Building a financially sustainable practice

Guy Holwill, Chief Executive of Fairbairn Consult, states that there is lots of talk about different fee models for financial advisors.

Preparing the Next Gen heirs for the complexities of managing the...

Stonehage Fleming addresses an often-asked quesion by families grappling with how to go about succession planning: When should we start preparing the Next Gen heirs for the complexities of managing the family fortune, and how should we go about it?

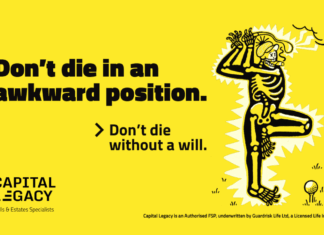

Don’t die in an awkward position

Capital Legacy stresses the importance of South Africans having a will regardless of age through their latest awareness campaign: "Don't die in an awkward position. Don't die without a will.".

A major milestone in the evolution of professional certification in financial...

The Financial Planning Institute of Southern Africa (FPI) is proud to announce the successful completion of its first CFP® Capstone and Financial Plan assessment, marking a significant milestone in the evolution of professional certification in financial planning.

ETF evolution: global and South African trends driving the future of index...

According to Fikile Mbhokota, CEO at Satrix, the ETF market is evolving at an unprecedented pace, reshaping global investment landscapes.

What 25 years as a market pioneer taught us about South...

Satrix is making investing accessible, affordable and effective for everyone. Kinsely Williams, Chief Investment Officer at Satrix explains how.

A shift up and to the left

By understanding their unique strategies and regulated nature, investors can leverage the true potential of hedge funds to achieve higher returns while effectively managing risk, writes Francois Olivier CA(SA), CFA, Portfolio Manager,

Mazi Asset Management and Stephan Engelbrecht, Portfolio Manager,

Mazi Asset Management.

Impact and returns: why financial planners should consider ACOF

Financial planners are often faced with a key challenge when advising clients: balancing the desire for strong financial returns with the growing demand for investments that drive positive social and economic impact, writes Warren Wheatley, CEO of Altvest Capital.

Altvest Capital reports robust FY2025 growth: asset expansion, strategic investments, and...

Altvest Capital reports strong FY2025 results driven by asset growth and investment performance

Survival of the fastest

With the arrival of Artificial Intelligence into the mainstream world, we find ourselves at a point of optimism over the future in this cycle of technology innovation, writes Doug Nicol, Investment Analyst at Fundhouse.

Most Popular

The Intelligent Adviser’s Playbook: PROpulsion hosts 2026 Practice Management Conference

A practical virtual conference for financial planning businesses that want to run smarter operations, without adding unnecessary risk or complexity.

PROpulsion Practice Management Conference 2026

The 2026 PROpulsion Practice Management Conference focuses on how advisers and their teams can use intelligent tools, including AI, in practical, defensible ways that improve efficiency, consistency, and client experience.

When clients ask if they have done enough

Kobus Kleyn (CFP®, Tax and Fiduciary Practitioner, Kainos Wealth) writes about understanding vulnerability in financial advice.

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.