Global investments portfolio composition continues to shift with more allocation to alternative investments in search of higher yield and effective diversification. Various research suggests that alternative investments have historically played a key role in improving risk-adjusted returns for investors where optimal allocation has been achieved, however, like any other asset classes, alternatives also have their challenges. Some alternatives are illiquid in nature while some can be too volatile. These two attributes could introduce further risks in the investment portfolios.

These challenges coming from investing in alternative investments in line with a shift to alternative is strengthening the case for investing in precious metals, an alternative asset that is considered more liquid and less volatile within its asset class group.

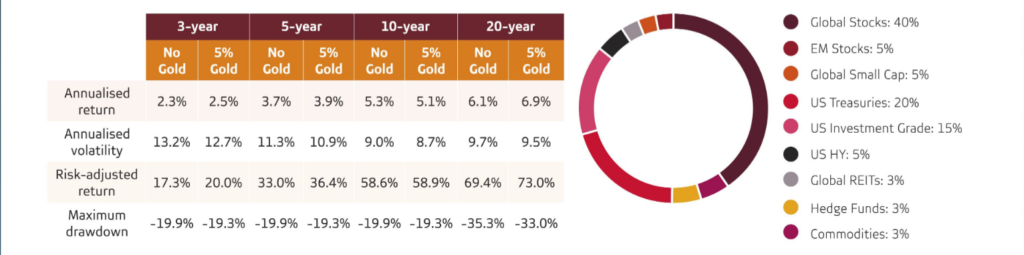

Precious metals have offered similar returns to stocks and real estate over the past 20 years but with a higher diversification. Adding precious metals into a portfolio has historically improved long-term returns according to research done by Sprott Asser Managers.

The most common metals within the precious metals group are gold, silver and platinum group metals with gold being the most liquid and used in most portfolio constructions. Historically, gold has proven effective as an inflation hedge and currency hedge. Its purchasing power has increased against fiat money, and it is known to be the best storage of value that survives the ravages of time. It is rare to find one financial instrument with so many attributes. The South African market does provide all types of investors with the opportunity to invest in precious metals such as gold. Research done by the World Gold Council suggests that adding gold to a diversified portfolio improved the overall performance of the investment.

Please refer to the graph below.

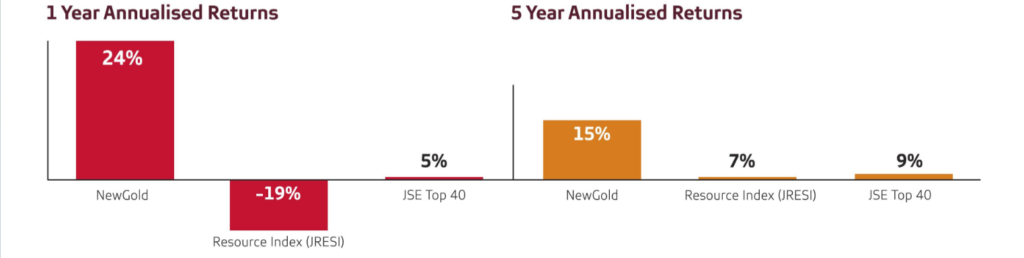

We believe that a similar outcome could be the case for SA investors. In South Africa, this could be achieved by investing in mining stocks, NewGold ETF or both. The diagram below suggests that investors in NewGold ETFs would have achieved better outcomes than investing in stocks.

Our view is that there is a place for both NewGold and mining stocks in one portfolio, it depends on each investor’s objective.

Traditional asset classes have historically helped Advisors achieve satisfactory results in portfolio construction for their clients, however, our view is that there is time to consider the inclusion of precious metals for the retail clients to improve risk-adjusted returns.