Introduction

Hedge funds in South Africa are investment vehicles that pool capital from accredited investors and institutions to invest in a variety of assets, often employing complex strategies and leverage to maximise returns. The structure and regulation of hedge funds in South Africa are governed by various regulatory bodies, including the Financial Sector Conduct Authority (FSCA). Hedge funds are a variant of a Collective Investment Scheme (CIS), issued under an arrangement with a Management Company (Manco) in a co-named arrangement. A Manco’s responsibilities include regulatory oversight, ensuring compliance, managing risks and facilitating investment management. They also act as a link between the fund’s trustees and investors, ensuring transparency and accountability.

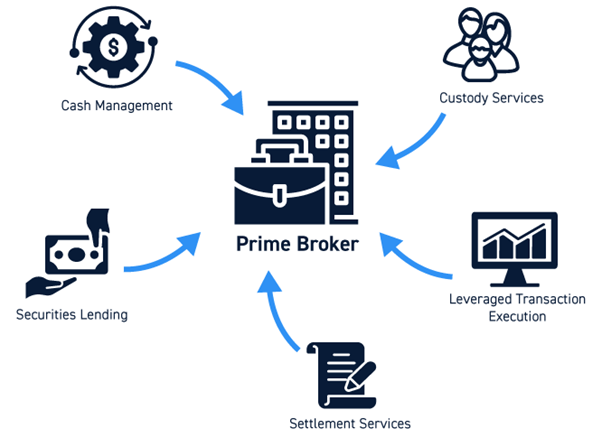

A prime broker is generally a large financial institution that assists hedge funds facilitate the implementation of the investment strategy.

They offer a range of services like executing trades, clearing and settling transactions, keeping custody of assets, providing loans and financing, and lending securities for the cover of short positions. These services allow hedge funds to concentrate on their investment strategies without worrying about the operational details.

Hedge funds depend on prime brokers for access to balance sheets to implement portfolio leverage.

Introduction to prime brokerage

The relationship between a prime broker and a hedge fund is mutually beneficial. Hedge funds depend on prime brokers for access to balance sheets to implement portfolio leverage, which helps them increase their investment positions and potentially earn higher returns. In return, prime brokers earn fees and interest from the services they provide. This partnership works well because both parties benefit from the hedge fund’s success.

Prime brokers also offer valuable market insights, research and risk management tools that help hedge funds make better investment decisions and manage their portfolios effectively.

This added support strengthens their relationship, as hedge funds rely on the expertise and resources of their prime brokers.

It is important that a hedge fund consider the strength of the prime broker’s balance sheet to ensure that the portfolio will not be put at risk should there be financial issues with the prime broker. Equally so, the prime broker needs to consider the hedge fund investment strategy and extension of leverage to avoid situations where excessive gearing or liquidity issues may impact its ability to finance the portfolio.

Core services provided by prime brokers

Trade execution and clearing

Prime brokers play a crucial role in facilitating trade execution for hedge funds, ensuring swift and accurate trades. They also handle the clearing process, ensuring that transactions settle correctly and efficiently.

Not only does Absa Prime Brokers offer access to all local markets (equities, bonds, derivatives), it also offers full access to offshore markets allowing South African hedge funds to take positions globally. This gives managers a greater chance in utilising strategies that might not be applicable to South Africa due to the relevant size of our markets.

Custody services

Prime brokers provide custody services, safeguarding hedge fund assets and ensuring accurate record-keeping. They also assist in aggregating risk, providing reporting and analytics to help hedge funds manage their portfolios effectively, while reporting the required data to the management company of the hedge fund.

Prime brokers play a crucial role in facilitating trade execution for hedge funds.

Financing and leverage

Prime brokers offer financing options to hedge funds, allowing them to leverage their investments. This includes margin financing, which enables funds to borrow against their assets to increase their exposures to other assets with the aim of increasing returns. Hedge funds can also use this funding mechanism to settle trades or margin calls leaving the hedge fund to keep exposures in other assets that outperform the lending rates charged by the prime broker.

Trade execution and clearing

Prime brokers facilitate securities lending, allowing hedge funds to borrow securities for short selling. This service is crucial for funds that employ short-selling strategies to capitalise on market inefficiencies. The securities are usually lent by long-term holders (such as pension funds) allowing them to earn extra fees on otherwise dormant holdings.

Risk management and reporting

Prime brokers provide risk management services, offering tools and analytics to help hedge funds assess their risk exposure. Additionally, they supply comprehensive reporting to ensure transparency and compliance. There are often benefits that a prime broker can introduce to hedge funds such as the efficient management of collateral that will minimise the impact of charges on the underlying portfolio.

Prime brokerage relationships with hedge funds

Prime brokers typically charge fees based on the services provided, which may include commissions on trades, asset management fees and financing charges. Understanding fee structures is vital for hedge funds to manage costs. Counterparty risk is a significant concern in prime brokerage relationships. Hedge funds must work closely with their prime brokers to assess and manage these risks to ensure financial stability. Prime brokers significantly influence the hedge fund industry by enhancing operational efficiency, supporting fund growth and navigating the complex regulatory landscape.

Future trends and challenges in prime brokerage

Technological advancements and the integration of fintech solutions are transforming the prime brokerage landscape. Prime brokers must adapt to these changes to remain competitive and meet the evolving needs of hedge funds.

The prime brokerage market is becoming increasingly competitive, with more scrutiny of size and quality of the balance sheet backing prime brokers. This could impact service levels and pricing, requiring hedge funds to carefully evaluate their prime brokerage relationships to ensure they are not adding additional risks to their funds outside their market

risk allocations.

Conclusion

In summary, prime brokers play a vital role in supporting hedge funds by providing essential services and resources. Their relationship is built on mutual dependence and shared interests, with both parties benefiting from each other’s success. However, it’s important to manage the risks to ensure smooth operations.

Chris Edwards is the Managing Director and Head of the Prime Services, and the Index & Structured Solutions businesses at Absa Bank Ltd. Chris has accumulated over 25 years of experience within financial services with a focus on global markets, alternative asset management and, more recently, the structured products sectors.

Chris Edwards is the Managing Director and Head of the Prime Services, and the Index & Structured Solutions businesses at Absa Bank Ltd. Chris has accumulated over 25 years of experience within financial services with a focus on global markets, alternative asset management and, more recently, the structured products sectors.

Working for leading firms such as Morgan Stanley and now Absa, Chris has spent the past 15 years conceptualising, building and working with businesses to serve these market sectors. During this time, Chris has dealt with financial regulators across UK, Africa and Asia, served on several boards and industry forums both as an independent director and in an advisory capacity.