US election provides both red flag and pat on the back for...

Helen Macdonald states that the 2024 election results in South Africa were met with widespread optimism and showcased South Africa’s robust and innovative electoral and legal system. However, we should also view the 2024 Trump victory in the US as a red flag.

How people become wealthy

The Mazi Global Equity team embraces a quality investment philosophy designed to tackle these challenges. Their approach ensures that only genuinely high-quality companies make the cut—those with low debt, sustainable cash flows, and high returns on invested capital.

Last mile planning advice

Financial advisors can tackle the complexities of last-mile service delivery by leveraging wealth technology solutions that simplify workflows, strengthen client interactions, and enable consistent, contextual engagement. These advancements not only boost business growth but also ensure higher client satisfaction, shares Andries de Jongh, Head of Sales at Seed Analytics.

The succession plan dilemma for financial advisors

Marc Wiese, Managing Director at Warwick Wealth's explores key challenges and solutions for a seamless transition.

Portfolios built for prosperity

Capital Internationals Group's collaborative approach enables them to better understand your business, adapt to its unique requirements and ensure that your client needs come first.

How a Secure AI Assistant transforms your client relationships and frees...

Zeldeen Müller, Founder and

CEO of AgendaWorx looks at how personal Secure AI Assistants can revolutionise financial advising by simplifying client interactions, streamlining operations, and offering instant, secure support, allowing advisors to focus on strategic growth while providing clients with peace of mind

How important is investment performance for a DFM?

As Discretionary Fund Managers differentiate their offerings, how should the advisor measure a DFM’s success?

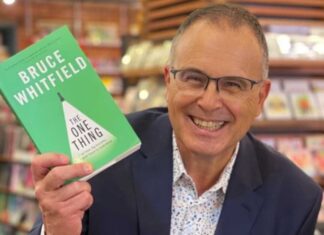

Cutting out the noise

The FPI Harry Brews’ Award recognises an individual who has made a significant contribution to the financial planning profession through service to society, academia, training, government, media and any other professional activities. Blue Chip speaks to Bruce Whitfield, winner of the FPI Harry Brews’ Award, 2024.

Levelling the playing field: Exchange control reforms and ETF growth in...

Ben Meyer, Managing Director at Prescient Capital Markets, unpacks how recent regulatory reforms could unlock significant growth in SA’s ETF market.

Should a financial planner use more than one DFM?

Most financial advisors in South Africa currently only use one discretionary fund manager (DFM), but some bigger practices have diversified their clients’ investments to...

Most Popular

Alexforbes named South African Manager of the Year at the Raging Bull Awards

Alexforbes were honoured at the Raging Bull Awards with two prestigious awards that highlighted the firms investment achievements and long-term performance.

What are the different types of structured products available to retail and institutional investors...

There is a limited range of structured products offered in South Africa compared to the rest of the world.

The 2026 guide to structured products in South Africa

Exclusive: The 2026 Structured Products Guide is now available as an eBook. This guide features a range of highly informative introductory articles about structured products in South Africa and provide profiles of leading companies offering structured products in South Africa.

Is everything becoming AI – and how can you respond without selling equities?

How can investors guard against the concentration risk of the technology/AI narrative without giving up equity exposure?

What is a structured product?

Structured products can offer investors a unique way to access market returns while managing risk with capital protection and tailored pay-offs. These innovative investments have evolved and can now offer the potential for enhanced or geared returns, with partial capital protection. Investors must weigh the trade-offs against the gains.