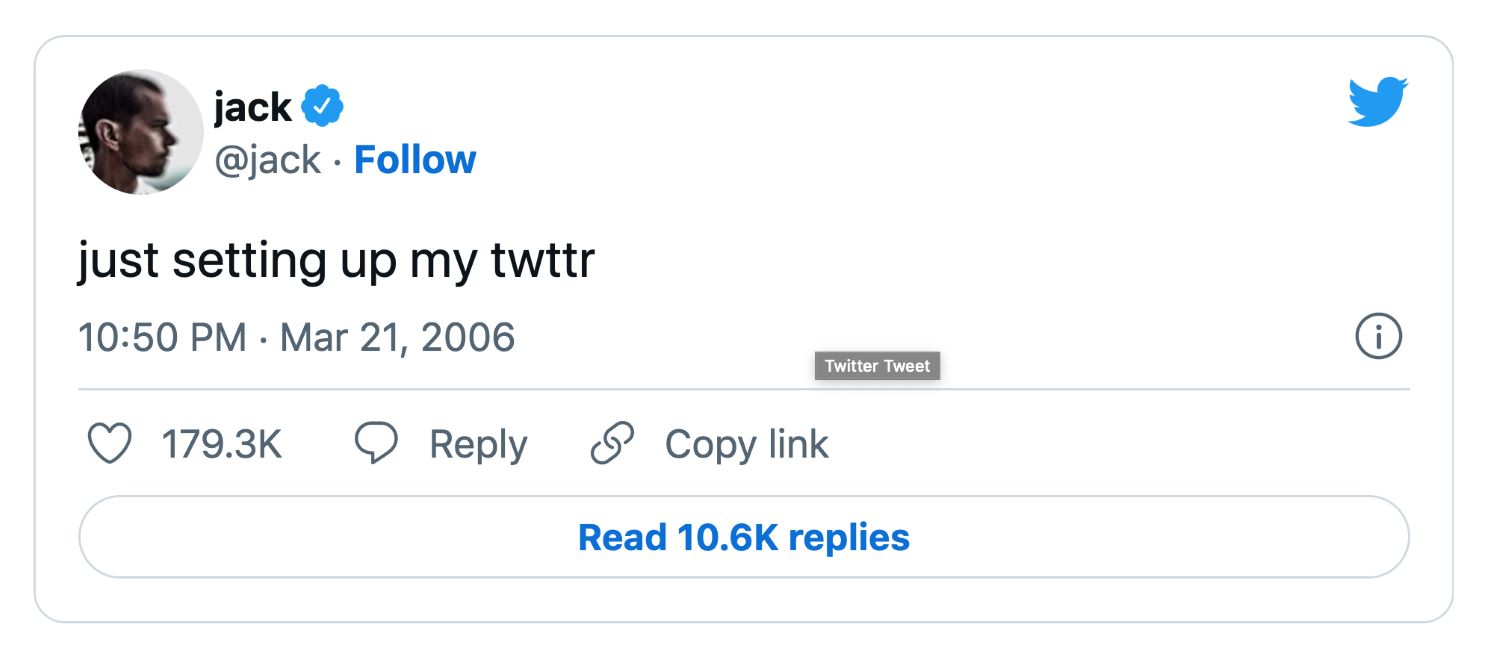

The NFT (Non-Fungible Token) market has gone bonkers in the past 12 months. Although NFTs have been around since 2014, the growth of Cryptocurrencies and the adoption of blockchain technology have catapulted these digital assets beyond celebrity status. Numismatics (coins) made of precious metals have been around since the 5th century and are a medium of exchange and representation of money. NFTs are widely recognised as frogs and first tweets.

In a world that is adapting to modern technology and generations who only saw the first cell phone 20 years ago, it is important to embrace this change and educate ourselves on blockchain technology, NFTs and other crypto projects. It might be early days, but change is coming, and it’s not the change in your pocket.

SAGCE & The Scoin Shop has over 45 years of experience bringing gold coins and collectables to South Africa. SAGCE & The Scoin Shop is always chasing innovation. We continue to reshape the industry by listening to our clients, anticipating their needs, redefining opportunities, and ensuring that gold is for everyone.

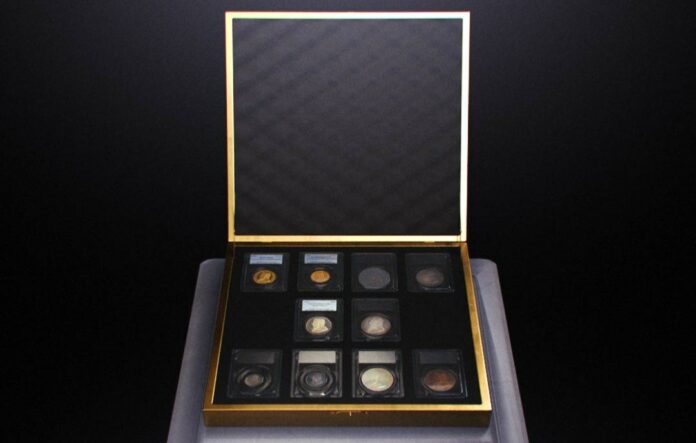

We have always embraced the future and are now responding to the next frontier, NFT assets, by partnering with South African NFT marketplace Momint to tokenise an R18-million ZAR coin collection.

Momint, a South African Web 3.0 tech firm, has tokenised an exclusive Complete Denomination Coin Proof set of the old Zuid-Afrikaansche Republiek (ZAR) coinage for the digital era. Collectively known as the original Krugerrands, the coins occupy a unique place in South African history and have only grown in legend and value. Now a new generation of collectors can get their hands on a piece of this iconic collectable set.

This ZAR coin collection NFT is unique because it is backed by one of the most highly graded, sought-after coin sets South Africa has ever produced. This is not a picture of a rock or a mutant ape; this is real, audited and insured.

This imaginative collaboration between SAGCE & The Scoin Shop, and Momint underlines the conversation about the similarities and differences between old vs new world tokens.

This debate can go back and forth for ages – but I like to start at the beginning- with an explanation of the correlations.

Why are NFTs and coins similar?

1. They are both minted.

Let’s start with “What is an NFT?” An NFT is a digital asset created (minted), stored and secured on a blockchain. This means that while the world wide web has generated 44.4 Zettabytes of data since its inception, someone can own a digital asset that they can safely call their own. Minting an NFT is the act of creating this NFT on the blockchain, sometimes for free, but on some platforms, gas fees can be incurred.

Minting coins is more well-known; stamping a round piece of metal confirms its weight, purity, and face value, making it a legal tender. There are 180 currencies in 195 countries around the globe. Precious metal coins go through rigorous artwork design, plaster or 3D moulding, sculpting and engraving to create the master die before the blank metal disks are pressed with between 500 and 1000 metric tons of force, depending on the metal. Likely, most Gen Z’s won’t relate to this type of minting in years to come.

2. They are both certified and non-fungible.

Ok, but “what the &#@! does fungible mean?” The best words to describe this is; interchangeable, returnable or can be substituted for something else. Your R100 note can be swapped for another R100 note. Your US Quarter can be exchanged for a different one – BUT your special, unique 1 oz gold coin that is minted, dated, certified and boxed cannot be swapped for another 1 oz gold coin… Just like an NFT, it is specifically yours, confirmed and cannot be swapped with another. It can be sold but not changed. This makes it non-fungible.

3. Both can be traded through various exchanges.

The most popular platforms for exchanging NFTs are OpenSea and Rarible, but there are many other open marketplaces for collectors to trade their unique tokens. This allows crypto fans to buy and sell NFTs across borders with instant payments via a smart contract (the confirmation of exchange through the blockchain) and a custodial wallet.

The numismatic industry is estimated to be worth over $18bn worldwide, with dealers, wholesalers and shops selling the most sought-after antique and modern coinage the world has ever seen. Gold currently has a market cap of $11.4-trillion, five times the size of the crypto market and 13 times the size of Bitcoin, also known as “digital gold”.

4. Royalties

Royalties are payments made to an artist or owner of Intellectual Property (IP) for their assets. For example, when mints design and create their masterpieces for currency or collecting, if the coins show national monuments or celebrated people like Nobel Laureates or leaders, there are royalties distributed for the visual or intellectual property to charities, foundations and communities. The South African Gold Coin Exchange has assisted the Nobel Institute, and The Nelson Mandela Foundation raise over R45m in royalties over the past decade.

An NFT royalty is when the original creator (or minter) receives ongoing revenue every time the NFT is resold. However, NFT royalties can get quite sticky; Hermes recently sued a digital artist for knocking off its Birkin handbag through the minting of “MetaBirkin” NFTs, and Nike sued StockX for sneaker NFTs not issued by the multi-billion dollar apparel company.

Royalties are just part of the creative process, and if you know where the money is going, you might feel more inclined to participate.

Why are they different?

1. Digital asset vs Real asset

-

- Digital assets are items you can buy, sell, and hold online but typically can’t physically touch. They can represent various properties, including artworks, collectables, virtual reality and gaming items, domain names or legal ownership records. While there is tremendous potential for the future of contractual ownership, the current scope of possibility lies within non-tangible assets.

- Real assets contain an economic value that can be converted into cash now or in the future. Hard or tangible assets could include genuine artworks, watches, wines, coins, stamps or property. Holding a coin in your hand gives a great sense of peace and power, knowing that the store of value can be moved around and is liquid in times of need. It’s the gold standard of hard assets.

2. Intrinsic value

-

- While some NFTs are sold for millions, like this picture of a rock for R20-million or Tim Berners-Lee’s source code for the world wide web for a whopping R85-million, it is usually nothing more than a JPEG on your computer or phone (that can be screenshot, even if it’s not yours). Think about a Jackson Pollock painting, isn’t it just paint splatters on canvas? Well, yes, that’s what makes it worth so much more.

- Coins, on the other hand, are made of precious metals like gold and silver. No matter how much provenance, craftsmanship, minting and tooling are used on a coin, there is always underlying (intrinsic) metal value (most commonly gold and silver).

3. (Some) NFTs have more utility than coins

-

- Physical artworks, access to exclusive clubs, and even digital citizenship give owners of NFTs comfort that their JPEG picture has more utility (you can do more with it) and therefore has real value that extends past owning a digital artwork. NFT projects try their best to add real-world value beyond the NFT itself.

- The problem with gold coins is that you can’t break off a piece of it and sell it or get much utility from it until you sell it as a whole. However, FinTech startup TroyGold allows for fractional ownership of Krugerrands, access to loans and an internationally accepted Mastercard that lets you spend your gold.

4. Execution

-

- If you are unfamiliar with cryptocurrencies, it could be very tricky to get into NFTs, whilst avoiding the rug pulls, scams and fake exchanges. One would need to have a cryptocurrency wallet linked to a verified exchange with a particular cryptocurrency balance before they could even begin. These gas fees might make you rethink buying or minting in the first place. NFT marketplaces like Momint allow you to buy NFTs with a credit card and not have to own any cryptocurrency.

- Whilst precious metal coins might seem overwhelming too, the mints, dealers and traders worldwide allow easy and trusted transactions.