Absolute return strategies are designed to deliver consistent outcomes by reshaping the distribution of returns. Their value lies less in outperforming during extended rallies and more in preserving capital when conditions deteriorate. By doing so, they sustain the compounding effect that drives long-term wealth creation.

To appreciate the absolute return mindset, consider Serena Williams’ historic win-loss record. Not every match was a blowout, but few were thrown away. Serena Williams won 23 Grand Slam singles titles and nearly 86% of her matches. Yet she won only about 55% of the points she played. Her dominance came from winning the points that mattered most, limiting unforced errors, and staying in the match when opponents faltered. Champions are not those who win the most points in the early rallies, but those who make the fewest errors when it matters most.

This principle is best understood through the lens of asymmetry. Figure 1 shows the familiar payoff curve, which is not marketing artifice but the principle of aiming to maximise participation in upside market movements while limiting downside risk. Absolute return is the investment philosophy and asymmetric returns are its implementation. The core objective is to protect capital and grow it in real terms.

Why the best offence is a good defence

Absolute return strategies are not designed to dominate every market rally but to remain resilient when conditions turn, steadily compounding capital while avoiding the deep drawdowns that can derail long-term growth.

There is a reason why Warren Buffett’s often-quoted first rule of investing – “never lose money” – is also the second rule: “never forget rule number one”. These should not be treated simply as aphorisms, but a recognition of the mathematics of drawdowns.

Buffett’s maxim is illustrated in Figure 2: the deeper the decline, the more disproportionate the recovery required. A loss of 20% necessitates a 25% gain to return to par; a 50% drawdown demands a full 100% recovery. Avoiding those large reversals is not a matter of conservatism – it is alpha expressed through the arithmetic of compounding.

The illusion of chasing the scoreboard

Absolute return strategies may appear uninspiring in bull markets, but they are critical when the cycle turns. Absolute return should not be mistaken for a strategy that outpaces equities in rallies, nor for a defensive refuge in perpetuity. Its role is more nuanced and enduring. The appropriate lens is not the quarterly scoreboard, but the shape of the return distribution, the speed of recovery after drawdowns, and the disciplined architecture that sustains compounding across cycles.

The distribution of returns, rather than the average, tells the most relevant story. Since 2007, the history of asset classes has been marked by negative skew: extended periods of apparent stability were punctuated by abrupt left-tail events such as the Global Financial Crisis (GFC), the Eurozone wobble, the Covid collapse and the 2022 equity–bond sell-off.

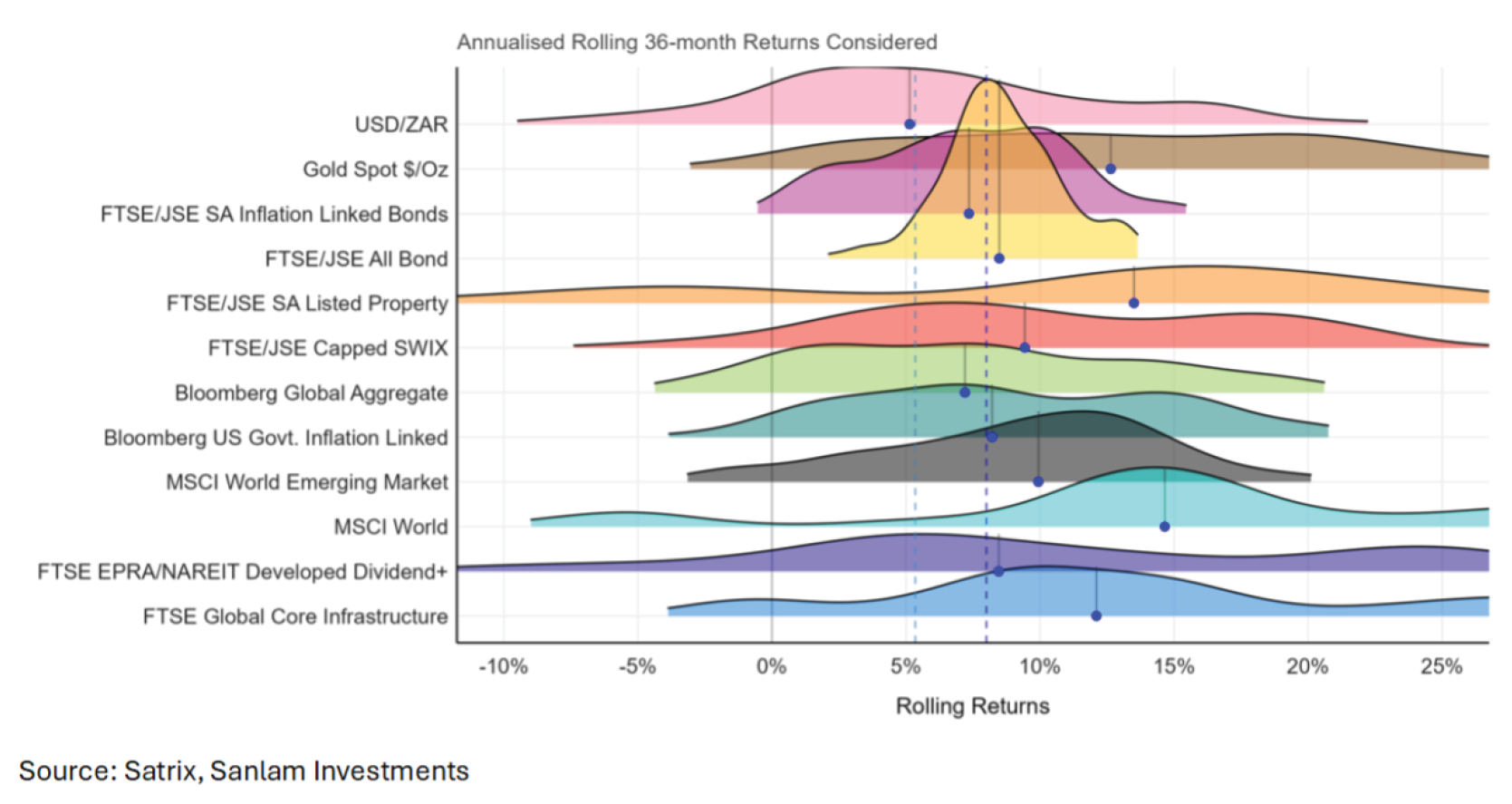

Figure 3, which depicts rolling return distributions in rand terms since 2007, illustrates this clearly. Property and equities carry fat left tails, which means they expose investors to large and sudden losses. Absolute return portfolios compress those tails. They do not always deliver higher peaks but they deliver shallower valleys, and that is the difference between staying invested and being forced out at precisely the wrong moment.

Just as the GFC in 2008 exposed the fragility of leverage and Covid tested liquidity, 2022 dismantled the assumption that a portfolio of equities and bonds would provide diversity. On that occasion, both fell simultaneously and left investors without ballast.

Today’s conditions strengthen the case for asymmetry. Leading institutional surveys show that global fund managers have sharply downgraded growth expectations but maintained crowded exposure to equities and credit. In other words, risk appetite and risk perception are diverging. At the same time, policy signals are fragmenting. Central banks are divided on real rate targets. Equity valuations globally remain elevated and forward earnings revisions are rising. Geopolitical tensions remain a key driver of investor sentiment.

In an environment marked by overconcentration in risk premia, not losing becomes a more powerful tool for long-term capital accumulation than chasing marginal alpha during liquidity-fuelled rallies. The next tail risk may not resemble the last, but the reality is that downside events are now occurring more frequently and coming from unexpected directions. In such an environment, relying solely on directional beta is fragile. Absolute return, by contrast, is structurally built to survive it. These strategies, with their capacity to compress the downside while harvesting selective dispersion, are positioned to navigate this landscape.

The best absolute return strategies optimise asset weights, not only by expected return but by their ability to shape the return distribution, narrowing volatility and compressing tail risks. The objective is to enhance the risk-adjusted return profile over time by pursuing asymmetry and harnessing the levers of the absolute return engine, which provides an anchor in diversified portfolios.

The Absolute Return Strategy is used in the construction of the Glacier Invest Real Income Solutions.

Disclaimer

Glacier Financial Solutions (Pty) Ltd is a Licensed Discretionary Financial Services Provider, trading as Glacier Invest FSP 770.

Sanlam Multi Manager International (Pty) Ltd FSP 845 is a Licensed Discretionary Financial Services Provider, acting as a Juristic Representative under Glacier Invest. As Juristic Representative of Glacier Invest, Sanlam Multi Manager International (Pty) Ltd manages the retail investment solutions offered by Glacier Invest.