Social media in financial planning

Kobus Kleyn, CFP®, underscores the value of social media in enhancing client relationships and professional growth.

The power of incentives

Rob Macdonald, the head of Strategic Advisory Services at Fundhouse, discusses the human side of investing using Charlie Munger's speech "The psychology of human misjudgment".

A case for precious metals

According to Michael Mgwaba, Head of Exchange Traded Products at ABSA, traditional asset classes have historically helped advisors achieve satisfactory results in portfolio construction for their clients; however, our view is that there is time to consider inclusion of precious metals for the retail clients to improve risk adjusted returns.

Shaping the future of investment management and advice, today

Momentum Investments’ Research Hive is a purposefully created hub of research and innovation activity dedicated to advancing the worlds of effective investment management and advice for both the business and our clients writes Eugene Botha, Deputy Chief Investment Officer at Momentum.

Blending security and flexibility for retirement

One crucial decision people face at retirement is choosing an annuity. We’ve reimagined retirement to make the choice easier, writes Martin Riekert, head of retail investments at Momentum Investments.

Could smaller companies have a bright spot despite a gloomy environment?

While it’s important to be mindful that investment performance can be hit by increasing the allocation to smaller companies too early, it’s prudent to ensure you have a seat at the table to avoid missing out on small-cap performance, which often arrives suddenly writes Nkosi Kondi, Country Head South Africa, Schroders.

Register for the FPI Professional Competency exams

The Professional Competency examinations allows candidates to demonstrate their ability to apply financial planning concepts in real-world scenarios.

Will June be the month when all three of the BoE,...

The Bank of England, US Federal Reserve, and European Central Bank have maintained their interest rates this month, but market expectations are now leaning towards cutting rates in June say Azad Zangana, Senior European Economist & Strategist at Schroders.

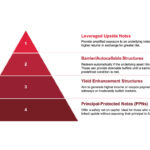

Structured products provide an investment lifeline in a volatile world

Discovery Invest has launched a new and enhanced version of this popular structured note, the Discovery Capital 200|300+. The Discovery Capital 200|300+ products pay a 100% gross return on investment after five years if the underlying global share portfolio return is flat or positive over the five-year period.

Coronation scoops international award for women empowerment in London

Coronation Fund Managers is honored to receive the 100 Women in Finance Europe, Middle East and Africa (EMEA) Diversity, Equity and Inclusion (DEI) Award for 2024.

Most Popular

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Enter adviser practice buy-and-sell conversations with confidence

Blue Chip speaks to Brokerspace and Commspace to find out why understanding the full picture before choosing a path forward might change your succession and sale conversations for the better.

Why blending unit trusts remains essential

In an environment where opportunity and uncertainty coexist, blending unit trusts is not about being cautious. It is about being prepared. By Natalie Harrison, Head of Distribution at Curate Investments.