H

opefully the title got your attention, so here goes. The Consumer Price Index (CPI) is our official rate of inflation. It’s based on the change in price of a broad basket of goods and services that the average South African consumes. If your basket of goods and services is different to that used to calculate CPI, you will have your own personal inflation rate that could be different to CPI.

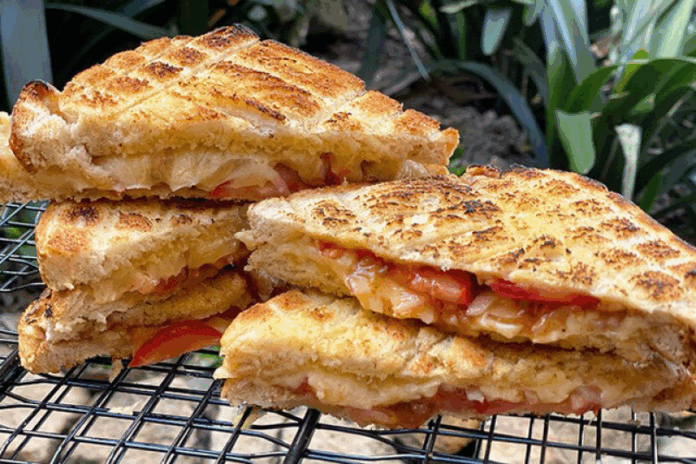

Johann Biermann, CFP®, has created the “Braaibroodjie Index”, which he has shared in LinkedIn recently. This is an inflation index made up of a basket of goods used to make a braaibroodjie (sandwich toasted on the braai) – specifically white bread, cheese, tomato, onion, butter, salt and chutney. What the Braaibroodjie Index shows is that inflation is roughly double CPI, which feels intuitively more like the inflation that I experience.

I expect that sentiment would be true for many people who intend to self-fund their retirement. People like you and many of your clients. I’m not saying that everyone should use the Braaiboodjie Index as their inflation number, but rather that you need to consider the impact if your clients’ personal inflation is higher than CPI. This is especially true for older clients where medical expenses make up a growing proportion of their monthly spend because this is governed by “medical inflation”.

Start by having a discussion with your client about their experience of inflation.

Let’s look at an example where I assume that CPI is 3% and that your client’s personal inflation is 6%. The first impact of personal inflation is in the accumulation phase, when you do the retirement calculations and need to assume an inflation rate. In most cases, people use CPI because it is the official rate. The problem is that if you use a rate that is too low, you will end up calculating a lump sum that will not give your client sufficient retirement capital to generate their desired retirement income. In this case you’ve used 3%, whereas you should have used 6% to determine the retirement capital that that specific client will need to generate their desired retirement income.

Assuming that the client is either fully or partly investing into a living annuity, the second impact is in the decumulation phase when you select an investment portfolio. In the living annuity, you need to select a portfolio that will give your client the best chance of receiving the desired income. You will do this by selecting a portfolio that targets an inflation plus x% return. The problem is that most portfolios have a targeted return of CPI plus x%. If you need a return of 4% more than inflation, you will select a portfolio targeting CPI + 4% = 7%. Whereas they should have gone into a portfolio targeting 6% + 4% = 10%. The effect of going into the CPI + 4% portfolio is that your client will end up with an even smaller income or, worse, they will run out of money if they draw down at a higher rate to maintain their income.

There are a few ways that you can manage this, but here’s one strategy Lizl Budhram, CFP®, suggested to me. Start by having a discussion with your client about their experience of inflation. Include this, and their decision about whether to increase the inflation in the calculations and targeted returns, when completing the risk/return strategy decision.

That way the rationale can be used in your calculation and captured as part of the investment strategy, which will ensure that the selected portfolio is aligned. This will make the advice record clean and based on a detailed advice conversation.

You need to consider whether you may be using the wrong inflation number before and after retirement, ie is your calculation of the retirement capital producing an amount that is too small, and whether the portfolio that you select is generating a return that is too low. The net effect is that your client will get a lower than desired retirement income and/or they will run out of money if their personal inflation is higher than CPI.