While we know that investing offshore should be a crucial consideration when it comes to diversification, less straightforward is the answer to which offshore markets to consider. More specifically, how much of your money should be invested in emerging markets versus developed markets?

Are emerging markets still the growth engine that they used to be? More importantly, are these markets worth the risks?

Firstly, it is important to consider that most of the assets that we as South Africans hold (including our local properties and pension funds) are predominantly emerging market assets. It is therefore very likely that most South African investors already have significant emerging market exposure, albeit in a single market. However, this is not a reason to write off emerging markets as a potential investment destination, but rather an important consideration when deciding how to allocate capital offshore.

Against this backdrop, emerging market equities currently constitute around 10% of the global equity market, yet emerging market economies contribute roughly 60% of global GDP. As such, investors are naturally “light” on emerging market exposure, unless there is a deliberate attempt to increase one’s allocation to emerging markets. Importantly though, investors are able to gain emerging market exposure by investing in companies that operate in emerging markets. Obvious examples of this include Diageo, Starbucks, Walt Disney and Nike, to name a few.

There are a number of reasons why investors are naturally drawn to developed market equities as opposed to emerging market equities.

These include the obvious points that developed equity markets are larger (as alluded to above), more established and more liquid than their emerging market counterparts, and as such present a larger opportunity set for investors. Alongside this, emerging markets are also viewed as inherently riskier than developed markets given the potential lack of accounting standards, corporate governance and transparency issues, volatile currencies, political uncertainties, a lack of analyst coverage and the inability to completely trust what is presented in annual reports and on company websites. In this way, investing in emerging market companies requires far more research than what one may otherwise have to do for more well-known, developed market companies. This often results in people having to be on the ground in the country to see and understand the various dynamics, which can be a costly exercise.

Having said that, emerging market equities have historically outperformed developed market equities. In the long run, corporate earnings growth typically drives equity market returns. And, unsurprisingly, the key ingredient in driving corporate earnings growth is economic growth (South Africans will be acutely aware of this). From there it is a short leap to arrive at the conclusion that economic growth plays a vital role in driving longer-term equity returns, although this is not necessarily the case in the shorter term.

Therefore, when thinking about emerging market economies and equity markets, it is easy to understand why emerging markets have historically outperformed developed markets, given that emerging market GDP growth has typically outpaced that of more developed markets.

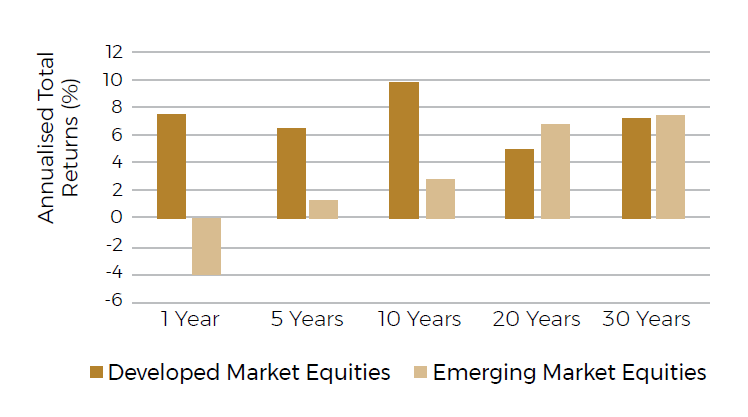

As we approach the end of the decade, it is quite apparent that the past 10 years have seen a reversal of fortunes for emerging market equities, as they have lagged developed markets by a hefty margin, as illustrated in graph 1. There are a few reasons for this. Firstly, low interest rates in developed markets have helped bolster developed market equities in what has been a lower growth environment over the past decade.

The second main reason for the underperformance of emerging market equities is that the growth differential between emerging and developed markets has reduced significantly over the past decade (see graph 2). When China is excluded, the differential is very close to zero over the past five years. This collapse in emerging market growth is due to a number of factors. While idiosyncratic factors have played a role, specifically in various large emerging market countries, there are also a number of common factors at play. These include the trade dispute between the US and China, increasing debt levels in emerging markets, and a strong US dollar. These have compounded to ultimately lower emerging market GDP growth rates to levels closer to those of developed markets.

Graph 1: Developed vs Emerging Market

Equity Returns: May 1990 – May 2020

Given the above, it may seem clear-cut that developed market equities should be prioritised over emerging market equities. This view is potentially reinforced by the onset of economic shutdowns, and the fact that emerging market economies are likely to be more severely impacted by economic shutdowns than their developed market counterparts.

Taking a step back, if we know one thing today, it is that the short- to medium term economic outlook is as uncertain as it has ever been. We also know that extrapolating recent events into the future is a sure way of being wrong. Our memories are often short, and we forget that at the beginning of the previous decade emerging market equities were all the craze after their spectacular returns of the 2000s. Given the resultant poor returns generated by emerging markets over the 2010s decade, today that sentiment is completely turned on its head.

From a pure equity perspective, the emotional response is that emerging market equities are likely to deliver more of the same over the next 10 years. The rational response, however, is to ensure global diversification across markets and geographies, and this includes emerging markets. Our experience of the past decade should teach us that the rational response is the more prudent one.