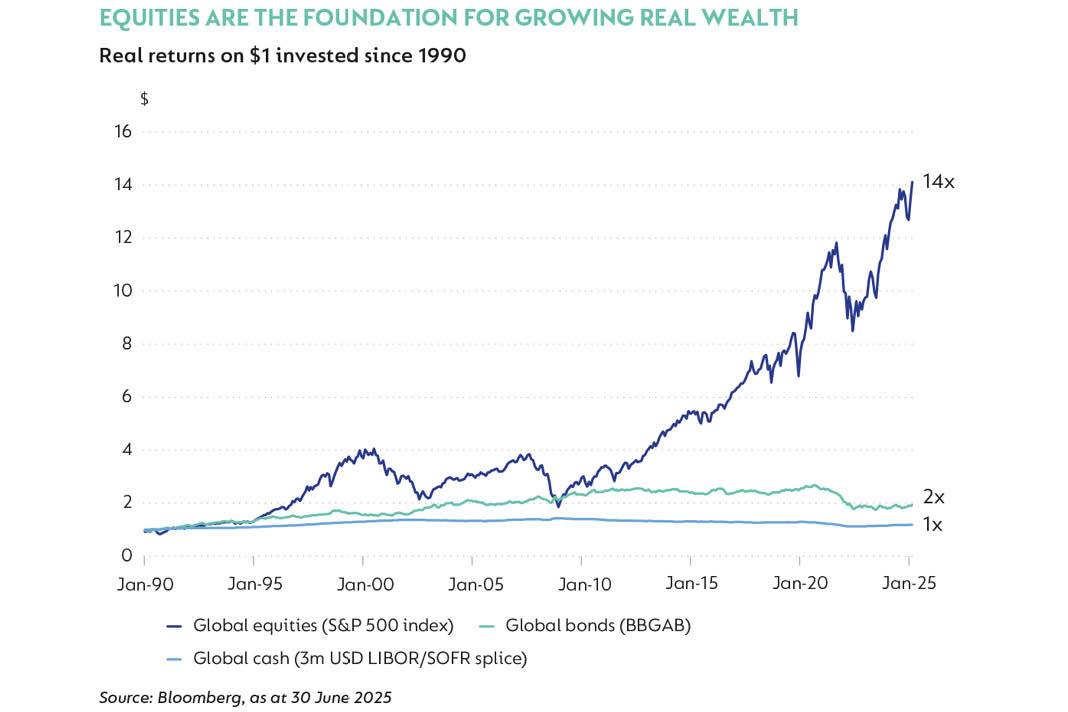

For advisors working with clients who are building or drawing on retirement portfolios, one question comes up over and again: Why equities? The answer is simple, but not always easy. Equities remain the most powerful engine for delivering long-term returns, but the asset class requires investors to withstand the volatility that comes with the territory.

The power of compounding

Take the S&P 500 Index as an example. Looking back over 45 years to 1980, the Index has compounded at just over 12% per year. That is a phenomenal rate of return over such a long horizon. Using the “rule of 72”, at a 12%* growth rate, your money doubles roughly every six years. Over 45 years, that works out to more than seven doubling periods. Put differently, $1-million at the start of the journey would have grown to around $180-million today!

This is why we often say equities are for the long run. They are unmatched in their ability to grow wealth meaningfully over time.

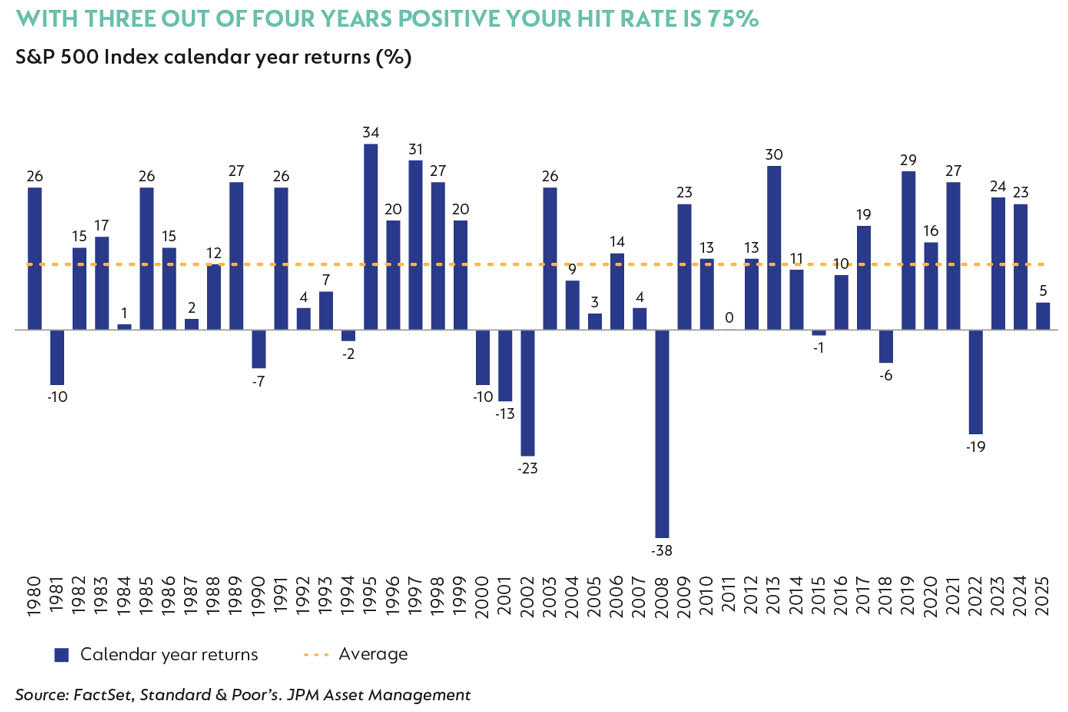

Consistency matters

But it is not just the headline number (12% per year return since 1980 for the S&P index) that makes the case compelling. Over the same 45-year period, three out of every four calendar years delivered positive returns, resulting in a 75% hit rate. When paired with the high long-term compounding rate, this makes equities uniquely attractive.

For clients, this message is important: most years have been rewarding. But the real magic lies in the fact that patient investors, who stayed invested through the cycle, benefited from the full compounding power of the market.

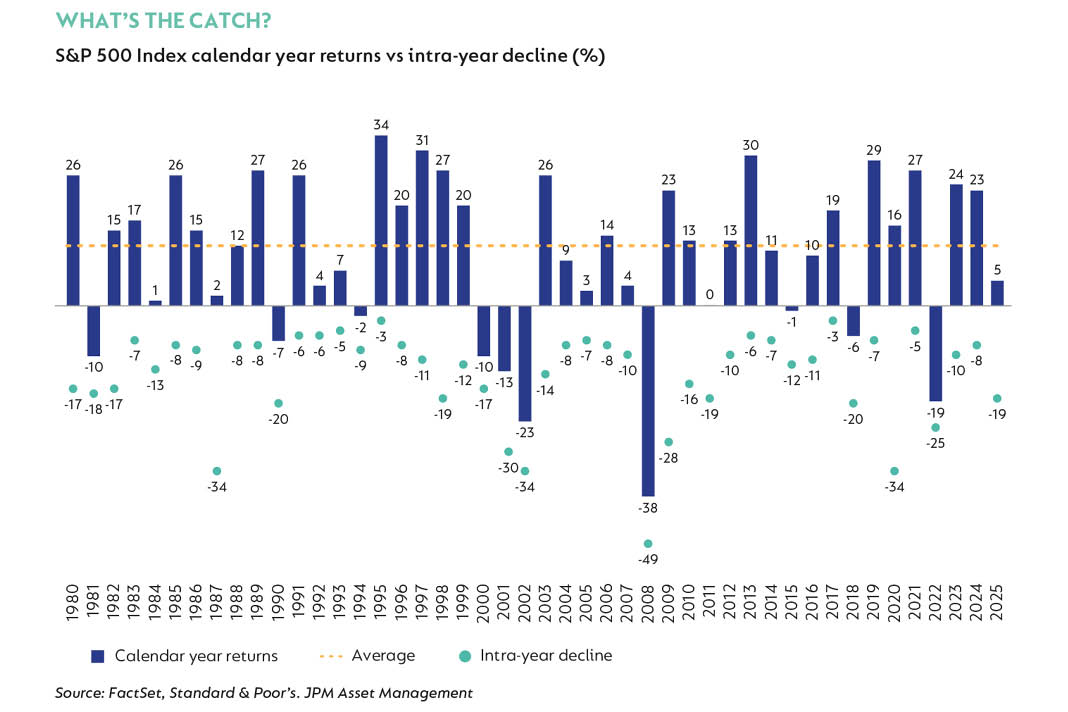

The catch: volatility

Of course, there is a catch. Equities are not a smooth ride. Every single calendar year since 1980, the S&P has experienced a drawdown. And the average fall from peak to trough within the year has been around 15%.

That means that even in years that ended up strongly positive, investors often had to stomach being on the brink of a bear market, or worse. For advisors, this is where behavioural coaching is critical. The market headlines, the pundits declaring that “this time is different” and the fear that comes with opening a brokerage statement in the middle of a downturn can all test clients’ resolve.

The price of admission

The lesson is clear: volatility is the price of admission for long-term equity returns. To access those 12% compounding rates, investors had to live through short-term uncertainty every single year. And there is no reason to believe this pattern will change. Another crisis will come. Another severe market sell-off will happen.

For clients, the real question is not if they can handle volatility, but how they will respond when it comes. Do they have the fortitude to stay invested? And perhaps even more importantly, are they aligned with a manager who has the experience, discipline and research capability to use volatility to their advantage?

What this means for advisors

As an advisor, your role is to help clients understand both sides of the equation. On the one hand, equities have delivered extraordinary long-term returns and are likely to remain the cornerstone of wealth creation. On the other hand, the path is never linear. Annual drawdowns are not a bug of the system – they are a feature.

For retirees or clients investing for income and growth, the balance is even more delicate. Equities provide the growth engine needed to protect purchasing power against inflation. But they must be combined with income-generating assets and a disciplined multi-asset process that can cushion some of the volatility while still capturing long-term upside.

The bottom line

Equities remain the asset class most likely to deliver meaningful real returns over time. But the journey is punctuated with periods of discomfort that can tempt clients to abandon course. Helping clients understand this trade-off and positioning them with managers who can harness volatility rather than fear it, is one of the most valuable roles you can play.

In a world where the next crisis is always just around the corner, the real differentiator is not predicting the exact timing of downturns, but preparing clients to stay invested when they arrive. Equities reward those who endure.

*Source: Bloomberg, compounding at 12.1% p.a.