunities could mean an investor missing the investment of the next decade and beyond.

Our investment approach to access the AI investment case is multi-pronged:

- Start with the index. Buy passive, because we don’t know who the winner will be. We have done this – conservatively – but it has added material returns from holding winners which hardly anyone saw.

- Invest in specialist growth funds, who set out to look for these opportunities and others like them every day.

- From a valuation perspective, we need to weigh up high prices versus the size of the opportunity, as you can get drawn into overpaying. Like the trajectory of technology out of the Internet boom in the 1990s, it is likely that you will need to adjust positions in portfolios as the market finds its path to the ultimate winners as Google and Amazon showed. Balancing likely reality and optimism is important in this phase.

New disruptive technologies like AI will become pervasive, benefiting many companies, creating new ones and rendering others obsolete. However, accessing these opportunities while avoiding pitfalls is less straightforward. As AI becomes embedded, we expect the path to be one with volatility, along with disruptions and surprises, as we navigate this exciting technological revolution.

[1] www.elon.edu

[2] “The New New Thing – A Silicon Valley Story” written by Michael Lewis about the rise and fall of Netscape.

[3] An online world which integrates real life activities.

[4] Non-Fungible Tokens – essentially turning data into asset form.